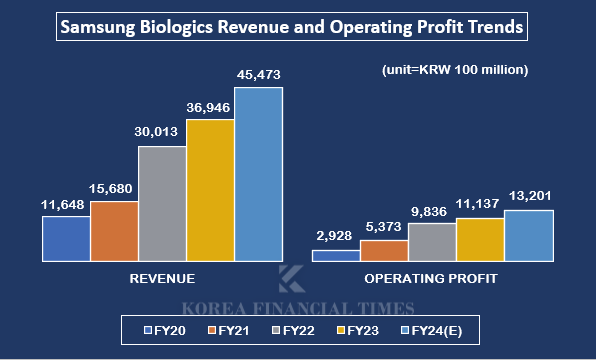

According to Samsung Biologics on the 23rd, the company achieved consolidated revenue of KRW 4.5473 trillion and operating profit of KRW 1.3201 trillion last year, marking year-on-year growth of 23% and 19%, respectively. In Q4 alone, the company posted its highest-ever quarterly performance with a 17% increase in revenue. Following its milestone of exceeding KRW 3 trillion in annual revenue in 2022, Samsung Biologics has once again taken a significant leap forward.

The company’s growth trajectory has been steep. In just eight years since its IPO in 2016, when its revenue was only KRW 294.6 billion, Samsung Biologics has achieved an astonishing growth rate of over 1,400%. This translates to an average annual growth rate of 48%.

Behind this success lies the company's "overwhelming production capacity." All three of its initial plants operated at full capacity last year, with its fourth plant also contributing significantly to revenue growth as its operational rate increased. The fourth plant, which began full-scale operations in June 2023, played a major role in driving revenue.

High-quality standards also played a critical role. Currently, Samsung Biologics counts 17 of the top 20 global pharmaceutical companies as clients. Last year, the company won three large contracts worth KRW 1 trillion out of a total of KRW 5.4035 trillion in annual orders, and all three were with global pharmaceutical companies. A company representative said, "We are strengthening partnerships with global clients based on our superior quality competitiveness.“

John Lim, CEO of Samsung Biologics, delivers a corporate presentation at the Grand Ballroom, the main venue of the JPMorgan Healthcare Conference (JPMHC) in San Francisco, U.S., on the 14th (local time)./Photo=Samsung Biologics

이미지 확대보기Samsung Biologics plans to continue to expanding its scale this year as part of its 'unrivaled capacity' strategy. This April, its fifth plant, with a production capacity of 180,000 liters, is set to begin operations. Once operational, Samsung Biologics’ total production capacity will reach 784,000 liters. For comparison, Celltrion, another Korean CDMO (contract development and manufacturing organization), currently operates at a total capacity of approximately 250,000 liters.

The company has already laid out a long-term plan to expand production capacity to eight plants. This year, Samsung Biologics plans to present investment proposals for constructing a sixth plant to its board of directors. When the sixth plant is completed in 2027, the company’s capacity will increase by an additional 180,000 liters, reaching a total of 964,000 liters. When all eight plants are completed in 2032, the company will have a total capacity of 1.32 million liters, nearly double the capacity of Switzerland's Lonza (780,000 liters) and Japan's Fujifilm (750,000 liters), which are among the top three global CDMOs alongside Samsung Biologics.

While there are concerns about 'excessive facilities', the company is not simply increasing its size. It is also applying the super-gap formula in various ways in terms of technology, such as securing new modalities and investing in biotech ventures. The plan is to increase technological prowess as the company grows in size, and to easily obtain orders proportional to its production capacity.

Particular emphasis will be placed on emerging modalities, such as antibody-drug conjugates (ADCs) and cell and gene therapies (CGTs), as these areas are expected to grow significantly. As part of this, Samsung Biologics, along with Samsung C&T and Samsung Bioepis, has established the 'Samsung Life Science Fund' to invest in promising biotech companies. Last year, the fund provided financial support to companies such as BrickBio, Latus Bio, Generate Biomedicines, and Flagship Pioneering, a startup venture capital firm.

