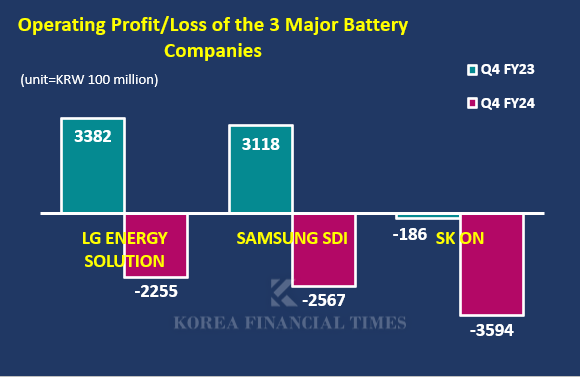

On the 6th, SK Innovation announced that its battery subsidiary, SK On, posted an operating loss of KRW 359.4 billion in Q4 2024. This represents a KRW 340 billion increase in losses compared to the KRW 18.6 billion deficit recorded in the same period of 2023. The company’s total annual losses for 2024 reached KRW 1.127 trillion.

LG Energy Solution, which had reported its earnings earlier, recorded an operating loss of KRW 225.5 billion, while Samsung SDI posted a deficit of KRW 256.7 billion. Both companies saw their losses increase by approximately KRW 560 billion year-over-year. The decline is attributed to sluggish EV sales in Europe and falling battery metal prices. The slowdown in EV growth, which began in the second half of 2023, appears to be persisting.

Graph=Korea Financial Times / Material source=Each company

Battery companies, which had previously dismissed the "Trump risk" as having a low chance of materializing, are now growing increasingly uneasy.

During an earnings conference call on January 24, LG Energy Solution stated, "Policy uncertainty in North America is quite high." While the company believes there is little likelihood of changes to battery production subsidies under the Advanced Manufacturing Production Credit (AMPC), it sees a risk of EV purchase subsidies being reduced or eliminated. This uncertainty is leading automakers to adopt a more conservative approach to their EV plans, which in turn is affecting battery production rates.

Samsung SDI, which is set to begin full-scale operations at its first U.S. plant this year, acknowledged the challenges, stating, "Given the fluctuating market conditions and uncertainty, we are in discussions with our customer, Stellantis, regarding annual production volumes."

In Q4 2024, the financial benefits from the AMPC program amounted to KRW 377.3 billion for LG Energy Solution, KRW 81.3 billion for SK On, and KRW 24.9 billion for Samsung SDI. With an increasing portion of their earnings now tied to U.S. policies, any drastic changes could deal a severe blow to their financial performance.

LG Energy Solution announced that it will cut its investment budget by 20–30% compared to last year’s KRW 13 trillion, meaning it will likely spend around KRW 10 trillion in 2025. SK On plans to slash its investments from KRW 7.5 trillion to KRW 3.5 trillion—roughly half. While Samsung SDI did not disclose a specific investment figure, it confirmed that spending will decrease compared to last year’s KRW 6.6 trillion.

![이영종 신한라이프 대표, 통합 이래 최대 실적 달성…신한카드와 지주 비은행 이익 주도 [금융사 2024 실적]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024120623095906388dd55077bc212411124362.jpg&nmt=18)

![박춘원 JB우리캐피탈 대표, 중고차·투자금융으로 역대 최대 순익 2239억원 달성 [2024 금융사 실적]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024030323134809470dd55077bc211420517591.jpg&nmt=18)

![[DCM] DB생명, 이유 있는 ‘긍정적’ 등급 전망…자본확충 청신호](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025020523215200916a837df64942192515869.jpg&nmt=18)

![[카드뉴스] 국립생태원과 함께 환경보호 활동 강화하는 KT&G](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202403221529138957c1c16452b0175114235199_0.png&nmt=18)

![[카드뉴스] 신생아 특례 대출 조건, 한도, 금리, 신청방법 등 총정리...연 1%대, 최대 5억](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=20240131105228940de68fcbb35175114235199_0.jpg&nmt=18)

![[카드뉴스] 어닝시즌은 ‘실적발표기간’으로](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202311301105084674de68fcbb35175114235199_0.png&nmt=18)

![[신간] 지속 가능 경영, 보고와 검증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025011710043006774f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 사모펀드 투자와 경영의 비밀](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024102809331308730f8caa4a5ce175114235199.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 김국주 전 제주은행장, ‘나는 시간을 그린다 1·2’ 에세이 출간](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024111517430908074c1c16452b012411124362.jpg&nmt=18)

![[AD] 기아, 혁신적 콤팩트 SUV ‘시로스’ 세계 최초 공개](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113461807771f9c516e42f12411124362.jpg&nmt=18)

![[AD] 아이오닉5 '최고 고도차 주행 전기차' 기네스북 올랐다...압도적 전기차 입증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113204707739f9c516e42f12411124362.jpg&nmt=18)