Choi Yoon-bum, Chairman of Korea Zinc (left) and Jang Hyeong-jin, Advisor of Youngpoong

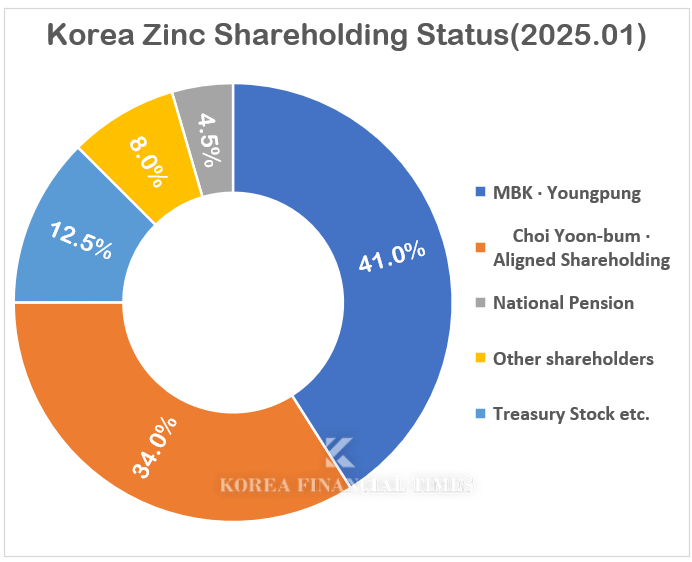

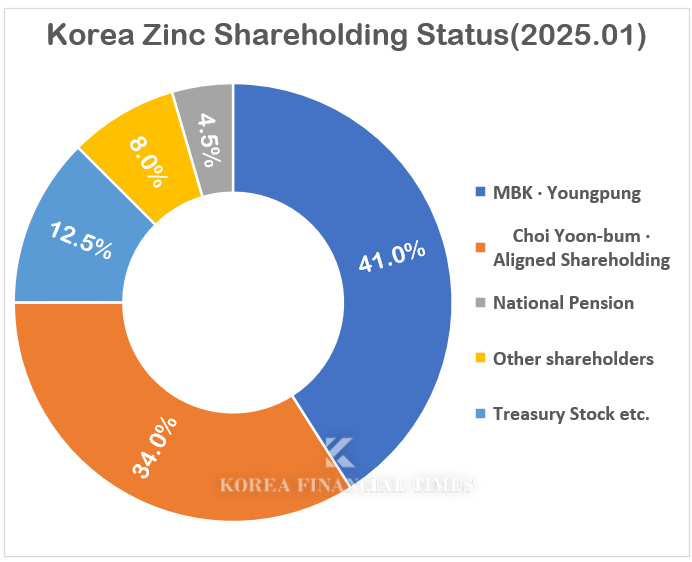

MBK-Youngpung holds a 40.97% stake in Korea Zinc. Chairman Choi Yoon-bum and his friend are estimated to hold 34%. MBK-Youngpung is ahead by 6 to 7 percentage points. However, MBK-Youngpung does not have a majority with 46.7 percent of voting shares. It is far from certain that it will be able to pass its agenda. Choi's Aligned Shareholding consists of Hanwha, Hyundai Motor, LG Chem, Trapigura, Morgan Stanley, and Chosun Refractories, all of which are classified as friends. However, it's hard to be sure what position they will take at the actual shareholders' meeting.

To begin with, there are three main issues on the agenda for the extraordinary general meeting of Koryo Zinc: ▲ concentrated voting system, ▲ limitation of the number of directors (19), and ▲ nomination of director candidates.

The concentrated voting system is a method that grants voting rights to the number of directors elected per share when appointing multiple directors. For example, if 10 directors are elected, a shareholder with 10 shares has 100 votes. They can also vote for a single director candidate. Under the same conditions, under the traditional “one share = one vote” system, they would have 10 votes. The existing system favors large shareholders with large stakes.

In the case of Korea Zinc, voting in favor of a concentrated voting system would mean supporting Chairman Choi Yoon-bum, whose shareholding is lagging behind. Moreover, the proposal to introduce the concentrated voting system limits the voting rights of a single shareholder to a maximum of 3%. The analysis favors Choi's side, whose shares are divided among various companies and institutions.

