Jung’s approach to the bio business is to ‘keep trying until it succeeds.’ Since officially entering the bio industry in 2019, the business results have been close to nonexistent, particularly in terms of financial performance, as the company has been unable to escape deficits.

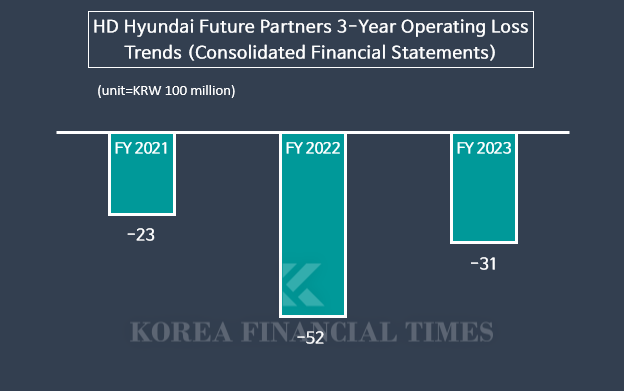

Founded on February 1, 2019, HD Hyundai Future Partners has recorded continuous operating losses in the billions of KRW from 2021 to 2023. The company reported an operating loss of KRW 2.3 billion in 2021, KRW 5.2 billion in 2022, and KRW 3.1 billion in 2023. The accumulated deficit has also expanded, reaching KRW 2.7 billion in 2021, KRW 6.8 billion in 2022, and KRW 8.9 billion in 2023.

This is not the first time HD Hyundai has liquidated a bio-related company. On March 1, 2019, the company partnered with Kakao to establish Asan-Kakao Medical Data, a joint venture for medical big data. However, due to differences in business direction, the company was dissolved in May 2022. HD Hyundai and Seoul Asan Hospital had invested a total of KRW 10 billion, holding 45% and 5% stakes, respectively, but failed to achieve significant results, recording an operating loss of KRW 51 million in 2021.

The move can also be seen as a restructuring of HD Hyundai’s new business portfolio. HD Hyundai Future Partners had been overseeing new drug development and digital healthcare businesses through its subsidiaries, AMC Bio and Mediplus Solution. However, in November 2024, HD Korea Shipbuilding & Offshore Engineering, an intermediate holding company of HD Hyundai, established AMC Science as a subsidiary specializing in medical and pharmaceutical R&D.

Following this, AMC Bio held a shareholders’ meeting on the 13th and decided to dissolve the company, with the liquidation process currently underway. Once the dissolution is complete, the company will lose its business rights, effectively ending its new drug research and development activities.

However, given that AMC Bio’s total assets were only KRW 35 million as of the first half of last year, it appears that the company was still in the early stages of new drug development. There is a possibility that the new drug business has been transferred to AMC Science. As a result, HD Hyundai is expected to focus on healthcare, while HD Korea Shipbuilding & Offshore Engineering will oversee new drug development.

Graph=Korea Financial Times

Mediplus Solution was acquired by HD Hyundai Future Partners in September 2021, with a 76.76% stake. The company provides specialized healthcare solutions for cancer and chronic disease patients based on data algorithms verified through clinical research at South Korea’s top five hospitals. Its main business includes Employee Assistance Programs (EAPs), offering services such as scheduling and managing comprehensive health checkups, reviewing results, monitoring key health indicators, and providing post-exam follow-up care.

Last year, Mediplus Solution secured KRW 8 billion in investment from Kyobo Life Insurance’s corporate venture capital fund, ‘Kyobo New Technology Investment Association No.1,’ validating its business potential. The company plans to expand into value-added services linked to insurance products. With user consent, it will provide continuous health monitoring and management solutions through professional oversight while also offering personalized insurance product recommendations.

Mediplus Solution is currently conducting a clinical study involving 5,000 participants in collaboration with Seoul Asan Hospital to evaluate the effectiveness of its mobile healthcare services in improving health outcomes.

Shin Haeju (hjs0509@fntimes.com)

![여승주 한화생명 부회장, 삼성 추월 3만명 설계사 GA 실적 고공행진…낮은 K-ICS 비율·무배당 비상 [금융사 2024 실적]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20230901143428080248a55064dd12115218260.jpg&nmt=18)

![[DQN] 5대 은행 글로벌 순익 역대 최대…순익 1등 '신한', 성장률은 '농협' [2024 은행 리그테이블]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025022511450405010237391cf86145616778.jpg&nmt=18)

![[DCM] '사실상 A+' 롯데물산, 신용등급 혼선…사업 불확실성 내포](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025022420330802100a837df64942192515869.jpg&nmt=18)

![금감원장 마음 돌린 임종룡號 우리금융···건전성·내부통제 '올인' [변화하는 우리금융①]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025022516352802553b4a7c6999c11919212895.jpg&nmt=18)

![[DCM] ‘첫 공모채 도전’ 한화리츠, 대규모 유증 참패 흔적](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025022518551500442a837df64942192515869.jpg&nmt=18)

![[카드뉴스] 국립생태원과 함께 환경보호 활동 강화하는 KT&G](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202403221529138957c1c16452b0175114235199_0.png&nmt=18)

![[카드뉴스] 신생아 특례 대출 조건, 한도, 금리, 신청방법 등 총정리...연 1%대, 최대 5억](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=20240131105228940de68fcbb35175114235199_0.jpg&nmt=18)

![[카드뉴스] 어닝시즌은 ‘실적발표기간’으로](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202311301105084674de68fcbb35175114235199_0.png&nmt=18)

![[신간] 지속 가능 경영, 보고와 검증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025011710043006774f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 사모펀드 투자와 경영의 비밀](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024102809331308730f8caa4a5ce175114235199.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 김국주 전 제주은행장, ‘나는 시간을 그린다 1·2’ 에세이 출간](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024111517430908074c1c16452b012411124362.jpg&nmt=18)

![[AD] 기아, 혁신적 콤팩트 SUV ‘시로스’ 세계 최초 공개](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113461807771f9c516e42f12411124362.jpg&nmt=18)

![[AD] 아이오닉5 '최고 고도차 주행 전기차' 기네스북 올랐다...압도적 전기차 입증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113204707739f9c516e42f12411124362.jpg&nmt=18)