Samsung Electronics CFO Park Soon-cheol, who assumed the role this year, stated this during the 2024 Q4 and annual earnings conference call held on the 31st. His remarks are interpreted as an effort to reassure investors amid concerns over uncertainties such as weakened HBM competitiveness last year, semiconductor export regulations under the Trump administration, and the shock from China’s DeepSeek this year.

Samsung Electronics reported consolidated annual revenue of KRW 300.9 trillion and an operating profit of KRW 32.7 trillion for the previous year. Revenue surpassed the KRW 300 trillion mark for the second time in history, following 2022. Operating profit saw a 398% increase year-on-year, benefitting from the semiconductor downturn base effect in 2023.

Q4 performance also reflected this base effect, with revenue reaching KRW 75.8 trillion and operating profit at KRW 6.5 trillion, marking year-on-year increases of 12% and 130%, respectively. However, revenue and operating profit declined by 4% and 29%, respectively, compared to the previous quarter.

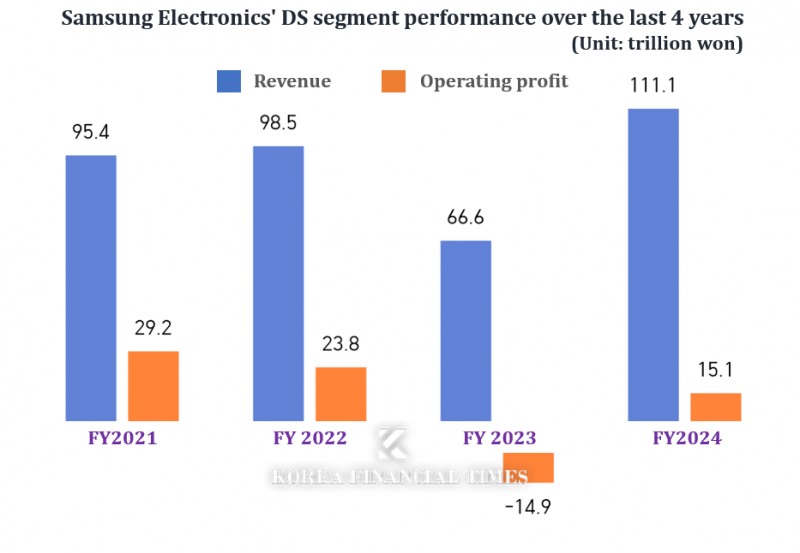

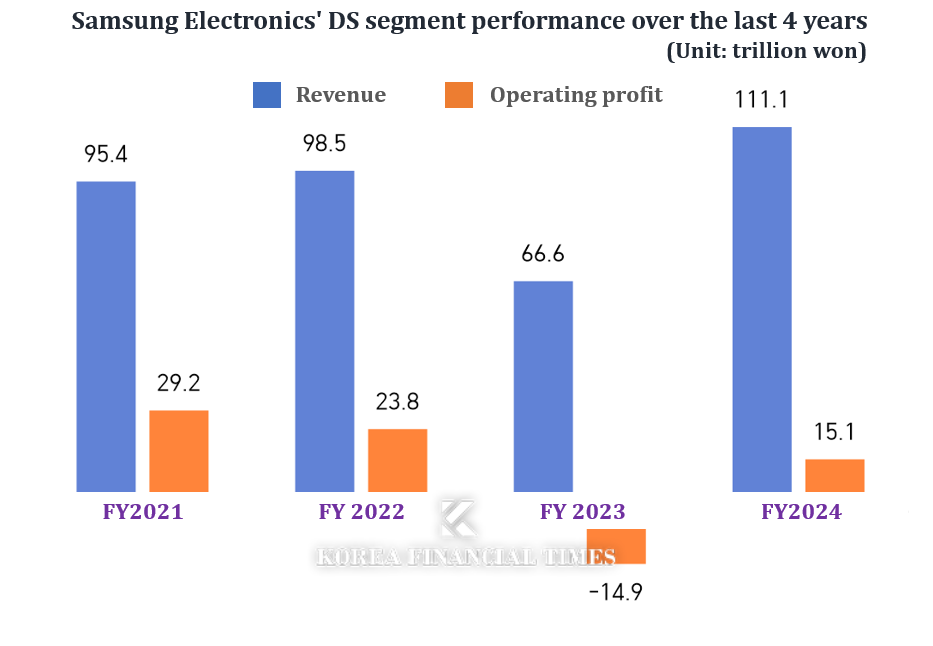

The continued weakness in the semiconductor (DS) division was particularly painful. The DS division posted revenue of KRW 30.1 trillion and an operating profit of KRW 2.9 trillion in Q4. While revenue set a record high for Q4, operating profit fell short of the securities market forecast of approximately KRW 3.5 trillion. The DS division’s annual operating profit stood at KRW 15.1 trillion, marking the first time it lagged behind SK Hynix’s annual operating profit (approximately KRW 22 trillion).

This was attributed to delays in HBM (High Bandwidth Memory) supply, declining utilization rates in the foundry business, increased R&D expenses for advanced processes, and weak mobile demand in the System LSI division. Industry insiders estimate that the foundry and System LSI divisions each recorded annual losses of around KRW 2 trillion last year.

Samsung Electronics anticipates continued weakness in the DS division in Q1 of this year. Kim Jae-jun, Vice President of Samsung’s Memory Business Division, stated, "HBM demand uncertainty is increasing more than expected due to geopolitical issues such as U.S. export controls on AI semiconductors, and there is also a delay in demand due to the introduction of improved products." Regarding NAND, he added, "Customer inventory adjustments are expected to continue through Q1, leading to a projected bit growth decline of around 10% compared to the previous quarter."

