It’s hard to believe there was a time when rosy outlooks ran rampant amid fierce technological competition. Since the battery industry’s leadership can shift with a single decision, related companies are developing nearly all technologies simultaneously while differentiating themselves through factors like mass production timing.

According to SNE Research, the combined global market share of South Korea's three leading battery companies in 2024 was 18.5%, down 4.7 percentage points from 23.1% in 2023.

In contrast, the combined market share of the six Chinese battery companies in the top 10 increased by 3.6 percentage points, from 63.5% to 67.1%. CATL (37.9%) and BYD (17.2%) maintained their positions as No. 1 and No. 2 while further expanding their market share.

Korean battery companies have been engaged in a "performance competition" through so-called NCM (nickel-cobalt-manganese) batteries.

NCM batteries use cathode materials made by combining nickel, cobalt, and manganese. Companies have focused on increasing the nickel content, which is the most expensive component and plays a key role in determining battery performance.

NCM batteries started with a nickel composition of 50% in the mid-2000s, and by 2020, products with 90% nickel content had been developed.

However, improving performance in this way also leads to higher costs and greater vulnerability to thermal runaway, making them less fire-resistant.

Meanwhile, Chinese companies dominate the LFP (lithium iron phosphate) battery market. LFP batteries are composed of lithium (Li) and iron phosphate (FePO₄) compounds. They are cheaper and have higher fire safety, but their performance is relatively lower.

Korean companies initially considered LFP batteries unsuitable for automotive use. However, automakers seeking greater cost competitiveness began showing interest.

In particular, Tesla’s decision to adopt LFP batteries for its budget models helped dispel concerns about their performance.

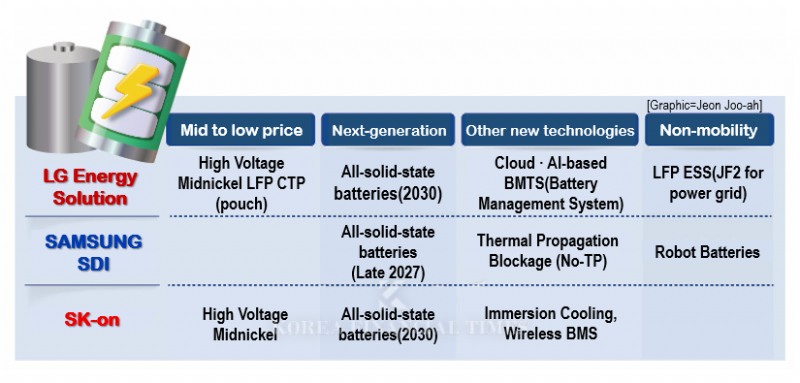

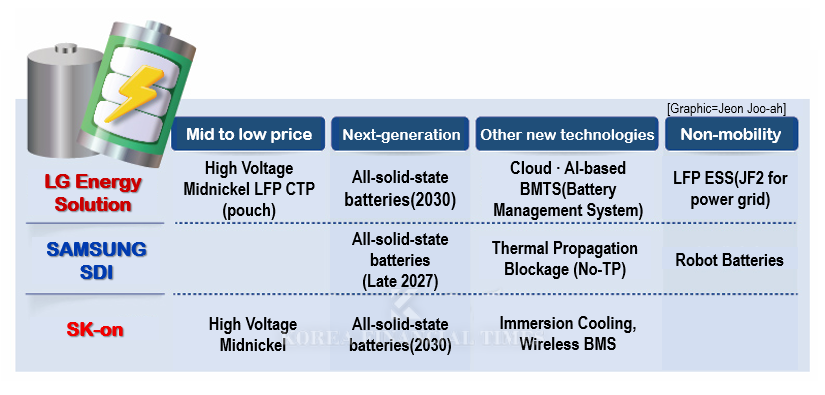

Recently, South Korean battery makers have focused on finding ways to satisfy both cost-effectiveness and performance demands to compete with Chinese firms dominating the market. Last month, the three major battery companies—LG Energy Solution, Samsung SDI, and SK-on—showcased their ongoing developments in mid-to-low-priced batteries and related technologies at the "2025 InterBattery" exhibition, a key event in the secondary battery industry.

Last year, they merely introduced mid-to-low-priced battery strategies; this year, they have fully embraced them.

Keen to address diverse market demands, SK-on showcased all three major battery form factors—pouch, prismatic, and cylindrical—at the exhibition. Notably, the company introduced its high-voltage mid-nickel battery in a pouch format for the first time. Mid-nickel batteries contain approximately 50–70% nickel, meaning their performance is inevitably lower compared to high-nickel NCM batteries.

To compensate, SK-on increased the proportion of manganese, a relatively cheaper material, to raise voltage and enhance energy density. However, this approach results in shorter battery lifespan. To address this, the company is developing additives that protect the cathode interface and extend battery life.

