In contrast, the Vehicle component Solutions (electric vehicle, electronic device) and Business Solutions (B2B) divisions, which Cho has nurtured as future growth engines, still fall short in terms of profitability despite their increased scale.

LG Electronics anticipates a blow to its core appliance business this year due to U.S. tariffs under the Trump administration. As a result, the success of the company’s non-appliance sectors—promised by Cho last year—has become more critical than ever.

LG Electronics attributed this to not only stable growth in its core businesses but also to qualitative growth led by B2B, subscription services, webOS (Non-HW), and direct-to-consumer (D2C) sales channels.

On the other hand, operating profit dropped 5.7% compared to the same period last year, despite easing logistics costs, which had been a burden. Analysts point out that while the appliance segment maintained solid profitability, business imbalance remains due to underperformance in the VS (automotive electronics) and BS (business solution) divisions.

Park Sang-hyun, a researcher at Korea Investment & Securities, said, “Pull-in demand ahead of expected U.S. tariff hikes helped LG deliver solid Q1 results,” but added, “The VS and BS divisions likely struggled due to slowing EV demand and delayed visibility of new business achievements.”

Subsequently, he further forecasted Q2 operating profit at KRW 985 billion, down 17.7% year-on-year and revised 6.5% below prior expectations. “The company must prove its tariff response strategy in Q2 and demonstrate reduced quarterly earnings volatility from B2B and Non-HW growth in Q3 and Q4,” he emphasized.

Notably, Cho had been leading business portfolio reforms even before becoming CEO of LG Electronics. As Chief Strategy Officer (CSO, vice-presodent) in 2021, he played a key role in LG's exit from the smartphone business.

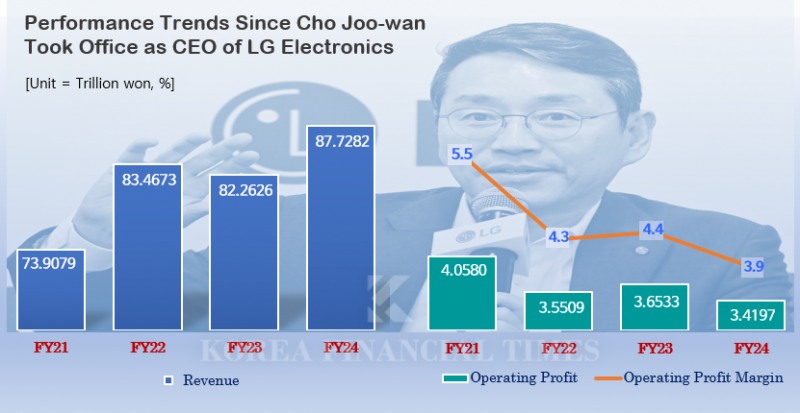

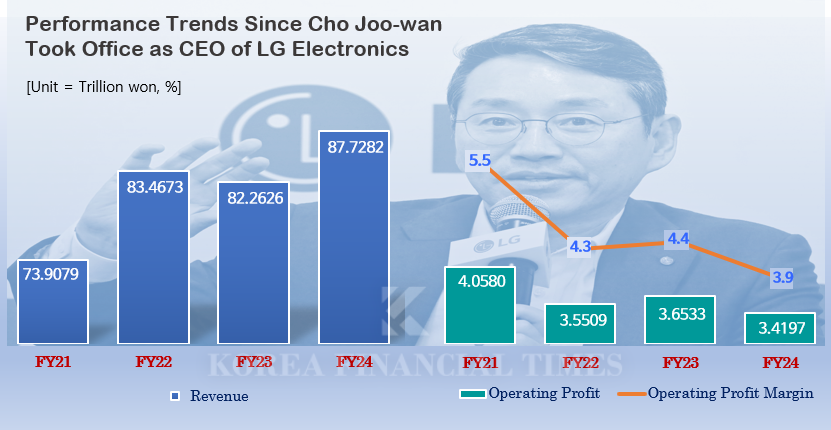

He was appointed CEO in December of the same year under a direct mandate from LG Group Chairman Koo Kwang-mo to reduce the company's dependency on appliances. Subsequently, he launched the “Vision 777” strategy, which aims to reduce reliance on home appliances and increase the share of new businesses, targeting 7% annual growth and operating profit margins, and a sevenfold increase in corporate value by 2030.

However, current conditions remain tough. The company’s new businesses are under pressure from external risks such as a strong Korean won. Although revenue from home appliances remains dominant, profitability is slipping amid various internal and external challenges.

In 2024, the Home Appliance & Air Solution (H&A) division accounted for 37.8% of total revenue and 59.8% of operating profit. Excluding its subsidiary LG Innotek, which ranked second in revenue, H&A’s share jumps to 49.9% of revenue and 75.3% of operating profit.

By contrast, the VS division posted KRW 10.6205 trillion in revenue, up 4.7% year-on-year, but its operating profit halved to KRW 115.7 billion. As a result, the division reported impairment losses of around KRW 100 billion at year-end.

