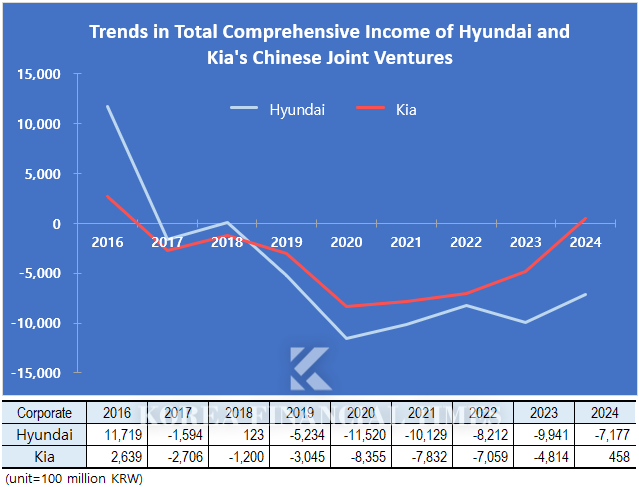

Beijing Hyundai Motor Company (BHMC), Hyundai's joint venture in China, recorded a comprehensive loss of KRW -717.7 billion last year. Although this marks an improvement of approximately KRW 300 billion compared to the KRW -1 trillion loss in 2023, the company has been incurring significant losses for six consecutive years. Due to these ongoing losses, Hyundai ceased equity method accounting for BHMC last year and reduced its book value to zero. Back in 2016, when Hyundai achieved its highest sales in China, BHMC’s book value stood at KRW 2.2258 trillion.

In contrast, Kia’s joint venture in China, Jiangsu Yueda Kia Motors Co. (KCN), reported a comprehensive income of KRW 45.8 billion last year, breaking a seven-year streak of losses since 2017.

The key factor differentiating the performance of Hyundai and Kia is exports. According to Kia's investor relations materials, the company exported 140,000 units from its Chinese factories last year—more than three times Hyundai's volume of 45,000 units. By Q3 of last year, Kia’s Chinese factory utilization rate exceeded 96%.

Kia began leveraging its Chinese factories as export bases two years earlier than Hyundai, starting in 2021. Its Yancheng plant in southeastern China strategically targets markets such as the Asia-Middle East (43%) and Latin America (30%). Although current sales volumes remain modest, Kia has also started exporting its EV5 electric vehicle model designed specifically for overseas markets from China. The company plans to increase exports from its Chinese plants to around 250,000 units this year.

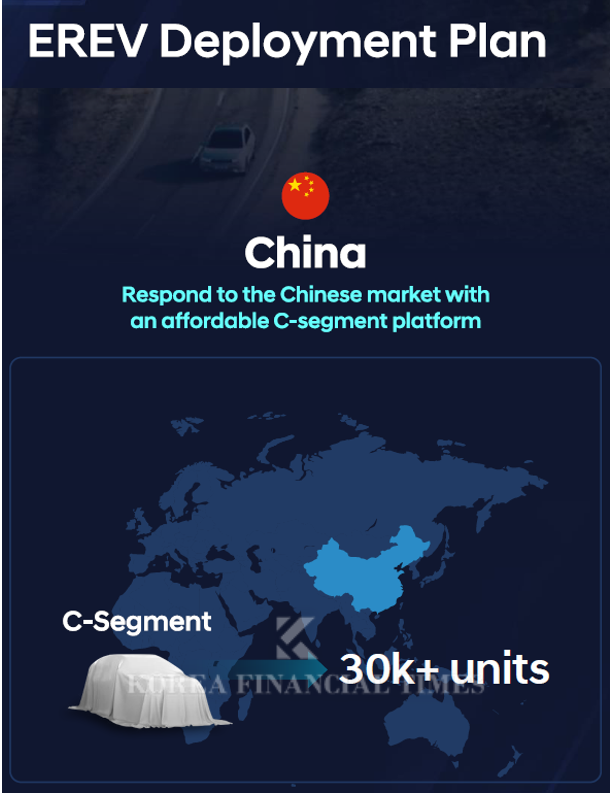

Hyundai Motor's EREV Development Plan. 2024 CEO Investor Day IR Materials

Gwak Horyung (horr@fntimes.com)

![[DCM] ‘후순위채 발행’ 현대해상, 다소 열위한 기본자본 확충](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025031905380203624a837df64942192515869.jpg&nmt=18)

![[카드뉴스] 국립생태원과 함께 환경보호 활동 강화하는 KT&G](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202403221529138957c1c16452b0175114235199_0.png&nmt=18)

![[카드뉴스] 신생아 특례 대출 조건, 한도, 금리, 신청방법 등 총정리...연 1%대, 최대 5억](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=20240131105228940de68fcbb35175114235199_0.jpg&nmt=18)

![[카드뉴스] 어닝시즌은 ‘실적발표기간’으로](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202311301105084674de68fcbb35175114235199_0.png&nmt=18)

![[신간] 지속 가능 경영, 보고와 검증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025011710043006774f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 사모펀드 투자와 경영의 비밀](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024102809331308730f8caa4a5ce175114235199.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 똑똑한 금융생활...건전한 투자와 건강한 재무설계 지침서](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025031015443705043c1c16452b012411124362.jpg&nmt=18)

![[AD] 기아, 혁신적 콤팩트 SUV ‘시로스’ 세계 최초 공개](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113461807771f9c516e42f12411124362.jpg&nmt=18)

![[AD] 아이오닉5 '최고 고도차 주행 전기차' 기네스북 올랐다...압도적 전기차 입증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113204707739f9c516e42f12411124362.jpg&nmt=18)