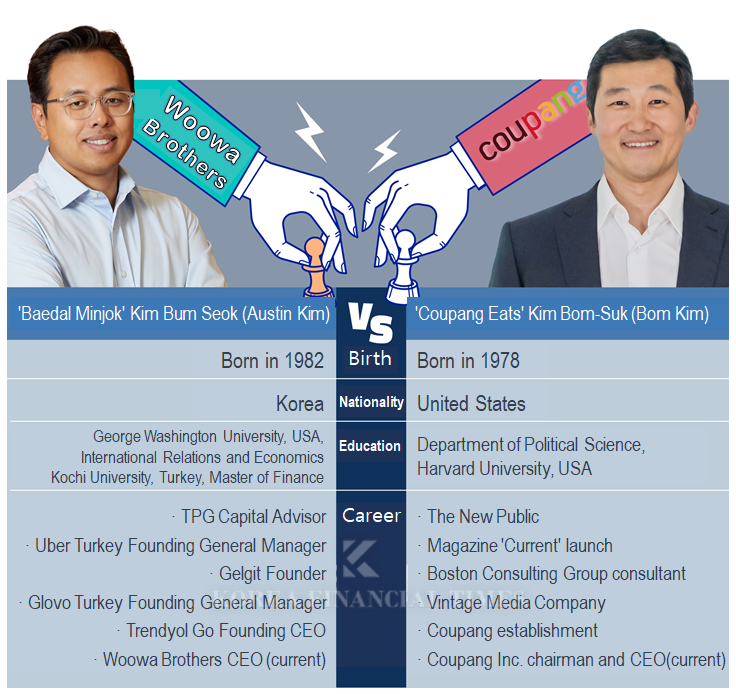

김범석기사 모아보기 (Kim Beom-seok)'. This rare coincidence has drawn attention recently with Bum Seok Austin Kim officially appointed as the new head of Woowa Brothers, the operator of Baemin.

김범석기사 모아보기 (Kim Beom-seok)'. This rare coincidence has drawn attention recently with Bum Seok Austin Kim officially appointed as the new head of Woowa Brothers, the operator of Baemin.Baemin and Coupang Eats are the top two competitors in the delivery industry. While Baemin leads the pack, Coupang Eats has been rapidly closing the gap, turning the competition into an intense race.

This year, attention is particularly high due to both companies being led by CEOs with the same Korean name. The industry is eagerly watching to see what strategic moves these leaders will make to dominate the market.

Kim Bom-Suk of Coupang serves as the chairman and CEO of Coupang, Inc., Coupang’s parent company. Although he does not directly operate Coupang Eats, he is often mentioned along with Baemin's new CEO, Bum Seok Austin Kim, because Coupang Eats is operated under his influence. On earnings calls, Kim frequently highlights the benefits of Coupang Eats, reinforcing its integral role within the company’s ecosystem.

Interestingly, both Bum Seok Austin Kim and Kim Bom-Suk have international experience.

Bum Seok Austin Kim of Baemin, born in 1982, also goes by the English name Austin Kim. Though he has spent much of his career abroad, he holds Korean citizenship. His family moved to Turkey in 1991 to run a family business, and he spent his school years primarily in the United States. He graduated from Wilbraham & Monson Academy in Massachusetts and earned a degree in International Relations and Economics from George Washington University. He later returned to Turkey, completing a master’s degree in finance at Koç University, one of the country’s prestigious institutions.

Coupang’s Kim Bom-Suk, born in 1978, is a Korean-American who moved to the U.S. during middle school. Known as Bom Kim in English, he graduated with a degree in Political Science from Harvard University and started an MBA at Harvard Business School, though he dropped out midway.

Both Bum Seok Austin Kim and Kim Bom-Suk share a history of founding startups, though their focus areas differ.

Bum Seok Austin Kim began his career at TPG Capital Advisors before taking on key roles such as ▲ Founding manager of Uber Turkey ▲ Founder of Gelgit, a mobility platform ▲ Launching Glovo Turkey ▲ Founding Trendyol Go, a prominent e-commerce player in Turkey. Most of his ventures revolved around platforms like e-commerce and delivery, with Trendyol Go standing out as a significant name in the Turkish market.

Coupang’s Kim Bom-Suk initially pursued interests in media. He founded the magazine Current, selling it to Newsweek in 2001, and later worked as a consultant at Boston Consulting Group. After running his own media company, Vintage Media, he dropped out of Harvard Business School and returned to Korea to establish Coupang, which has since become a behemoth in e-commerce and logistics.

As these two individuals with overlapping yet distinct journeys face off in the delivery industry, intense competition is expected to unfold. This year is anticipated to bring even more variables to the mix, making each company’s strategies crucial.

Baemin’s Bum Seok Austin Kim aims to solidify the company’s position as the top player by leveraging his expertise in global platforms. Speaking at a company-wide event on January 8 at the Lotte World Tower in Songpa, Seoul, he stated, “I will bring Baemin back onto a growth trajectory in 2025. To achieve this, we must thoroughly transform from the ground up, maximizing customer value and enhancing their experiences.”

