Graph=Korea Financial Times

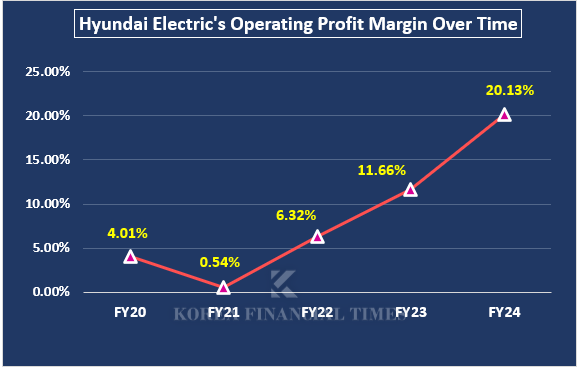

The company recorded its highest-ever revenue of KRW 3.3233 trillion last year. Notably, its operating profit reached KRW 669 billion, achieving an impressive 20% operating profit margin—an exceptional feat for a manufacturing company.

How did HD Hyundai Electric achieve such results? The company primarily focuses on producing high-value ultra-high voltage (UHV) power equipment among various power devices. It holds the largest market share in South Korea’s UHV power equipment sector.

An industry official explained, "Ultra-high voltage power equipment is extremely expensive. For instance, the contract value of an ultra-high voltage direct current (HVDC) transformer can reach up to KRW 500 billion."

According to the Korea Trade Statistics Information Portal (TRASS), in October last year, the export price of ultra-high voltage transformers peaked at $19.99 per kilogram (approximately KRW 29,335).

Another strength of HD Hyundai Electric is its selective order strategy. Since late 2019, the company has moved away from low-margin contracts and adopted a profit-focused approach to order selection. This shift helped the company turn around from operating losses of KRW 100.6 billion and KRW 156.7 billion in 2018 and 2019, respectively, to a profit of KRW 72.7 billion in 2020.

In 2023, HD Hyundai Electric secured orders worth $3.816 billion (approximately KRW 5.6015 trillion), exceeding its original business plan by $73 million (approximately KRW 107.1 billion).

Cho Seok, President and CEO, HD Hyundai Electric

Among South Korea's three major power equipment manufacturers (LS Electric, Hyosung Heavy Industries, and HD Hyundai Electric), HD Hyundai Electric operates the largest transformer production facility in the U.S. It has two key subsidiaries: HD Hyundai Electric America Corporation in Atlanta, which handles transformer sales, and HD Hyundai Power Transformers USA in Alabama, which manufactures industrial power equipment.

As of the end of 2023, the Atlanta subsidiary recorded KRW 633.6 billion in revenue, while the Alabama subsidiary posted KRW 285.9 billion. However, in Q4 2024, the company's North American revenue fell 11.8% year-on-year to KRW 181.8 billion, as deliveries from its U.S. subsidiary were postponed at the request of customers.

Shin Haeju (hjs0509@fntimes.com)

![‘실적부진·갑질논란’ 김선진 코오롱생명과학 대표, 희망은 ‘인보사’ [라스트 1년]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025013116534907092dd55077bc212411124362.jpg&nmt=18)

![보험판매전문회사 입법 잰걸음…GA 위상 제고 기대 [GA사 특집]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025013116165104381dd55077bc212411124362.jpg&nmt=18)

![‘발상의 전환’ 현대제철 서강현, 美에 제철소 짓는다 [라스트 1년]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025013116464701923dd55077bc212411124362.jpg&nmt=18)

![권오갑 회장, HD현대 3세 승계 ‘화룡점정’ 찍을까 [라스트 1년]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025013116395908771dd55077bc212411124362.jpg&nmt=18)

![“소주 이어 맥주도” 하이트진로 김인규, 간절한 ‘소맥왕’ 도전 [라스트 1년]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025013116485906554dd55077bc212411124362.jpg&nmt=18)

![“스쳐 지나갈 일은 없다” 정신아가 던진 ‘카나나 승부수’ [라스트 1년]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025013116424508001dd55077bc212411124362.jpg&nmt=18)

![[카드뉴스] 국립생태원과 함께 환경보호 활동 강화하는 KT&G](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202403221529138957c1c16452b0175114235199_0.png&nmt=18)

![[카드뉴스] 신생아 특례 대출 조건, 한도, 금리, 신청방법 등 총정리...연 1%대, 최대 5억](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=20240131105228940de68fcbb35175114235199_0.jpg&nmt=18)

![[카드뉴스] 어닝시즌은 ‘실적발표기간’으로](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202311301105084674de68fcbb35175114235199_0.png&nmt=18)

![[신간] 지속 가능 경영, 보고와 검증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025011710043006774f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 사모펀드 투자와 경영의 비밀](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024102809331308730f8caa4a5ce175114235199.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 김국주 전 제주은행장, ‘나는 시간을 그린다 1·2’ 에세이 출간](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024111517430908074c1c16452b012411124362.jpg&nmt=18)

![[AD] 기아, 혁신적 콤팩트 SUV ‘시로스’ 세계 최초 공개](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113461807771f9c516e42f12411124362.jpg&nmt=18)

![[AD] 아이오닉5 '최고 고도차 주행 전기차' 기네스북 올랐다...압도적 전기차 입증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113204707739f9c516e42f12411124362.jpg&nmt=18)