According to the Financial Supervisory Service's electronic disclosure system on March 23, the cumulative net loss of five subsidiaries and sub-subsidiaries related to future mobility established by Hyundai Motor in the United States over the past four years (2021-2024) amounts to KRW 5.7 trillion.

The five companies are HMG Global (new business investment), Motional (autonomous driving software), Supernal (AAM, Advanced Air Mobility), Boston Dynamics (robotics), and Boston Dynamics AI Institute (AI).

Motional has the largest cumulative loss at KRW 1.9184 trillion, followed by Supernal (KRW 1.3804 trillion) and Boston Dynamics (KRW 1.0304 trillion).

Despite not generating significant performance, the book value of these companies increased substantially last year. The value of Hyundai Motor's stake in four companies, excluding the sub-subsidiary Boston Dynamics, more than doubled from KRW 1.96 trillion in 2022 to KRW 4.23 trillion in 2024.

While the sharp rise in the dollar value had a significant impact, the continuous investment from Hyundai Motor Group also played a major role. This is interpreted as a willingness to endure immediate losses to nurture these as core future businesses.

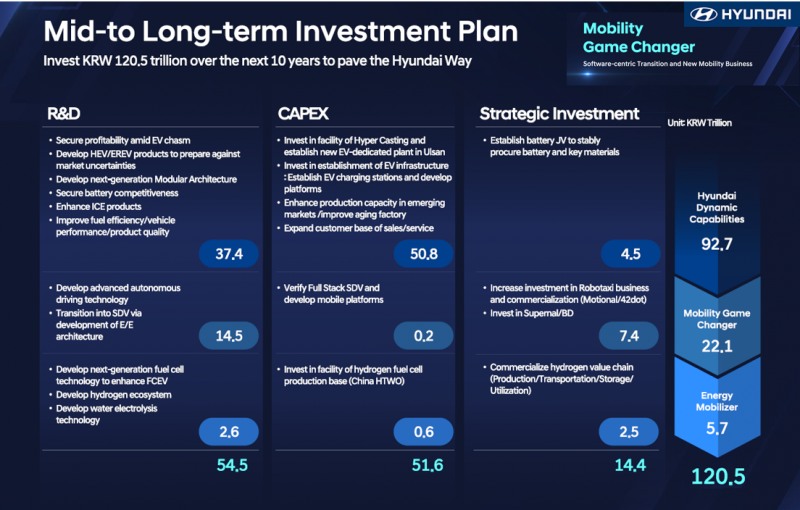

This can also be confirmed through the 10-year large-scale investment plan 'Hyundai Way' announced at Hyundai Motor's 'CEO Investor Day' in August last year.

Hyundai Motor plans to invest a total of KRW 120.5 trillion from 2024 to 2033. 77% of the investment (KRW 92.7 trillion) will be allocated to advancing the complete vehicle business, including eco-friendly vehicles. The remaining KRW 27.8 trillion will be invested in new businesses.

In particular, most of the new business investment (KRW 22.1 trillion) will be concentrated in three areas: autonomous driving, advanced air mobility, and robotics, under the name 'Mobility Game Changer'. These are all businesses centered around U.S. subsidiaries. This reflects the intention to continue investing heavily in these businesses.

HMG Global is an investment company established in Delaware, USA in 2022. It is responsible for discovering and investing in companies with new technologies. However, so far, it has been more active in investing in domestic companies to support the existing complete vehicle business, such as SK On's U.S. battery joint venture and Korea Zinc's equity investment.

Managing Boston Dynamics is also a key mission for HMG Global. HMG Global is the parent company of Boston Dynamics. HMG Global's ownership structure consists of Hyundai Motor 49.5%, Kia 30.5%, and Hyundai Mobis 20%. At the time of establishment, Hyundai Motor and Kia invested about KRW 700 billion, and Hyundai Motor and Hyundai Mobis contributed their 50% stake in Boston Dynamics.

Boston Dynamics is gaining attention for its potential as a robotics company. The humanoid robot 'Atlas' was newly introduced as a second-generation model with a battery after Hyundai Motor Group's acquisition. If it is deployed in Hyundai Motor and Kia's complete vehicle factories, a full-fledged performance upswing is expected.

Business expansion is also being explored. Earlier this month, the company announced collaboration with NVIDIA to build next-generation AI for humanoids, and it will start a new business consulting companies looking to utilize robots in industrial settings.

Boston Dynamics is also about 22% owned by Chung Eui-sun, Chairman of Hyundai Motor Group. This may be key to raising funds for future equity succession.

Motional is an autonomous driving company jointly invested by Hyundai Motor, Kia, Hyundai Mobis, and U.S.-based Aptiv in 2020.

Hyundai Motor Group invested KRW 2.7 trillion, and Aptiv provided corresponding manpower and technology, splitting the shares 50-50.

However, as plans for commercializing autonomous robo-taxis in the U.S. were delayed, Aptiv showed signs of pulling out. In contrast, Hyundai Motor injected emergency funds into Motional and also acquired some of Aptiv's Motional shares. As a result, Motional's ownership structure as of the end of last year was Hyundai Motor 44.2%, Kia 23.5%, and Hyundai Mobis 17%. Hyundai Motor Group now owns 84.7% of the shares.

Supernal, which is in charge of the Urban Air Mobility (UAM) business, is not yet generating revenue. It is developing vertical take-off and landing aircraft in line with the U.S. UAM commercialization timeline, which is expected to be possible around 2028 at the earliest.

Gwak Horyung (horr@fntimes.com)

![[DCM] 메리츠금융, 1500억 조달…홈플러스 사태" 평가 시험대](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025032605033808641a837df64942192515869.jpg&nmt=18)

![[DCM] KDB생명·푸본현대, ‘실질적’ 기본자본 킥스 마이너스(-)…무너진 자본·부채 균형](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025032519515109434a837df64942192515869.jpg&nmt=18)

![부산은행, 리스크에도 제4인뱅 뛰어든 속내는 [지방은행은 지금]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025032418025009291b4a7c6999c121131189150.jpg&nmt=18)

![[DCM] 한화에어로, 유증 규모가 예상을 뛰어 넘은 이유](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025032422161805670a837df64942192515869.jpg&nmt=18)

![[카드뉴스] KT&G ‘Global Jr. Committee’, 조직문화 혁신 방안 제언](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202503261121571288de68fcbb3512411124362_0.png&nmt=18)

![[카드뉴스] 국립생태원과 함께 환경보호 활동 강화하는 KT&G](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202403221529138957c1c16452b0175114235199_0.png&nmt=18)

![[카드뉴스] 신생아 특례 대출 조건, 한도, 금리, 신청방법 등 총정리...연 1%대, 최대 5억](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=20240131105228940de68fcbb35175114235199_0.jpg&nmt=18)

![[신간] 지속 가능 경영, 보고와 검증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025011710043006774f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 사모펀드 투자와 경영의 비밀](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024102809331308730f8caa4a5ce175114235199.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 똑똑한 금융생활...건전한 투자와 건강한 재무설계 지침서](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025031015443705043c1c16452b012411124362.jpg&nmt=18)

![[카드뉴스] KT&G ‘Global Jr. Committee’, 조직문화 혁신 방안 제언](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202503261121571288de68fcbb3512411124362_0.png&nmt=18)

![[AD] 기아, 혁신적 콤팩트 SUV ‘시로스’ 세계 최초 공개](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113461807771f9c516e42f12411124362.jpg&nmt=18)

![[AD] 아이오닉5 '최고 고도차 주행 전기차' 기네스북 올랐다...압도적 전기차 입증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113204707739f9c516e42f12411124362.jpg&nmt=18)