Austin Kim, CEO, has a lot of homework to do. He has to implement the win-win plan that he has been investing manpower, money, and time in since the end of last year, starting in February, and he also has to strengthen his own competitiveness to shake off Coupang Eats, which is chasing Baemin.

To this end, CEO Austin Kim is pushing for improvements to the UI (user interface) of the app, which is divided into food delivery and store delivery. He also announced plans to strengthen the benefits of the subscription service Baemin Club, expand the region, and improve the service structure so that customers can conveniently enjoy discount benefits.

However, concerns persist regarding his understanding of the Korean market. Bum Seok Austin Kim was appointed by Delivery Hero, Woowa Brothers’ German parent company. While renowned as a platform expert, much of his career has been centered in Turkey and Europe. His grasp of Korean consumer sentiment and market dynamics will likely play a critical role in shaping Baemin’s strategies. In addition, as Baemin is the ‘number one company’ representing the delivery app, it has the task of taking into account the sentiments of Korea, the political circles, and stakeholders.

Coupang Eats Chairman Kim Bom-Suk is expected to continue its aggressive growth this year. Chairman Kim Bom-Suk has continued aggressive investments to create Coupang, which has 40 trillion won in annual sales. He invested under the name of ‘planned deficit’ and eventually created an annual surplus. It has now emerged as the most influential distribution channel both online and offline.

Coupang Eats is also expected to follow a similar growth pattern to Coupang. At one time, it was treated as a ‘sore finger’ to the point that there were ‘sale rumors’, but now it has become one of the driving forces that can attract more ‘Wow members’ to Coupang. This was possible because of continuous investments such as ‘10% discount on delivery fees’ and ‘free delivery.’

Through this, Coupang Eats has overtaken Yogiyo, the second largest company in the industry, and has also increased its market influence.

Kim Bom-Suk has repeatedly emphasized, “Despite our growth, Coupang’s market share in the vast retail sector remains in the single digits.” Coupang Eats is likely to continue aligning itself with Coupang’s subscription program, Wow Membership, to drive synergy.

However, its commitment to “coexistence” within the industry remains a question. While Coupang Eats initially dragged its feet in negotiations for an industry-wide partnership plan last year, it eventually joined late in the process.

Recently, on December 19, the Democratic Party’s Euljiro Committee and Civic Action Committee announced plans to form a new collaborative organization for delivery app agreements, creating uncertainty for the existing partnership plan. Attention is being paid to how Coupang Eats will implement the partnership plan it initially promised and what discussions it will have with the new consultative body.

According to data firm IGAWorks, Coupang Eats recorded 9.63 million monthly active users (MAU) as of December 2024, a 72.1% increase (4.04 million users) from the previous year. During the same period, Baemin maintained its dominant lead with 22.43 million users, while Yogiyo saw a decline to 5.47 million users.

An industry insider remarked, “The delivery app market this year will likely be dominated by the two giants, Baemin and Coupang Eats. As the competition between the two intensifies, especially in metropolitan areas, the race is bound to heat up further.”

Park seulgi (seulgi@fntimes.com)

![기관 '알테오젠'·외인 '에코프로'·개인 '리노공업' 1위 [주간 코스닥 순매수- 2026년 2월19일~2월20일]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026022023314903795179ad4390711823566145.jpg&nmt=18)

![[주간 보험 이슈] 보험사에도 행동주의 펀드 목소리…얼라인파트너스 DB손보 공개서한·에이플러스에셋 주주제안 外](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20250915111248076232a735e27af12411124362.jpg&nmt=18)

![기관 '삼성전자'·외인 'SK하이닉스'·개인 '삼성전자' 1위 [주간 코스피 순매수- 2026년 2월19일~2월20일]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026022023232506292179ad4390711823566145.jpg&nmt=18)

![12개월 최고 연 4.95%, 제주은행 'MZ 플랜적금' [이주의 은행 적금금리-2월 4주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260220164037004135e6e69892f2114827133.jpg&nmt=18)

![12개월 최고 연 3.25%…SC제일은행 'e-그린세이브예금' [이주의 은행 예금금리-2월 4주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260220161811090515e6e69892f2114827133.jpg&nmt=18)

![24개월 최고 연 5.15%, 제주은행 'MZ 플랜적금' [이주의 은행 적금금리-2월 4주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260220164219002235e6e69892f2114827133.jpg&nmt=18)

![24개월 최고 연 3.10%…부산은행 '더 특판 정기예금' [이주의 은행 예금금리-2월 4주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260220162010050335e6e69892f2114827133.jpg&nmt=18)

![12개월 최고 연 3.30%…참저축은행 '비대면 회전정기예금' [이주의 저축은행 예금금리-2월 4주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260220180505017526a663fbf34175192139202.jpg&nmt=18)

![12개월 최고 연 5.00%…세람저축은행 '펫밀리 정기적금' [이주의 저축은행 적금금리-2월 4주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260220184140081126a663fbf34175192139202.jpg&nmt=18)

![24개월 최고 연 3.25%…흥국저축은행 '정기예금(강남)' [이주의 저축은행 예금금리-2월 4주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260220183141006236a663fbf34175192139202.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)