Anwar A. Al-Hejazi, CEO of S-OIL

Despite a Q1 "earnings shock," S-OIL remains confident about a rebound in performance starting in the second quarter. However, the company is closely monitoring U.S. President Donald Trump's tariff policies, which could potentially trigger an economic downturn.

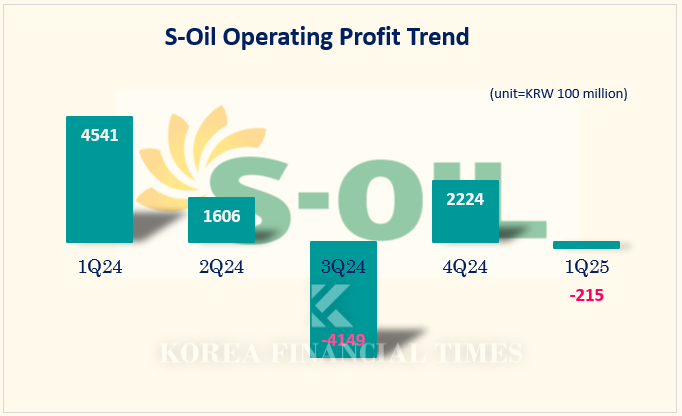

S-OIL announced on the 28th that its Q1 2025 sales were provisionally calculated at KRW 8.9905 trillion, with an operating loss of KRW 21.5 billion. Compared to the same period last year, sales decreased by 3.4%, and operating profit turned to deficit.

Looking at the actual results, all business divisions performed poorly.

The refining division shifted from an operating profit of KRW 250.4 billion in Q1 last year to an operating loss of KRW 56.8 billion in Q1 this year. The petrochemical division also recorded an operating loss of KRW 74.5 billion during the same period, compared to an operating profit of KRW 48 billion last year.

The lubricant base oil division maintained profitability with an operating profit of KRW 109.7 billion. However, the profit size decreased by about 30% compared to the same period last year. This was due to lubricant base oil margins falling by about 17% to an average of $43 per barrel in the first quarter.

S-OIL explained, "Demand was weak due to concerns about economic slowdown, and profitability declined as scheduled regular maintenance by some regional refineries in Q1 was postponed to Q2."

The company presented a generally positive outlook for performance after the second quarter. A S-OIL official stated, "Refining margins will recover with some time lag starting from Q2." He added, "OPEC+'s production increase is expected to lower Official Selling Prices (OSP) for crude oil, and the lower product prices will also have a positive impact on demand."

S-OIL appears to be on high alert regarding the "tariff risk" from the U.S. government.

According to S-OIL, the company has almost no direct impact from U.S. tariff policies. Refining and lubricants, which account for about 90% of sales, are not subject to tariffs. For petrochemicals, most items except MX (mixed xylene) are subject to tariffs. For example, exports of benzene, a U.S. tariff target item, decreased in the first quarter.

However, S-OIL noted, "Even for items subject to tariffs, direct exports to the U.S. accounted for only about 0.1% of sales based on 2024 figures."

Nevertheless, the company did not deny the impact from overall market demand weakness due to tariffs. S-OIL said, "Market participants in olefin and aromatic markets are taking a wait-and-see approach due to U.S. tariff policies," adding, "Major global organizations predict that petroleum demand will decrease by 100,000 to 500,000 barrels per day."

If S-OIL's poor performance continues, financial burden is also expected to be significant. The company has been conducting the "Shaheen Project" since 2023, investing approximately KRW 9.3 trillion to build large-scale petrochemical facilities in Ulsan. The company's net borrowings have soared from KRW 3.862 trillion at the end of 2023 to KRW 6.075 trillion at the end of Q1 2025.

Dividend expectations may also decrease. S-OIL paid KRW 5,500 per share in 2022, but reduced this to KRW 1,700 in 2023 when the Shaheen Project began. In 2024, only KRW 125 was paid due to poor performance.

This year, according to the "Value-up" disclosure announced in January, the company plans to maintain a minimum dividend payout ratio of 20%. Based solely on Q1 performance, which recorded a net loss, the company would not be able to pay dividends.

Gwak Horyung (horr@fntimes.com)

![‘K뷰티로 매출 5조’ 올리브영, CJ 승계 작업 군불 때나 [슬기로운 승계플랜 (2)]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025042606064601084dd55077bc212411124362.jpg&nmt=18)

![[ECM] DN솔루션즈, 중복상장 우려 VS 이례적 행동주의 등장](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025042907183204655a837df64942192515869.jpg&nmt=18)

![한화생명 여승주, 삼성 추월 영업 성과…기본자본 관리는 과제 [IFRS17 3년차 대응력]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025042605275001047dd55077bc212411124362.jpg&nmt=18)

![‘AI 회사’로 변신한다는 김영섭의 KT…이사회는 그대로 [2025 이사회 톺아보기]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025042816291902123c1c16452b012411124362.jpg&nmt=18)

![[카드뉴스] KT&G ‘Global Jr. Committee’, 조직문화 혁신 방안 제언](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202503261121571288de68fcbb3512411124362_0.png&nmt=18)

![[카드뉴스] 국립생태원과 함께 환경보호 활동 강화하는 KT&G](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202403221529138957c1c16452b0175114235199_0.png&nmt=18)

![[카드뉴스] 신생아 특례 대출 조건, 한도, 금리, 신청방법 등 총정리...연 1%대, 최대 5억](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=20240131105228940de68fcbb35175114235199_0.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 지속 가능 경영, 보고와 검증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025011710043006774f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 똑똑한 금융생활...건전한 투자와 건강한 재무설계 지침서](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025031015443705043c1c16452b012411124362.jpg&nmt=18)

![[카드뉴스] KT&G ‘Global Jr. Committee’, 조직문화 혁신 방안 제언](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202503261121571288de68fcbb3512411124362_0.png&nmt=18)

![[AD] 기아, 혁신적 콤팩트 SUV ‘시로스’ 세계 최초 공개](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113461807771f9c516e42f12411124362.jpg&nmt=18)

![[AD] 아이오닉5 '최고 고도차 주행 전기차' 기네스북 올랐다...압도적 전기차 입증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113204707739f9c516e42f12411124362.jpg&nmt=18)