Doosan Bobcat CI

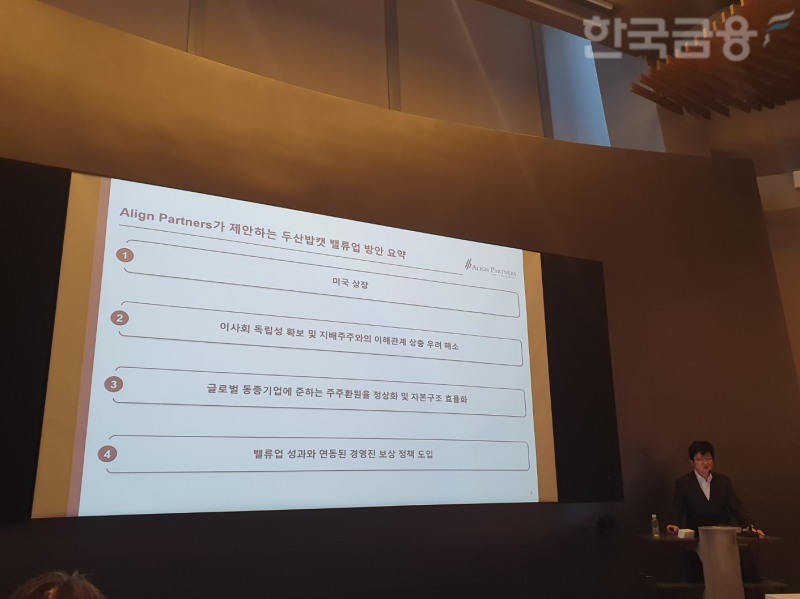

Lee Chang-hwan, CEO of Align Partners, held a press conference at the IFC in Yeouido, Seoul on the 18th and personally presented four measures to increase corporate value for Doosan Bobcat, including ▲ listing on the US stock market ▲ securing independence of the board of directors and resolving concerns about conflicts of interest ▲ normalizing shareholder return rates and improving capital structure efficiency ▲ introducing a management compensation policy linked to value-up.

Lee Chang-hwan, CEO, emphasized, "As of 2023, Doosan Bobcat's North American sales ratio is 74%, which is higher than the North American sales ratio of similar companies listed in the US, such as 'Caterpillar' or 'Deere'," and "It is necessary to align Doosan Bobcat's main business sites with the listing sites to increase investor interest and understanding."

The representative continued, "Doosan Bobcat's business performance in recent years has been among the top in the industry, but unlike its peers, it has not been properly evaluated in the capital market." He added, "Doosan Bobcat is listed in Korea and is not included in major U.S. indices or research coverage by investment banks, and its holdings by U.S. institutional investors are also low."

The representative said, “Doosan Bobcat’s US listing will improve the trading accessibility of overseas institutional investors and lead to increased investment in passive funds such as ETFs (exchange-traded funds),” and “Doosan Bobcat’s 2015 pre-IPO and 2016 IPO were in-depth reviews of the US listing, and the US listing is a good value-up plan with sufficient probability.”

He pointed out that more efficient capital allocation is needed to increase Doosan Bobcat’s corporate value.

The representative said, “If the PBR (price to book value ratio) is less than 1, it is generally advantageous to expand capital allocation for shareholder returns rather than reinvestment, and an efficient capital structure strategy that utilizes borrowing costs that are lower than the cost of capital is needed,” and suggested, “We can normalize the shareholder return rate to 65%, which is the average level of similar companies, and consider a special dividend to improve capital structure efficiency.”

Lee Chang-hwan, CEO of Align Partners Asset Management, held a press conference at IFC in Yeouido, Seoul on the 18th and proposed four ways to increase corporate value for Doosan Bobcat. / Photo = Korea Financial Times (2024.11.18)

이미지 확대보기In addition, Align expressed its "disappointment" in Doosan Bobcat's response to the shareholder letter on the 14th.

As a first measure, it announced on the 17th that it had filed a 'request for injunction for illegal acts' against the directors of Doosan Bobcat.

Article 402 (Injunctions) of the Commercial Act stipulates that "if a director acts in violation of laws or the Articles of Incorporation and there is a concern that irreparable damage will occur to the company, an auditor or a shareholder with a 1% or more stake may request that the directors be prohibited from such acts on behalf of the company."

“In order to prevent the company from suffering damages due to the board’s wrong decision, we had no choice but to take the measure of filing a injunction for illegal acts,” he said.

In addition, Align, through a request for an injunction against illegal acts, requested that Doosan Bobcat's Audit Committee investigate whether the board of directors had conducted internal reports, discussions, and reviews on the comprehensive stock exchange prior to July 11, when the board of directors resolved to do so, and the contents of such reports, as well as whether the requirements of Article 398 of the Commercial Act (requirements for content and procedural fairness) were met when the resolution for the comprehensive stock exchange was made, and the specific contents thereof, and publicly announce them by December 31.

Jeong Suneun (bravebambi@fntimes.com)

![전쟁이 가른 한화 삼형제 실적, 동관 1등·동원 2등·동선 3등 [정답은 TSR]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024111702520901009dd55077bc25812315232.jpg&nmt=18)

![‘밸류업하며 투자 챙기기’…KT 장민의 바쁜 하루 [나는CFO다]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024111702551001722dd55077bc25812315232.jpg&nmt=18)

![“임신·출산·육아 휴직 3년 줍니다” 여성 복지 소문난 강남 그 회사 [여기 어때?]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024111703072709555dd55077bc25812315232.jpg&nmt=18)

![[카드뉴스] 국립생태원과 함께 환경보호 활동 강화하는 KT&G](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202403221529138957c1c16452b0175114235199_0.png&nmt=18)

![[카드뉴스] 신생아 특례 대출 조건, 한도, 금리, 신청방법 등 총정리...연 1%대, 최대 5억](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=20240131105228940de68fcbb35175114235199_0.jpg&nmt=18)

![[카드뉴스] 어닝시즌은 ‘실적발표기간’으로](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202311301105084674de68fcbb35175114235199_0.png&nmt=18)

![[신간] 사모펀드 투자와 경영의 비밀](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024102809331308730f8caa4a5ce175114235199.jpg&nmt=18)

![[신간]퍼스널브랜딩, 문학에서 길을 찾다](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024102214123606876f8caa4a5ce175114235199.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 김국주 전 제주은행장, ‘나는 시간을 그린다 1·2’ 에세이 출간](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024111517430908074c1c16452b012411124362.jpg&nmt=18)