The company is also accelerating its portfolio expansion. In 2024, Samsung Biologics launched five new technology platforms and customized service packages, boosting its competitiveness in contract development (CDO). Additionally, in December 2024, the company completed a dedicated ADC production facility and aims to establish an ADC drug product (DP) production line by Q1 2027.

Samsung Biologics has set a revenue target of KRW 5.5705 trillion for 2025. Already, on January 14, the company secured a massive KRW 2 trillion contract with a European pharmaceutical company, marking its largest contract to date at $1.41 billion (approximately KRW 2.0747 trillion). Furthermore, the potential benefits of U.S. policies under a second Trump administration—such as measures to curb Chinese competitors and support biosimilars—may present additional growth opportunities for Samsung Biologics.

A company representative remarked, "We will continue to work closely with our clients to ensure the rapid and stable supply of medicines," adding, "We plan to accelerate our three-pronged strategy of expanding production capacity, diversifying our portfolio, and strengthening global hubs to sustain our growth momentum.“

Meanwhile, on a standalone basis, Samsung Biologics recorded KRW 3.4971 trillion in annual revenue and KRW 1.3214 trillion in operating profit last year. Its subsidiary, Samsung Bioepis, posted revenue of KRW 1.5377 trillion and operating profit of KRW 435.4 billion during the same period.

Kim Nayoung, Korea Finacial Times (steaming@fntimes.com)

![할아버지 정주영이 짓고, 손자 정의선 애정이 담긴 국내 最古 경영학부 [오너가 나온 그 대학]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025030323512906011dd55077bc25812315232.jpg&nmt=18)

![이환주號 국민은행, 순익 163.5% 늘었지만···대외 변동성에 수익성·건전성↓ [금융사 2025 1분기 실적]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025042421110200774b4a7c6999c145616778.jpg&nmt=18)

![도봉 '창동주공3단지' 24평, 2.9억 내린 6.1억원에 거래 [이 주의 하락아파트]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2022111808264906239dd55077bc2175114235199.jpg&nmt=18)

![임종룡號 우리금융, 비용 증가에 순이익 11%↓···비은행·건전성 관리도 '미흡' [금융사 2025 1분기 실적]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025022818101104975b4a7c6999c121131189150.jpg&nmt=18)

![[4월 5주 청약일정] 잇따른 ‘분양가 상한제’ 단지 공급…전국 12곳 4162가구 접수](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025042518030800663e41d7fc6c2183101242202.jpg&nmt=18)

![[카드뉴스] KT&G ‘Global Jr. Committee’, 조직문화 혁신 방안 제언](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202503261121571288de68fcbb3512411124362_0.png&nmt=18)

![[카드뉴스] 국립생태원과 함께 환경보호 활동 강화하는 KT&G](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202403221529138957c1c16452b0175114235199_0.png&nmt=18)

![[카드뉴스] 신생아 특례 대출 조건, 한도, 금리, 신청방법 등 총정리...연 1%대, 최대 5억](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=20240131105228940de68fcbb35175114235199_0.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 지속 가능 경영, 보고와 검증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025011710043006774f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 똑똑한 금융생활...건전한 투자와 건강한 재무설계 지침서](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025031015443705043c1c16452b012411124362.jpg&nmt=18)

![[카드뉴스] KT&G ‘Global Jr. Committee’, 조직문화 혁신 방안 제언](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202503261121571288de68fcbb3512411124362_0.png&nmt=18)

![[AD] 기아, 혁신적 콤팩트 SUV ‘시로스’ 세계 최초 공개](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113461807771f9c516e42f12411124362.jpg&nmt=18)

![[AD] 아이오닉5 '최고 고도차 주행 전기차' 기네스북 올랐다...압도적 전기차 입증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113204707739f9c516e42f12411124362.jpg&nmt=18)