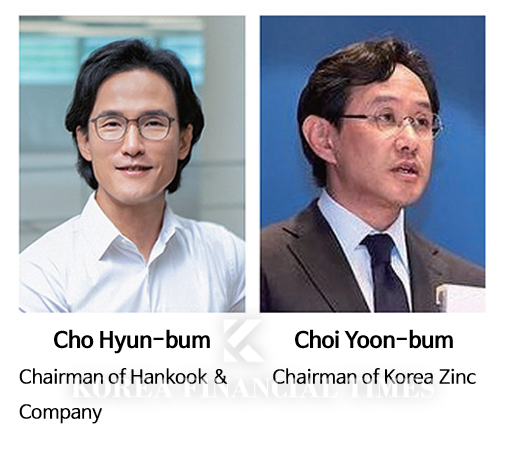

Hankook Tire, the core subsidiary of Chairman Cho Hyun-bum’s Hankook & Company Group, recorded consolidated sales of KRW 9.4119 trillion and an operating profit of KRW 1.7622 trillion in 2024. These figures mark a 5% increase in sales and a 33% surge in operating profit compared to the company’s best-ever performance in 2023.

This achievement is particularly noteworthy given the sluggish growth in the global automotive market due to economic downturns. Hankook Tire’s ability to break its own records again is attributed to its strategic focus on high-value tire products. In 2023, the proportion of high-inch (18 inches and above) tires in its total sales rose to 47%, up 3 percentage points from the previous year.

The company also performed well in the electric vehicle (EV) market, which has been experiencing a temporary slowdown. The proportion of EV-specific tires in its original equipment (OE) tire sales jumped from 15% at the end of 2023 to 22% by the end of 2024, a seven-percentage-point increase. Securing major automakers like Hyundai, Kia, Tesla, and BYD as customers was key to this growth.

To support this expansion, Hankook Tire launched ‘iON,’ the world’s first full lineup of EV-dedicated tires for summer, all-season, and winter conditions.

Korea Zinc, led by Chairman Choi Yoon-bum, also posted solid results despite a challenging business environment. In 2024, the company’s consolidated sales reached KRW 12.0828 trillion, a 25% increase from the previous year, while operating profit rose 11.5% to KRW 736.1 billion.

Korea Zinc acknowledged difficulties in maintaining profitability due to declining non-ferrous metal prices and lower refining fees in Q4 2024. However, it exceeded its business plan targets for key products on an annual basis: zinc (113.9%), lead (100.7%), and silver (124.5%).

Uncertainties in the global economy are expected to persist this year. Nevertheless, Korea Zinc sees opportunities to expand its business due to the shutdown or downsizing of competing smelters overseas, production halts at domestic rival Young Poong Corporation, and China’s export restrictions on rare metals to the U.S.

Hankook Tire and Korea Zinc share a common factor: both have been targeted by MBK Partners in attempts to challenge their leadership. MBK has sought to gain control under the pretext of improving governance, but the companies’ strong recent performances weaken the credibility of such claims.

An industry insider noted, “Owner-led management has the advantage of enabling large-scale investments with a long-term perspective. Under a professional management system that is judged on short-term performance, such bold decisions are difficult to make quickly.”

Chairman Cho Hyun-bum finalized the acquisition of Hanon Systems in November 2024, aiming to expand the group’s focus from automotive tires to thermal management systems. His vision is to transform Hankook & Company into a leading mobility group for the EV era, despite concerns about the high acquisition cost and potential financial strain.

Similarly, Chairman Choi Yoon-bum is advancing what he calls the ‘Troika Initiative,’ which focuses on hydrogen, battery materials, and resource recycling. However, MBK Partners has leveraged concerns over Korea Zinc’s financial structure to mount an attack on its leadership.

That said, owner-led management has also faced criticism for its lack of shareholder-friendly policies. Hankook & Company perfected its governance through so-called “treasury stock trick,” which restored treasury stock voting rights in the Hankook & Company-Hankook Tire spinoff in 2021.

Additionally, Hankook Tire’s acquisition of Hanon Systems was blamed for a decline in its stock price. Meanwhile, Korea Zinc’s Chairman Choi Yoon-bum faced backlash after attempting to raise KRW 2.5 trillion through a rights issue to defend his leadership. He was ultimately forced to withdraw the plan and issue an apology following opposition from investors and government intervention.

Gwak Horyung (horr@fntimes.com)

![[DCM] SK엔무브, 배당 퍼주고 빚 돌려막기? 최대 3000억 회사채 발행](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025022017354706250141825007d12411124362.jpg&nmt=18)

![김종현 쿠콘 대표, 데이터 사업 집중 전략으로 순익 2배 '껑충' [2024 금융사 실적]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20250220100504085116a663fbf34175192139202.jpg&nmt=18)

![[카드뉴스] 국립생태원과 함께 환경보호 활동 강화하는 KT&G](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202403221529138957c1c16452b0175114235199_0.png&nmt=18)

![[카드뉴스] 신생아 특례 대출 조건, 한도, 금리, 신청방법 등 총정리...연 1%대, 최대 5억](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=20240131105228940de68fcbb35175114235199_0.jpg&nmt=18)

![[카드뉴스] 어닝시즌은 ‘실적발표기간’으로](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202311301105084674de68fcbb35175114235199_0.png&nmt=18)

![[신간] 지속 가능 경영, 보고와 검증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025011710043006774f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 사모펀드 투자와 경영의 비밀](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024102809331308730f8caa4a5ce175114235199.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 김국주 전 제주은행장, ‘나는 시간을 그린다 1·2’ 에세이 출간](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024111517430908074c1c16452b012411124362.jpg&nmt=18)

![[AD] 기아, 혁신적 콤팩트 SUV ‘시로스’ 세계 최초 공개](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113461807771f9c516e42f12411124362.jpg&nmt=18)

![[AD] 아이오닉5 '최고 고도차 주행 전기차' 기네스북 올랐다...압도적 전기차 입증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113204707739f9c516e42f12411124362.jpg&nmt=18)