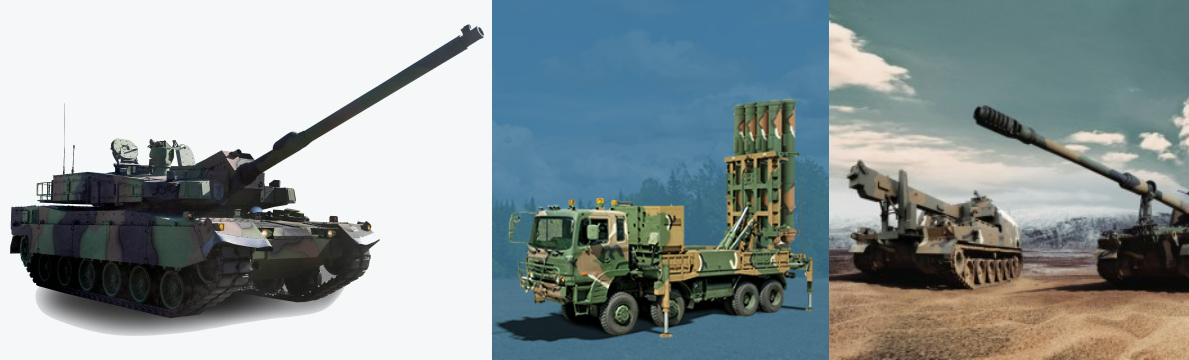

(From left to right) Hyundai Rotem K2 tank (Polish), LIG Nex1 M-SAM II, Hanwha Aerospace K9 self-propelled howitzer. /Photo courtesy of each company

이미지 확대보기European and Middle Eastern countries are actively pursuing military modernization projects to replace aging weapons, while U.S. President Trump is demanding increased defense spending from NATO members, leading to a surge in global defense demand.

As countries worldwide strengthen investments in self-reliant national defense, Korean defense companies, recognized for their high technology and quick delivery, are expected to play a significant role.

Hanwha Aerospace secured contracts for K9 howitzer supply to Romania (approximately KRW 1.3828 trillion), M-SAM II launcher and component production for Saudi Arabia (about KRW 940 billion), and the second implementation contract for K9 howitzers with Poland (around KRW 3.4758 trillion).

Hyundai Rotem signed a contract with the Polish Armaments Agency in July 2022 to export 1,000 K2 tanks, followed by the first implementation contract for 180 units in August of the same year.

LIG Nex1, after exporting M-SAM II worth over KRW 4 trillion each to the UAE in 2022 and Saudi Arabia in 2023, secured another KRW 3.7135 trillion contract with the Iraqi Ministry of Defense for M-SAM II in 2024.

Several export projects are also in the pipeline. According to a report by Samil PwC Management Institute, as the "Atlantic Alliance" between the U.S. and Europe shows signs of fracturing, defense exports are expected to increase, particularly in Eastern Europe, the Middle East, and Southeast Asia.

Hanwha Aerospace is currently negotiating K9 howitzer supply with India and is in the final stages of talks with Vietnam for exporting 20 units. A second contract with Romania, following last year's initial agreement, is also anticipated.

Hyundai Rotem is close to finalizing its second K2 tank contract with Poland, expected to be worth up to KRW 9 trillion. A decision on exports to Romania is also expected in the first half of this year.

Hyundai Rotem is currently negotiating with Romania, which is seeking to introduce new tanks for military modernization, for K2 tank exports.

LIG Nex1 aims to export Long-range Surface-to-Air Missiles (L-SAM) in addition to M-SAM II this year. The company actively promoted L-SAM at IDEX 2025, the largest defense exhibition in the Middle East and Africa region, held in the UAE last month.

TThere's also a high possibility of exporting the guided missile Poniard to the United States. Poniard passed evaluation tests last July, hitting all six targets during the final test firing at the Foreign Comparative Testing (FCT) in Hawaii. The potential sale of the naval air defense Surface-to-Air Anti-Missile SAAM to Malaysia is also being discussed.