Impairment losses represent the difference between book value and recoverable value, and a large gap indicates a decline in business or corporate value.

Furthermore, ZKW and LG Magna, LG's subsidiaries in the vehicle electorpnics sector, also turned to losses. The BS division, responsible for B2B products such as commercial displays, robotics, and IT, reported an operating loss of KRW 193.1 billion.

Regarding the sluggish performance of its automotive electronics businesses including the VS division, LG Electronics explained, “Temporary losses occurred due to the ‘EV chasm’ following a fire incident last year,” and added, “Increased R&D spending to support new orders also impacted operating profit.”

Cho is expected to ramp up investments and accelerate new business development this year to address inter-business imbalances.

To prepare for the EV chasm, the company plans to invest approximately KRW 936.9 billion in the VS division in 2025, a 2.5% increase from last year. This continues a five-year trend of growing investment: KRW 456.3 billion in 2021, KRW 662.7 billion in 2022, KRW 868.5 billion in 2023, and KRW 913.6 billion in 2024. It is the second-largest investment among LG Electronics’ divisions this year, following the HS Division (renamed from the M&A Division this year), which is allocated KRW 1.1605 trillion, out of the company’s total KRW 4.3345 trillion investment for the year.

During the company’s annual earnings conference call in January, LG stated, “We will focus on securing Software-Defined Vehicle (SDV) capabilities as a future-preparedness strategy,” and emphasized its intent to “maintain stable sales based on order backlogs while enhancing profitability through improved product mix and operational efficiency.”

In addition, among non-appliance businesses, CEO Cho is spotlighting the Heating, Ventilation, and Air Conditioning (HVAC) segment as a key growth driver this year. HVAC systems, which manage indoor air quality, are increasingly vital with the rise of AI data centers that require advanced thermal management. This makes HVAC a high-potential offering, particularly in the B2B market.

To accelerate HVAC growth, LG established the ES division at the end of last year. The move aims to lead digitalization in the air solutions industry using AI, and to capture new growth opportunities such as nuclear power plants, mega factories, and cooling systems for AI data centers—where demand is rapidly increasing.

In particular, LG recently supplied HVAC solutions to a large-scale logistics center in Singapore on the 2nd, strengthening its foothold in the global market. Starting with this deal, the company plans to aggressively pursue customized HVAC business opportunities in Southeast Asia, particularly in countries like Indonesia and Malaysia that are pushing sustainable urban development initiatives.

Regarding the Singapore deal, CEO Cho Joo-wan stated, “As Singapore strengthens its role as a key regional logistics hub, demand for high-performance HVAC solutions is expected to grow,” adding, “LG is ready to meet this demand by providing innovative, market-tailored solutions that deliver efficiency, sustainability, and long-term value.”

Kim JaeHun (rlqm93@fntimes.com)

![[DCM] NH투자증권, 차입만기 확대 조달…MBK 불확실성 부담](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025041507101809805a837df64942192515869.jpg&nmt=18)

![김창규 우리벤처 대표, 토스 덕 성과보수 급증…올해 달바 IPO로 잭팟 기대 [2024 VC 실적]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025041417261701075b4a7c6999c145616778.jpg&nmt=18)

![국민은행, 인니법인 경영 정상화 속도…‘성장기반 재건’ 목전 [은행 글로벌 성과]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025041511232702137300bf52dd221123420718.jpg&nmt=18)

![양천 '목동신시가지10' 25평, 8.46억 오른 15.75억에 거래 [일일 아파트 신고가]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025041509201508270e41d7fc6c2183101242202.jpg&nmt=18)

![[카드뉴스] KT&G ‘Global Jr. Committee’, 조직문화 혁신 방안 제언](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202503261121571288de68fcbb3512411124362_0.png&nmt=18)

![[카드뉴스] 국립생태원과 함께 환경보호 활동 강화하는 KT&G](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202403221529138957c1c16452b0175114235199_0.png&nmt=18)

![[카드뉴스] 신생아 특례 대출 조건, 한도, 금리, 신청방법 등 총정리...연 1%대, 최대 5억](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=20240131105228940de68fcbb35175114235199_0.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 지속 가능 경영, 보고와 검증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025011710043006774f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 똑똑한 금융생활...건전한 투자와 건강한 재무설계 지침서](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025031015443705043c1c16452b012411124362.jpg&nmt=18)

![[카드뉴스] KT&G ‘Global Jr. Committee’, 조직문화 혁신 방안 제언](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202503261121571288de68fcbb3512411124362_0.png&nmt=18)

![[AD] 기아, 혁신적 콤팩트 SUV ‘시로스’ 세계 최초 공개](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113461807771f9c516e42f12411124362.jpg&nmt=18)

![[AD] 아이오닉5 '최고 고도차 주행 전기차' 기네스북 올랐다...압도적 전기차 입증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113204707739f9c516e42f12411124362.jpg&nmt=18)