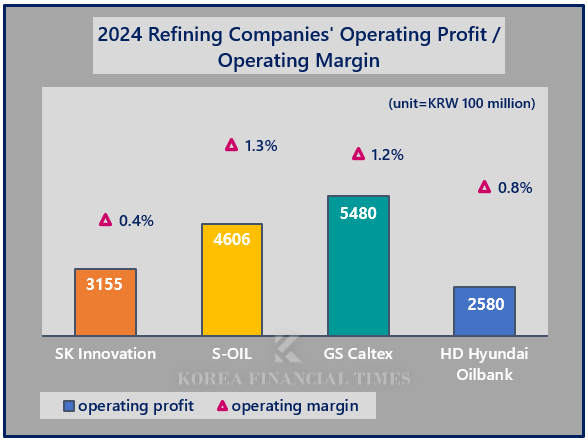

The combined annual operating profit of South Korea’s four major refiners stood at approximately KRW 1.58 trillion in 2024, a sharp decline to nearly one-third of the KRW 4.47 trillion recorded in 2023.

Looking back over the past year, all four companies were in the red in the wake of the economic slowdown that began in earnest in the second quarter and the plunge in oil prices in the third quarter, before rebounding in the fourth quarter on the back of a recovery driven by winter heating demand.

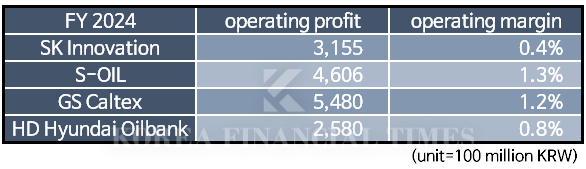

Graphic & Table Creation=Korea Financial Times / Data Source=Each company

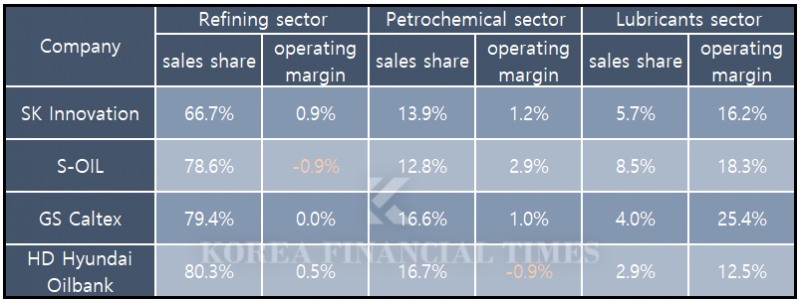

S-OIL recorded the highest operating margin (1.3%) among the four major refiners. Although it was the only company in the sector to post a deficit in its refining operations, its relatively strong performance in the struggling petrochemical sector helped offset losses. It was the only one of the four to post a loss in its refining business, but it offset this with relatively solid profitability in petrochemicals, where all were struggling.

S-Oil plans to start the Shahine Project in Ulsan in 2026, investing KRW 9 trillion to build a large-scale petrochemical complex. It is expected that the project will disrupt the domestic petrochemical landscape, leveraging the raw material prices and technological competitiveness of its parent company, Saudi Aramco. S-OIL plans to nearly double the proportion of its revenue derived from petrochemicals, increasing it from the current 12-13%.

* Excluding consolidation adjustments such as HD Hyundai Oil Bank's internal transactions / Data Source=Each company

이미지 확대보기Meanwhile, SK Innovation delivered relatively stable results in its traditional oil-based businesses. However, it suffered a substantial KRW 1.4 trillion deficit in its battery and battery materials divisions. The company did alleviate some financial pressure through its Q4 merger with E&S.

There is, however, a variable: former U.S. President Donald Trump. The domestic industry holds mixed feelings of “half expectation, half concern.”

If the Trump administration enforces a policy of strengthening tariffs, it could have a positive impact on the domestic refining industry. The increase in the proportion of expensive U.S. refineries could raise margins for oil products overall. However, uncertainty surrounding implementation and potential side effect of a global trade reduction make it difficult to gauge the actual impact on the industry.

Gwak Horyung (horr@fntimes.com)

![[주간 보험 이슈] 높은 손해율에 21일부터 삼성화재·현대해상·DB손보·KB손보 간병인사용일당 한도 하향 外](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20250420151700054058a55064dd12233887235.jpg&nmt=18)

![기관 '비에이치아이'·외인 '에이비엘바이오'·개인 '레인보우로보틱스' 1위 [주간 코스닥 순매수- 2025년 4월14일~4월18일]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025041912100306543179ad439072211389183.jpg&nmt=18)

![[4월 4주 청약일정] 올해 첫 수도권 대단지 등장...전국 5곳 4150가구 접수](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025041917052706712e41d7fc6c2183101242202.jpg&nmt=18)

![[DQN] 삼성생명 투자손익 1조원대 저력…교보생명 보험손익 폭풍성장·한화생명 주춤 [2024 보험 리그테이블]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20250420040021085738a55064dd112456187226.jpg&nmt=18)

![기관 'HD현대일렉트릭'·외인 '한국전력'·개인 'SK하이닉스' 1위 [주간 코스피 순매수- 2025년 4월14일~4월18일]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025041912002401443179ad439072211389183.jpg&nmt=18)

![12개월 최고 연 3.11%…iM뱅크 ‘iM주거래우대예금’ [이주의 은행 예금금리-4월 3주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20250418165350001645e6e69892f12113117217.jpg&nmt=18)

![[DQN] 순익 2조 돌파 삼성화재… 2위 접전 DB손보·메리츠화재 1조 클럽 턱걸이 현대해상 KB손보 성장세 [2024 보험 리그테이블]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20250418174146069919efc5ce4ae1183381150.jpg&nmt=18)

![24개월 최고 연 3.10%…고려저축은행 '회전정기예금'[이주의 저축은행 예금금리-4월 3주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025041823484408318957e88cdd522223380122.jpg&nmt=18)

![12개월 최고 연 5.20%, 제주은행 ‘MZ 플랜적금’ [이주의 은행 적금금리-4월 3주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20250418170104095705e6e69892f12113117217.jpg&nmt=18)

![[카드뉴스] KT&G ‘Global Jr. Committee’, 조직문화 혁신 방안 제언](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202503261121571288de68fcbb3512411124362_0.png&nmt=18)

![[카드뉴스] 국립생태원과 함께 환경보호 활동 강화하는 KT&G](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202403221529138957c1c16452b0175114235199_0.png&nmt=18)

![[카드뉴스] 신생아 특례 대출 조건, 한도, 금리, 신청방법 등 총정리...연 1%대, 최대 5억](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=20240131105228940de68fcbb35175114235199_0.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 지속 가능 경영, 보고와 검증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025011710043006774f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 똑똑한 금융생활...건전한 투자와 건강한 재무설계 지침서](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025031015443705043c1c16452b012411124362.jpg&nmt=18)

![[카드뉴스] KT&G ‘Global Jr. Committee’, 조직문화 혁신 방안 제언](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202503261121571288de68fcbb3512411124362_0.png&nmt=18)

![[AD] 기아, 혁신적 콤팩트 SUV ‘시로스’ 세계 최초 공개](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113461807771f9c516e42f12411124362.jpg&nmt=18)

![[AD] 아이오닉5 '최고 고도차 주행 전기차' 기네스북 올랐다...압도적 전기차 입증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113204707739f9c516e42f12411124362.jpg&nmt=18)