This represents a 151.88% increase from the previous year's KRW 5.5578 trillion. While domestic sales of KRW 4.9715 trillion slightly exceeded exports of KRW 3.6369 trillion, exports more than doubled in a year.

Hyundai Rotem made history with defense exports exceeding KRW 1 trillion. Last year, the defense solutions division alone recorded sales of KRW 2.3652 trillion, accounting for more than half of the total KRW 4.3766 trillion. Defense exports increased by 133.18% year-on-year to KRW 1.5917 trillion.

In particular, Hyundai Rotem has grown rapidly to reach KRW 1 trillion in five years.

In 2020, the company had no exports in its defense solutions division. However, starting with KRW 300 million the following year, it increased to KRW 193.7 billion in 2022, KRW 682.6 billion in 2023, and surpassed KRW 1 trillion for the first time last year.

LIG Nex1 reported provisional sales of KRW 3.2771 trillion last year, with KRW 774.7 billion from overseas. While domestic sales still account for 76.4% of total revenue compared to 23.6% from overseas, foreign sales grew by 116.16% year-on-year.

As K-defense products gain popularity globally, the stock values of the defense industry's big three - Hanwha Aerospace, Hyundai Rotem, and LIG Nex1 - have soared.

Hanwha Aerospace's stock price rose by 151.73% last year, starting at KRW 129,700 on January 2, 2024, and reaching KRW 326,500 on December 30. This year, it surpassed KRW 700,000 for the first time on the 4th and continues to climb.

During the same period, Hyundai Rotem showed an 85.79% increase. The stock price, which was KRW 26,750 at the beginning of last year, rose to KRW 49,700 by the end of December. In March this year, it exceeded KRW 100,000.

LIG Nex1 started last year at KRW 128,300 and increased by 71.86% to KRW 220,500 over the year, currently surpassing KRW 300,000.

Shin Haeju (hjs0509@fntimes.com)

![[DCM] 메리츠금융, 1500억 조달…홈플러스 사태" 평가 시험대](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025032605033808641a837df64942192515869.jpg&nmt=18)

![[DCM] KDB생명·푸본현대, ‘실질적’ 기본자본 킥스 마이너스(-)…무너진 자본·부채 균형](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025032519515109434a837df64942192515869.jpg&nmt=18)

![부산은행, 리스크에도 제4인뱅 뛰어든 속내는 [지방은행은 지금]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025032418025009291b4a7c6999c121131189150.jpg&nmt=18)

![[DCM] 한화에어로, 유증 규모가 예상을 뛰어 넘은 이유](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025032422161805670a837df64942192515869.jpg&nmt=18)

![[카드뉴스] KT&G ‘Global Jr. Committee’, 조직문화 혁신 방안 제언](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202503261121571288de68fcbb3512411124362_0.png&nmt=18)

![[카드뉴스] 국립생태원과 함께 환경보호 활동 강화하는 KT&G](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202403221529138957c1c16452b0175114235199_0.png&nmt=18)

![[카드뉴스] 신생아 특례 대출 조건, 한도, 금리, 신청방법 등 총정리...연 1%대, 최대 5억](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=20240131105228940de68fcbb35175114235199_0.jpg&nmt=18)

![[신간] 지속 가능 경영, 보고와 검증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025011710043006774f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 사모펀드 투자와 경영의 비밀](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024102809331308730f8caa4a5ce175114235199.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 똑똑한 금융생활...건전한 투자와 건강한 재무설계 지침서](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025031015443705043c1c16452b012411124362.jpg&nmt=18)

![[카드뉴스] KT&G ‘Global Jr. Committee’, 조직문화 혁신 방안 제언](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202503261121571288de68fcbb3512411124362_0.png&nmt=18)

![[AD] 기아, 혁신적 콤팩트 SUV ‘시로스’ 세계 최초 공개](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113461807771f9c516e42f12411124362.jpg&nmt=18)

![[AD] 아이오닉5 '최고 고도차 주행 전기차' 기네스북 올랐다...압도적 전기차 입증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113204707739f9c516e42f12411124362.jpg&nmt=18)