Hotel Shilla focuses on duty-free and hotel businesses. Shinsegae operates department stores and operates duty-free, fashion, and furniture businesses. Although they operate somewhat different businesses in detail, we looked into the profitability of the two companies because they are led by female CEOs from the Samsung family.

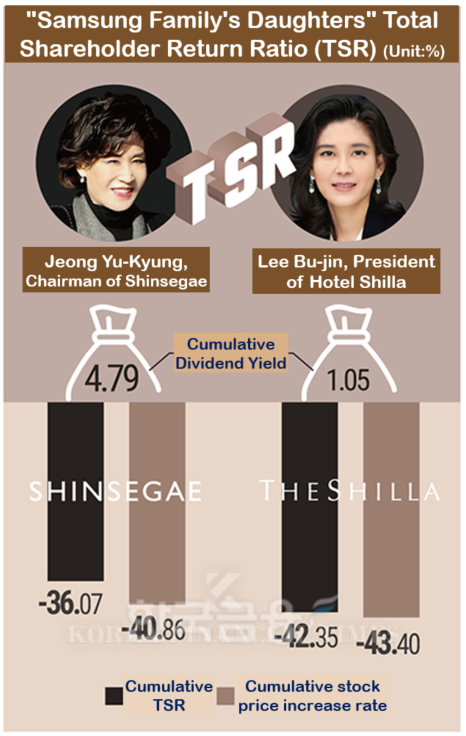

The Korea Financial Times calculated the cumulative total shareholder return ratio (TSR) of Hotel Shilla under President Lee and Shinsegae under Chairman Jeong through the data platform ‘Deep Search.’ The period is from 2019, before the full-scale outbreak of COVID-19, to the end of October this year. TSR is the sum of the stock price return ratio and the dividend yield, and refers to the return that shareholders can receive from stock price gains and dividends over a certain period.

According to the Deep Search analysis results on the 25th, both companies showed negative returns. Of the two, Shinsegae's losses were less than Hotel Shilla's. Shinsegae had -36.07%, while Hotel Shilla had -42.35%. If two shareholders invested KRW 10 million each in Shinsegae and Hotel Shilla on January 2, 2019, it would have shrunk to KRW 6.39 million in Shinsegae and KRW 5.76 million in Hotel Shilla over 5 years and 10 months.

Hotel Shilla's massive losses are a reflection of industry conditions. Hotel Shilla’s duty-free shops account for more than 80% of its total sales. It was hit hard by the direct hit of COVID-19, the decrease in Chinese group tourists as the industry’s “big hand,” and the change in travel patterns to focus on FIT (individual tourists), and as the business slump continued, its difficulties expanded even further.

Hotel Shilla recorded its first-ever annual deficit in 2020, when COVID-19 was at its peak. At that time, the number of passengers entering and exiting Incheon International Airport plummeted by more than 90%, leading to a sharp decline in airport store sales, and profitability deteriorated as the dependence on Chinese peddlers soared to 90%.

The stock price also fell sharply. During the previous TSR calculation period, Hotel Shilla's stock price fell 41.7% from KRW 76,500 (based on the closing price) on December 28, the last trading day of 2018, to KRW 44,600 on October 31, 2024.

Shinsegae also suffered during the COVID-19 period. This is because the number of consumers who prefer online shopping over offline shopping has increased. However, as the so-called ‘revenge spending’ that compensates for the thirst for overseas travel with luxury goods has become popular, Shinsegae has benefited greatly from luxury goods. At least it had something to lean on compared to Hotel Shilla.

However, this is not a laughing matter. Shinsegae’s stock price has also plummeted. During the same period, Shinsegae’s stock price fell 39.9% from KRW 256,000 to KRW 153,800.

Since then, Hotel Shilla and Shinsegae’s stock prices have continued to weaken, and as of the 22nd, Hotel Shilla has fallen 13.1% to KRW 38,750, and Shinsegae has fallen 15.5% to KRW 130,000.

Accordingly, voices are growing louder in the market that shareholder returns are needed for stock price reevaluation.

Hotel Shilla issued KRW 132.8 billion worth of convertible bonds using its own stock as collateral in July of this year. The exchange target was 2,135,000 Hotel Shilla common stocks. Hotel Shilla explained that this was a “decision to improve the financial structure by reducing financing costs.” It used its own stocks to repay corporate debt, not to increase shareholder value.

Hotel Shilla has never canceled any treasury shares for shareholder returns since its listing in 1991. Recently, amid growing calls for shareholder returns, Hotel Shilla announced that it was “reviewing the issue from various angles.”

What about Shinsegae? Demands for shareholder returns continue to grow for Shinsegae as well. The company announces its shareholder return policy every three years, and in November of last year, it expanded the level of dividends to shareholders through a public notice.

For fiscal years 2020-2022, 10% of annual operating profit based on separate financial statements will be used as a return resource, and if this return resource falls below KRW 1,500 per share, a minimum dividend of KRW 1,500 per share will be paid. For three years from 2023 to 2025, the return resource will be increased to 10-15% of annual operating profit based on separate financial statements, and if it falls below KRW 3,500 per share, a minimum dividend of KRW 3,500 per share will be paid.

Regarding this, Shinsegae stated, “The purpose of easing the dividend criteria is to increase the long-term predictability of shareholder returns while also ensuring stable dividends.”

According to Deep Search, the cumulative dividend yield from 2019 to the end of October this year is 1.05% for Hotel Shilla and 4.79% for Shinsegae.

Park seulgi (seulgi@fntimes.com)

![[DCM] '금리 충격' 롯데그룹, 전방위 구조조정∙자산매각 불가피](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024112521455208787a837df64942192515869.jpg&nmt=18)

![4대 금융 CEO 37명 임기 만료…인사 태풍 ‘촉각’ [연말 금융 인사 미리보기]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024112607143100418f09e13944d391241172.jpg&nmt=18)

![[DCM] DL, 유동성 확보 총력…여천NCC는 ‘발목’](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024112601153906131a837df64942192515869.jpg&nmt=18)

![이재근 행장 필두 부행장 24명 전원 임기 만료...국민은행 인사 행방은[연말 금융 인사 미리보기]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024080716110804667c1c16452b0175114235199.jpg&nmt=18)

![이재근·김성현·이창권·이환주 등 인사 대상…‘취임 2년차’ 양종희 회장 선택은 [연말 금융 인사 미리보기]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024112621442006457f09e13944d582914364.jpg&nmt=18)

![이환주 KB라이프생명 대표, 푸르덴셜-KB 안정적 합병 성과…세대교체 VS 안정 [연말 금융 인사 미리보기]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024112608410108437dd55077bc212411124362.jpg&nmt=18)

![[카드뉴스] 국립생태원과 함께 환경보호 활동 강화하는 KT&G](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202403221529138957c1c16452b0175114235199_0.png&nmt=18)

![[카드뉴스] 신생아 특례 대출 조건, 한도, 금리, 신청방법 등 총정리...연 1%대, 최대 5억](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=20240131105228940de68fcbb35175114235199_0.jpg&nmt=18)

![[카드뉴스] 어닝시즌은 ‘실적발표기간’으로](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202311301105084674de68fcbb35175114235199_0.png&nmt=18)

![[신간] 사모펀드 투자와 경영의 비밀](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024102809331308730f8caa4a5ce175114235199.jpg&nmt=18)

![[신간]퍼스널브랜딩, 문학에서 길을 찾다](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024102214123606876f8caa4a5ce175114235199.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 김국주 전 제주은행장, ‘나는 시간을 그린다 1·2’ 에세이 출간](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024111517430908074c1c16452b012411124362.jpg&nmt=18)