Limiting the number of directors is also a proposal from Choi's side. Currently, the board of directors of Koryo Zinc consists of 12 members. Excluding non-executive director Jang Hyung-jin and advisor Youngpung, the remaining 11 are Choi's people. The 19-member limit would mean seven new directors. This means that MBK-Youngpung will not be able to control the board of directors at this extraordinary general meeting.

ISS sided with MBK and Youngpung on this issue. It opposed the concentrated voting system and voted against all director nominees recommended by the board. Glass Lewis, on the other hand, voted in favor of Choi. It favored the introduction of the concentrated voting system and opposed MBK-Youngpung's nominees. ISS noted that a concentrated voting system for minority shareholders “could have unintended consequences” in the case of Korea Zinc. “The company's financial and operational performance has been quite good compared to its peers, including the leadership of Chairman Choi Yoon-bum,” Glass Lewis said.

With such conflicting opinions, it is difficult to predict the outcome of the extraordinary general meeting of Korea Zinc. Some observers believe that the management dispute will be prolonged.

Even if MBK-Youngpung wins control of the board this time, it is doubtful that the uncertainty caused by the dispute will disappear completely. This is because Korea Zinc employees are actively voicing their support for the current management.

On the 16th, Vice Chairman Lee Jae-joong, Chief Technology Officer of Korea Zinc, and core technical staff issued a statement saying, “We will not stand with MBK-Youngpung if the hostile M&A attempt by MBK-Youngpung is successful.”

The Korea Zinc Workers' Union also announced on the 17th that it recently held a meeting with the Korean Confederation of Trade Unions and the Korean Federation of Metalworkers' Unions to discuss solidarity struggles against the 'hostile M&A'. “If MBK robs Korea Zinc, we will do everything we can to stop it at any cost, including a general strike, to protect our workplace,” said Moon Byung-guk, chairman of the KZIN union.

Gwak Horyung (horr@fntimes.com)

![메리츠·키움증권 ‘먹통’ 반복…1조 전산비, 어디로 갔나 [증권 줌인]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025050817441903946237391cf86223384679.jpg&nmt=18)

![[정답은 TSR] 펄어비스, '붉은사막'으로 역전 홈런칠까](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=202505081629400159274925877362115218260.jpg&nmt=18)

![ABL생명에 쏠리는 눈…우리금융라이프 합병 vs 재매각 시나리오는 [우리금융-동양·ABL 인수]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20241023144316079148a55064dd1175114235199.jpg&nmt=18)

![[DCM] SK텔레콤 해킹, 계열사 연계 서비스 파장 우려](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025050816511407044a837df6494211219106120.jpg&nmt=18)

![케뱅 성장세에 밀린 전북은행, 인뱅 협업·외국인 시장 '승부수' [지방은행-인뱅 추격전②]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025050815441504268300bf52dd2121131180157.jpg&nmt=18)

![[카드뉴스] KT&G ‘Global Jr. Committee’, 조직문화 혁신 방안 제언](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202503261121571288de68fcbb3512411124362_0.png&nmt=18)

![[카드뉴스] 국립생태원과 함께 환경보호 활동 강화하는 KT&G](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202403221529138957c1c16452b0175114235199_0.png&nmt=18)

![[카드뉴스] 신생아 특례 대출 조건, 한도, 금리, 신청방법 등 총정리...연 1%대, 최대 5억](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=20240131105228940de68fcbb35175114235199_0.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 지속 가능 경영, 보고와 검증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025011710043006774f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 똑똑한 금융생활...건전한 투자와 건강한 재무설계 지침서](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025031015443705043c1c16452b012411124362.jpg&nmt=18)

![[카드뉴스] KT&G ‘Global Jr. Committee’, 조직문화 혁신 방안 제언](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202503261121571288de68fcbb3512411124362_0.png&nmt=18)

![[AD] 기아, 혁신적 콤팩트 SUV ‘시로스’ 세계 최초 공개](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113461807771f9c516e42f12411124362.jpg&nmt=18)

![[AD] 아이오닉5 '최고 고도차 주행 전기차' 기네스북 올랐다...압도적 전기차 입증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113204707739f9c516e42f12411124362.jpg&nmt=18)