Regarding the impact of China’s startup DeepSeek, which launched the AI model ‘DeepSeek R1’ using low-cost HBM, Samsung expressed a cautious stance, acknowledging both opportunities and risks for memory semiconductor companies. DeepSeek R1, constrained by U.S. sanctions against China, uses the lower-performance NVIDIA H800 AI accelerator instead of the high-end H100. However, it outperformed OpenAI’s ‘o1’ inference AI model, launched in September last year, in certain performance tests, causing a market stir.

In particular, the H800 utilized by DeepSeek is equipped with a relatively inexpensive GPU that is more than two generations behind the third (HBM2E) or fourth (HBM3) generation of HBM3E, which is heavily purchased by major global customers such as Nvidia. This is a high performance at a fraction of the price of U.S. AI with premium products. This poses a risk to Samsung Electronics and SK Hynix, which are currently focused on producing HBM3E products.

Vice President Kim Jae-jun remarked, "The industry dynamics are constantly evolving, and it is premature to make judgments with limited information." He continued, "Since we supply HBM to multiple customers in the GPU sector, there will be both long-term opportunities and short-term risks in the market."

"Industry dynamics always shift with the introduction of new technologies, and we are actively preparing to respond to the AI market. We are closely monitoring various scenarios to ensure timely adaptation," he emphasized.

Kim Jae-jun stated, "We are preparing the improved HBM3E product as planned and will start supplying it to select customers by the end of Q1, with visible supply growth expected from Q2." He added, "We will double our HBM supply compared to last year in response to customer demand, and HBM4 (6th generation) development is progressing as planned for mass production in the second half of 2025."

Additionally, Samsung is proceeding smoothly with plans for a rebound in other divisions, including the adoption of advanced foundry processes and the accelerated development of Exynos 2500. The foundry division aims to secure customer demand through the mass production and stabilization of its 2nm process while strengthening its competitiveness in the 4nm process with improved design infrastructure. The System LSI division plans to develop flagship SoCs in a timely manner for integration into major customer models, while the sensor division will expand its business by meeting the growing demand for high-resolution sensors, including 200MP models.

Samsung is going all-in on reviving its DS division through record-high R&D and facility investments. Its R&D expenses in Q4 2023 reached a record KRW 10.3 trillion, with full-year spending totaling KRW 35 trillion—the highest in history. Facility investments also surged, increasing by KRW 5.4 trillion from the previous quarter to KRW 17.8 trillion in Q4, with KRW 16 trillion allocated to semiconductors.

CFO Park Soon-cheol stated, "We will continue making investments at a scale similar to last year to secure future technological leadership, maintaining our focus on R&D and advanced HBM process investments."

He added, "All of us in management, including myself, recognize the challenging business environment and are doing our utmost to overcome it. Looking at Samsung’s history, we have always grown by leveraging our fundamental competitiveness and technological strength during crises. We believe today’s challenges are also an opportunity for a new leap forward."

Kim JaeHun (rlqm93@fntimes.com)

![김기준號 카카오벤처스, 당근·두나무로 흑자 성공…올해 리벨리온 IPO 기대 [2024 VC 실적]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025041716034400631957e88cdd522223380122.jpg&nmt=18)

![이재용 삼성전자 회장이 서울대 동양사학과를 선택한 이유 두 가지 [오너가 나온 그 대학]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20250418151700049270d260cda752115218260.jpg&nmt=18)

![김대웅 웰컴저축은행 대표, 리테일 중심 영업 순익 반등 성공…건전성 관리 과제 [2024 금융사 실적]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20250416041813025356a663fbf34175192139202.jpg&nmt=18)

![김동호號 KCD, 연 매출 1500억 목전···수익성 개선·흑자전환 '과제' [2024 핀테크 실적]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025041615450809096957e88cdd512116082156.jpg&nmt=18)

![진성원 우리카드 대표, '효율적' 업무체계로 조직 혁신·경쟁력 강화 [금융계열 카드사 CEO 취임 100일]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20250417154155045829efc5ce4ae17521479195.jpg&nmt=18)

![[DCM] ‘부정적 꼬리표’ 호텔신라, 불안한 AA급 방어전](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025041807200401791a837df64942192515869.jpg&nmt=18)

![서초 '디에이치반포라클라스' 34평, 7,3억 오른 40.3억원에 신고가 거래 [일일 아파트 신고가]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025032620355507501dd55077bc212411124362.jpg&nmt=18)

![[카드뉴스] KT&G ‘Global Jr. Committee’, 조직문화 혁신 방안 제언](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202503261121571288de68fcbb3512411124362_0.png&nmt=18)

![[카드뉴스] 국립생태원과 함께 환경보호 활동 강화하는 KT&G](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202403221529138957c1c16452b0175114235199_0.png&nmt=18)

![[카드뉴스] 신생아 특례 대출 조건, 한도, 금리, 신청방법 등 총정리...연 1%대, 최대 5억](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=20240131105228940de68fcbb35175114235199_0.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 지속 가능 경영, 보고와 검증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025011710043006774f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 똑똑한 금융생활...건전한 투자와 건강한 재무설계 지침서](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025031015443705043c1c16452b012411124362.jpg&nmt=18)

![[카드뉴스] KT&G ‘Global Jr. Committee’, 조직문화 혁신 방안 제언](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202503261121571288de68fcbb3512411124362_0.png&nmt=18)

![[AD] 기아, 혁신적 콤팩트 SUV ‘시로스’ 세계 최초 공개](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113461807771f9c516e42f12411124362.jpg&nmt=18)

![[AD] 아이오닉5 '최고 고도차 주행 전기차' 기네스북 올랐다...압도적 전기차 입증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113204707739f9c516e42f12411124362.jpg&nmt=18)