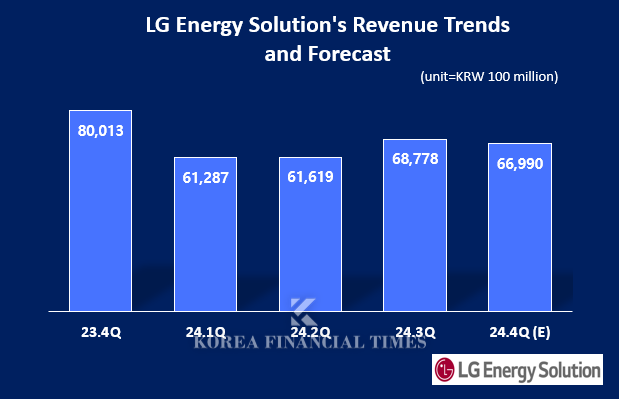

NH Investment & Securities researcher Joo Min-woo released a corporate analysis report on LG Energy Solution on the 30th and estimated that the company would record sales of KRW 6.699 trillion and an operating loss of KRW 258.4 billion in the fourth quarter of this year.

Previously, on the 25th of last month, researcher Joo estimated sales of KRW 7.039 trillion and an operating loss of KRW 154 billion through the company's fourth quarter performance outlook. At that time, it was lower than the consensus (average of securities firm estimates), but it was further adjusted downward after just over a month.

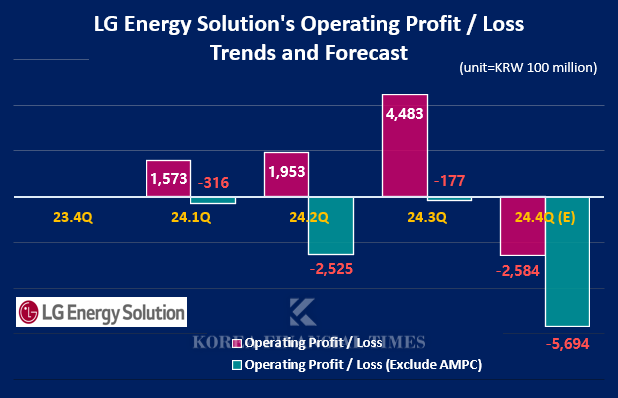

This operating loss outlook reflects the KRW 311 billion increase in operating profit due to the Advanced Manufacturing Production Tax Credit (AMPC) of the US Inflation Reduction Act (IRA). Excluding the subsidy effect, the actual deficit due to the business amounts to KRW 570 billion.

Regarding the reason for revising the performance outlook, the main researcher stated, "European demand is expected to be weaker than expected, and sales to GM have also been lowered from the previous 40GWh to 33GWh."

Other brokerages have also recently lowered their estimates for LG Energy Solutions' fourth-quarter earnings.

Samsung Securities researcher Cho Hyun-ryul, who issued a report on the 20th, forecast sales of KRW 6.843 trillion and an operating loss of KRW 189.6 billion. He added that sales of small batteries for IT products will also be in the red, along with sluggish sales to automotive customers.

According to FnGuide, LG Energy Solution's performance consensus as of the 27th is KRW 6.7984 trillion in sales and KRW 117.6 billion in operating loss.

LG Energy Solution successfully turned a profit in its first year after spinning off from LG Chem in 2021, and has continued to see steady growth in its performance since then. Even this year, when the electric car chasm was in full swing, the company posted operating profits of KRW 157.3 billion in Q1, KRW 195.3 billion in Q2, and KRW 448.3 billion in Q3. Actual profitability was in the red, but it was supported by subsidies. If it turns into a loss even including subsidies this time, it will be the first crisis since its independence.

Accordingly, LG Energy Solution Vice President Lee Chang-sil (CFO) and Executive Director Kim Ki-soo (CHO) recently sent an email to employees declaring 'crisis management'. It is reported that they are implementing cost-cutting plans such as requiring executives to travel in economy class for short-distance overseas business trips of less than 8 hours and limiting personnel recruitment.

The industry expects LG Energy Solution's performance to gradually recover in the first quarter of next year and rebound in the second quarter. In particular, expectations are high for the success of the Tesla Model Y facelift (Juniper), scheduled to be released in January next year.

Gwak Horyung (horr@fntimes.com)

![[현장] 지브리 프사 말고 ‘새로구미’ 어때?…압구정 뜨는 '새로도원' 가보니](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20250402115241068616febc6baa62115218260.jpg&nmt=18)

![[삼성전자의 와신상담] ③ 8년간 묵혀둔 곳간 올핸 열릴까?...삼성전자 초대형 M&A 가능성](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=202504021558020204074925877362115218260.jpg&nmt=18)

![[DCM] '15년만 회사채 최대 7000억 조달'...고려아연 엇갈린 시선](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025040300434208182a837df64942192515869.jpg&nmt=18)

![[단독] 대우건설 자회사 대우에스티, 지난해 공정위·서울시 제재](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025040212332508946e41d7fc6c2183101242202.jpg&nmt=18)

![[카드뉴스] KT&G ‘Global Jr. Committee’, 조직문화 혁신 방안 제언](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202503261121571288de68fcbb3512411124362_0.png&nmt=18)

![[카드뉴스] 국립생태원과 함께 환경보호 활동 강화하는 KT&G](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202403221529138957c1c16452b0175114235199_0.png&nmt=18)

![[카드뉴스] 신생아 특례 대출 조건, 한도, 금리, 신청방법 등 총정리...연 1%대, 최대 5억](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=20240131105228940de68fcbb35175114235199_0.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 지속 가능 경영, 보고와 검증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025011710043006774f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 똑똑한 금융생활...건전한 투자와 건강한 재무설계 지침서](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025031015443705043c1c16452b012411124362.jpg&nmt=18)

![[카드뉴스] KT&G ‘Global Jr. Committee’, 조직문화 혁신 방안 제언](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202503261121571288de68fcbb3512411124362_0.png&nmt=18)

![[AD] 기아, 혁신적 콤팩트 SUV ‘시로스’ 세계 최초 공개](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113461807771f9c516e42f12411124362.jpg&nmt=18)

![[AD] 아이오닉5 '최고 고도차 주행 전기차' 기네스북 올랐다...압도적 전기차 입증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113204707739f9c516e42f12411124362.jpg&nmt=18)