On March 14 (local time), global credit rating agency Moody's downgraded SK Innovation's credit rating from 'Baa3' to 'Ba1'. Baa3 was the lowest investment-grade rating, and this adjustment signifies a downgrade to below investment grade. Moody's cited "continued underperformance in the battery sector (SK On) and high debt burden" as reasons.

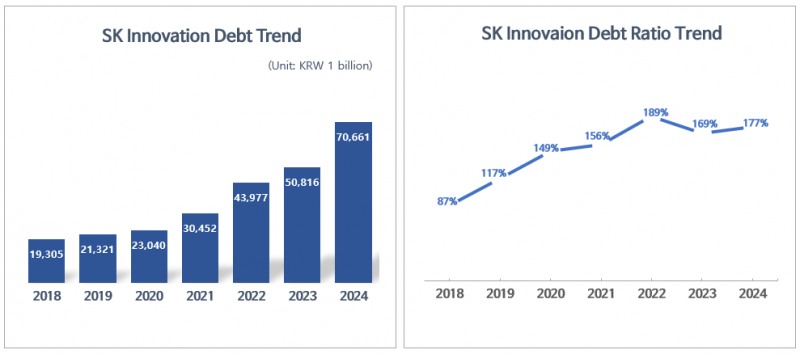

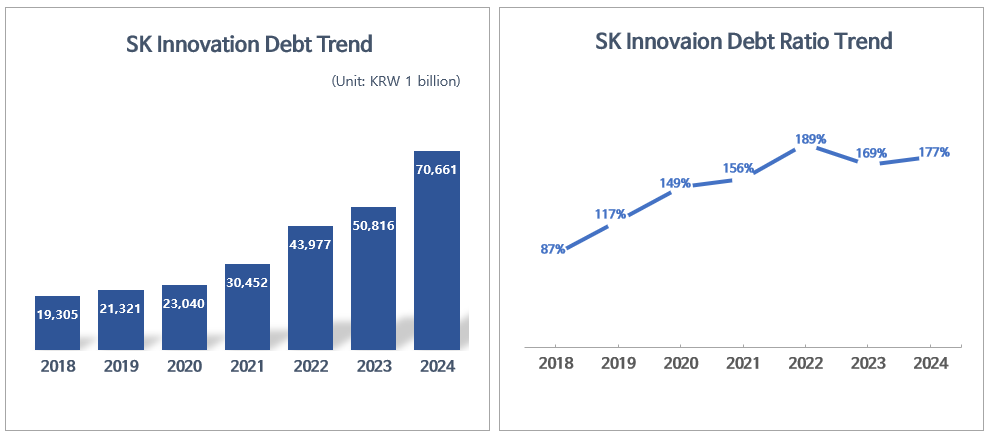

SK Innovation's financial burden has increased dramatically since 2020, largely due to increased borrowing for battery investments. The company's debt ratio has been on an upward trend: 87% in 2018, 149% in 2020, 189% in 2022, and 177% in 2024. Although it decreased slightly last year due to the merger with SK E&S, it remains at a level requiring management compared to other energy and battery companies maintaining ratios around 100%.

A greater concern is the uncertain short-term outlook for the battery sector. SK On reported an operating loss of KRW 1.127 trillion last year due to the electric vehicle chasm effect. Securities firms forecast a similar loss of around KRW 1 trillion this year, with no significant signs of recovery.

The poor profitability of the battery business could also negatively impact domestic credit ratings. Korea Ratings currently maintains SK Innovation's credit rating at AA (stable). One of the factors for a credit rating downgrade is "if the ratio of net borrowings to EBITDA (earnings before interest, taxes, depreciation, and amortization) consistently exceeds 7 times".

According to SK Innovation's IR materials, as of the end of last year, the company's net borrowings were KRW 27.5266 trillion, with an EBITDA of KRW 276.4 billion. The net borrowings to EBITDA ratio stands at 10.3 times, meeting the criteria for a credit rating downgrade.

Gwak Horyung (horr@fntimes.com)

![현대로템 흑자전환 '키맨' 김두홍 [나는 CFO다]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025031615594500123dd55077bc25812315232.jpg&nmt=18)

![게임강국 ‘콘솔 약체’ 오명 벗는다…K콘솔 5형제 [주목 이 기업]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025031616092101878dd55077bc25812315232.jpg&nmt=18)

![‘배달앱 새 시대’ 배민 vs 쿠팡이츠, 1위 뺏느냐 뺏기느냐 [주목 이 기업]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025031616115904614dd55077bc25812315232.jpg&nmt=18)

![정경선 현대해상 전무, 인사·조직 개편…위기 타개 시험대 [오너 보험사 리뷰 ②]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025031610134900117dd55077bc25812315232.jpg&nmt=18)

![강남권 재건축도 유찰…조합원들은 '발 동동' [2025 도시정비 기상도②]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025031716114705026e41d7fc6c2183101242202.jpg&nmt=18)

![[카드뉴스] 국립생태원과 함께 환경보호 활동 강화하는 KT&G](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202403221529138957c1c16452b0175114235199_0.png&nmt=18)

![[카드뉴스] 신생아 특례 대출 조건, 한도, 금리, 신청방법 등 총정리...연 1%대, 최대 5억](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=20240131105228940de68fcbb35175114235199_0.jpg&nmt=18)

![[카드뉴스] 어닝시즌은 ‘실적발표기간’으로](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202311301105084674de68fcbb35175114235199_0.png&nmt=18)

![[신간] 지속 가능 경영, 보고와 검증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025011710043006774f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 사모펀드 투자와 경영의 비밀](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024102809331308730f8caa4a5ce175114235199.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 똑똑한 금융생활...건전한 투자와 건강한 재무설계 지침서](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025031015443705043c1c16452b012411124362.jpg&nmt=18)

![[AD] 기아, 혁신적 콤팩트 SUV ‘시로스’ 세계 최초 공개](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113461807771f9c516e42f12411124362.jpg&nmt=18)

![[AD] 아이오닉5 '최고 고도차 주행 전기차' 기네스북 올랐다...압도적 전기차 입증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113204707739f9c516e42f12411124362.jpg&nmt=18)