According to foreign media and industry sources on the 14th, the U.S. Environmental Protection Agency (EPA) released a list of 25 vehicle models eligible for this year’s EV tax credit. This marks a significant drop from last year’s 40 models. Starting this year, the target vehicle types have been significantly reduced due to strengthened regulations on the proportion of core battery minerals procured from overseas concern groups (China, Russia, Iran, and North Korea).

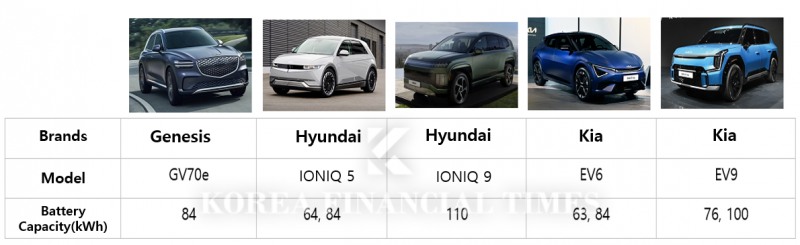

Although the number of eligible vehicles using SK On batteries dropped from 10 last year to 8 this year, SK On is still seen as a beneficiary of the tightened regulations. This is because five new electric vehicles from Hyundai Motor Group equipped with large-capacity batteries will be added, even though Volkswagen ID.4 and others are excluded from the tax deduction target. These include the Hyundai IONIQ 5 and 9, Genesis Electrified GV70, and Kia EV6 and 9.

Previously, at the beginning of last year, none of Hyundai Motor Group’s EVs sold in the U.S. qualified for tax credits. However, with the full-scale operation of Hyundai Motor Group’s Metaplant America (HMGMA) in Georgia, the vehicles are now eligible for benefits.

Hyundai Motor Group is expanding its influence in the U.S. EV market. According to Kelley Blue Book, Hyundai Motor Group sold 89,589 electrified vehicles (BEVs and PHEVs) in the U.S. during the third quarter of last year, marking a 31% increase compared to the same period the previous year. Hyundai’s sales placed it second after Tesla (471,374 units) and ahead of GM (69,458 units). Notably, Hyundai outperformed Volkswagen, which sold 16,375 units of the ID.4.

If Hyundai Motor Group performs well this year, it could provide much-needed relief for SK On, which is grappling with a deteriorating financial structure. Last year, SK On received approximately KRW 211 billion in IRA tax credit benefits, a decrease of about 44% from the same period due to sluggish sales by Volkswagen and Ford.

From SK On's perspective, in order to keep its promise of a successful initial public offering (IPO), it needs to survive this year by taking advantage of the Hyundai Motor Group's U.S. electric vehicle effect. Although the company succeeded in turning a profit in the third quarter of last year, it is expected to record a large deficit again in the fourth quarter as demand for electric vehicles continues to slow. Additionally, risks remain regarding potential changes in EV policies under President Donald Trump’s administration.

Gwak Horyung (horr@fntimes.com)

![[DQN] ‘김동선 체제 4년’ 한화갤러리아, 사업확장 했지만 돈은 못 벌었다 [Z스코어 기업가치 바로보기]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026030120193900218dd55077bc212411124362.jpg&nmt=18)

![박인원의 ‘휴머노이드 선언’...두산 ‘3차 대변신’ 이끌까 [K-휴머노이드 대전] ③ ‘오너 4세’ 주도 두산로보틱스](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026030120284507035dd55077bc212411124362.jpg&nmt=18)

![[인터뷰] 최인욱 두산에너빌리티 WPC 센터장 “두산이 하면 대한민국 최초, 그 자부심으로 일합니다”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260303085809018500d260cda7512411124362.jpg&nmt=18)

![전국 해상풍력발전 24시간 모니터링…AI로 고장 예측 [두산에너빌 제주 WPC 가보니]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026030120373904050dd55077bc212411124362.jpg&nmt=18)

![금융회사 최고경영자 10명 중 6명 “올 영업이익 5% 인공지능에 투자”[AX, 금융 대변혁의 시대]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026030119023002211dd55077bc212411124362.jpg&nmt=18)

![[그래픽 뉴스] “돈로주의 & 먼로주의: 미국 외교정책이 경제·안보에 미치는 영향”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602261105472649de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=2026022714105702425de68fcbb3512411124362.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=2026022714100604994de68fcbb3512411124362.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)