LG Energy Solution, which introduced a high-voltage mid-nickel battery for laptops last year, unveiled an electric vehicle (EV) version this year. Among Korea’s top three battery makers, LG Energy Solution is expected to be the first to launch mass production of high-voltage mid-nickel batteries in 2024. This product will complement its mid-to-low-end lineup alongside pouch-type LFP cell-to-pack (CTP) batteries.

Samsung SDI announced its target timeline for commercializing solid-state batteries, aiming for the second half of 2027. In comparison, LG Energy Solution and SK-on have set their commercialization timelines for 2030, positioning Samsung SDI as the frontrunner in this segment.

Solid-state batteries use solid electrolytes instead of liquid ones, reducing fire risks while significantly increasing energy density—earning them the title of the "dream battery." However, challenges remain in manufacturing costs and ensuring technological stability. Even in the next-generation battery era, companies are focusing more on technological differentiation rather than mass production.

A growing sense of urgency is also evident, as relying solely on the EV market is no longer seen as a sustainable strategy.

LG Energy Solution plans to build a U.S.-based LFP ESS (Energy Storage System) factory in the second half of this year and start mass production in 2025. It also unveiled its second-generation (JF2) LFP ESS technology, which improves energy density by 21% for power grid applications.

Samsung SDI is making an aggressive push into the robotics battery market. The company recently signed an MOU with Hyundai Motor to co-develop batteries for its robots. Samsung SDI already supplies cylindrical batteries for Hyundai and Kia’s in-house robotics division, Robotics Lab, and plans to extend this partnership into next-generation battery solutions.

SK-on, in collaboration with SK Enmove, introduced its immersion cooling technology. Unlike conventional cooling methods that only cool the bottom of battery cells, this technique submerges the entire battery cell in a special cooling fluid, effectively dissipating heat. This enhances cooling performance, enables faster charging, and significantly improves fire safety.

Immersion cooling systems have gained attention in data centers, and SK-on aims to expand the business by leveraging synergies within the SK Group, including partnerships with SK Telecom.

To strengthen its ESS business, LG Energy Solution has also secured major contracts. In December of last year, the company signed a 7.5GWh ESS supply deal with U.S.-based Excelsior Energy Capital. In March, it was selected as a key partner for Poland’s state-owned power company PGE’s large-scale ESS project. The ESS batteries supplied to North America and Europe will be LFP-based and are scheduled for delivery starting in 2026.

Gwak Horyung (horr@fntimes.com)

![[삼성전자의 와신상담] ② 삼성전자 바꾸는 이재용 3픽 '전장‧디스플레이‧로봇'](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=202504011507190072374925877362115218260.jpg&nmt=18)

![[DQN] 은행권 건전성지표 하락세…산업은행, BIS비율 최하위](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20250331144322006145e6e69892f2208613587.jpg&nmt=18)

![삼성·현대·DL이앤씨, 신재생·도시정비·입찰기술실 등 조직개편 속도 [건설사 수익성 개선①]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025033116355900751e41d7fc6c212014262187.jpg&nmt=18)

![싼타페 위협하는 그랑 콜레오스, 현대차 세단 상승세 [3월 자동차 판매량]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20250401165748096277de3572ddd2115218260.jpg&nmt=18)

![현대·포스코이앤씨, 주택 아닌 에너지로 새 성장 전략 ‘눈길’ [건설사 수익성 개선②]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025033111355006809b372994c95118332810.jpg&nmt=18)

![[카드뉴스] KT&G ‘Global Jr. Committee’, 조직문화 혁신 방안 제언](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202503261121571288de68fcbb3512411124362_0.png&nmt=18)

![[카드뉴스] 국립생태원과 함께 환경보호 활동 강화하는 KT&G](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202403221529138957c1c16452b0175114235199_0.png&nmt=18)

![[카드뉴스] 신생아 특례 대출 조건, 한도, 금리, 신청방법 등 총정리...연 1%대, 최대 5억](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=20240131105228940de68fcbb35175114235199_0.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 지속 가능 경영, 보고와 검증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025011710043006774f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 똑똑한 금융생활...건전한 투자와 건강한 재무설계 지침서](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025031015443705043c1c16452b012411124362.jpg&nmt=18)

![[카드뉴스] KT&G ‘Global Jr. Committee’, 조직문화 혁신 방안 제언](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202503261121571288de68fcbb3512411124362_0.png&nmt=18)

![[AD] 기아, 혁신적 콤팩트 SUV ‘시로스’ 세계 최초 공개](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113461807771f9c516e42f12411124362.jpg&nmt=18)

![[AD] 아이오닉5 '최고 고도차 주행 전기차' 기네스북 올랐다...압도적 전기차 입증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113204707739f9c516e42f12411124362.jpg&nmt=18)