Kim Young-Ki, CEO of HD Hyundai Electric

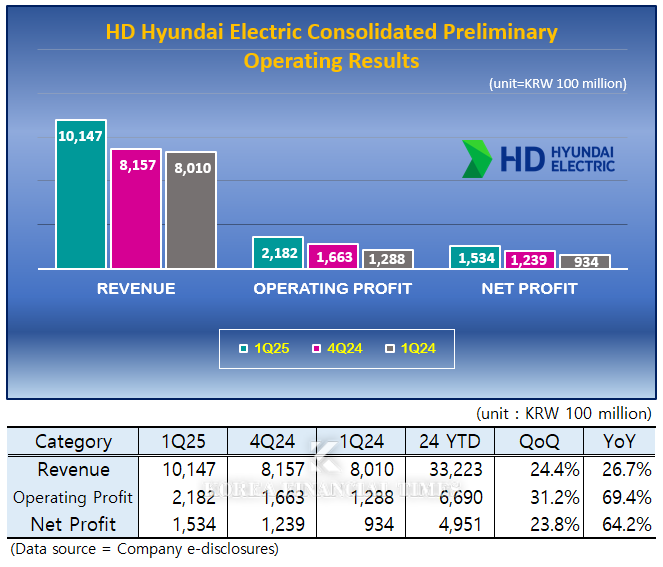

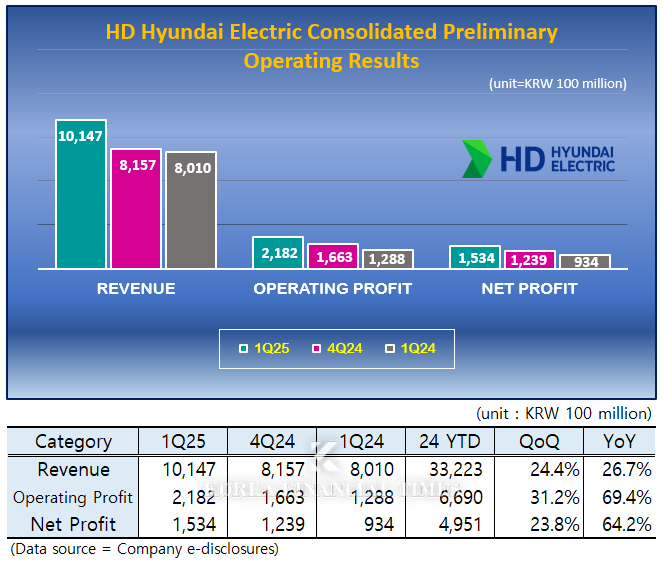

HD Hyundai Electric Co., Ltd. (CEO: Kim Young-ki) made this statement during its earnings conference call held on April 22, following its announcement of record-breaking quarterly revenue of KRW 1.0147 trillion in Q1, marking a notable earnings surprise.

Revenue increased by 26.7% year-on-year, while operating profit surged to KRW 218.2 billion — a 69.4% increase from the same period last year. The operating margin rose 5.4 percentage points year-on-year to reach 21.5%.

The Power Equipment division — the company’s core cash cow — led the overall performance, recording KRW 463.7 billion in sales, up 46.1% YoY. Overseas subsidiaries also contributed significantly, with shipments from Q4 2024 reflected in Q1 results. In particular, the North American subsidiary saw robust profitability from high-margin projects.

“This marks the first time since our spin-off in 2017 that we’ve exceeded KRW 1 trillion in quarterly revenue,” said HD Hyundai Electric. “The share of revenue from the North American market, known for strong profitability, has significantly increased.” The company added, “Given our strong pipeline of high-margin orders, we expect to maintain a similar level of profitability in the coming quarters.”

While recent developments surrounding reciprocal tariffs initiated by the United States have garnered attention, HD Hyundai Electric projects minimal impact.

“We have already begun negotiations with our North American clients. Most of them have responded positively to potential price increases,” the company stated. “We believe we can hedge a significant portion of our exposure to tariff-related risks.”

The company further clarified that, “To date, there have been no delays or cancellations of orders attributable to reciprocal tariffs.”

Addressing concerns over potential future impacts if orders continue under such tariff conditions, HD Hyundai Electric emphasized, “We are actively negotiating tariff risk hedging mechanisms with clients and are not concerned about a decline in profit margins.”

The company explained that its clients fall into two categories: “First, customers with existing short-term supply contracts containing finalized terms — they have expressed willingness to negotiate favorably if tariffs are imposed. Second, customers with whom we are pursuing new contracts under the understanding that the cost of reciprocal tariffs will be passed on to them.”

Shin Haeju (hjs0509@fntimes.com)

![금리인하요구권 유명무실 논란에도…신한은행 수용건수 '선방' [은행 공정금융 점검①]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025022418233109482b4a7c6999c121131189150.jpg&nmt=18)

![[DCM] LX판토스, '탈 LG' 기조 지속...’트럼프 관세’는 호재?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025042206574105692a837df64942192515869.jpg&nmt=18)

![전찬우 한국투자저축은행 대표, 리테일 확대로 순익 2위 달성…PF 신규 취급 '자신감' [2024 금융사 실적]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20250417154434068456a663fbf34175192139202.jpg&nmt=18)

!['고시촌' 노량진 월세 왜 이래…'한강뷰' 프리미엄에 100만원 [한기자의 나혼산①]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025042118171704322e41d7fc6c2183101242202.jpg&nmt=18)

![‘테슬라부터 웨이모까지’…NH-Amundi, 자율주행 핵심 ETF 출시 [ETF 통신]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025042220160006644dd55077bc212411124362.jpg&nmt=18)

![[카드뉴스] KT&G ‘Global Jr. Committee’, 조직문화 혁신 방안 제언](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202503261121571288de68fcbb3512411124362_0.png&nmt=18)

![[카드뉴스] 국립생태원과 함께 환경보호 활동 강화하는 KT&G](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202403221529138957c1c16452b0175114235199_0.png&nmt=18)

![[카드뉴스] 신생아 특례 대출 조건, 한도, 금리, 신청방법 등 총정리...연 1%대, 최대 5억](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=20240131105228940de68fcbb35175114235199_0.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 지속 가능 경영, 보고와 검증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025011710043006774f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 똑똑한 금융생활...건전한 투자와 건강한 재무설계 지침서](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025031015443705043c1c16452b012411124362.jpg&nmt=18)

![[카드뉴스] KT&G ‘Global Jr. Committee’, 조직문화 혁신 방안 제언](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202503261121571288de68fcbb3512411124362_0.png&nmt=18)

![[AD] 기아, 혁신적 콤팩트 SUV ‘시로스’ 세계 최초 공개](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113461807771f9c516e42f12411124362.jpg&nmt=18)

![[AD] 아이오닉5 '최고 고도차 주행 전기차' 기네스북 올랐다...압도적 전기차 입증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113204707739f9c516e42f12411124362.jpg&nmt=18)