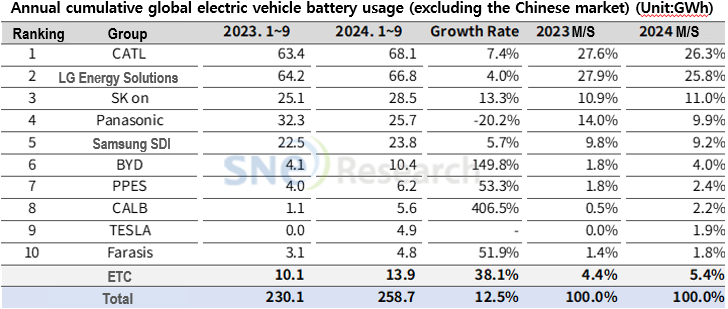

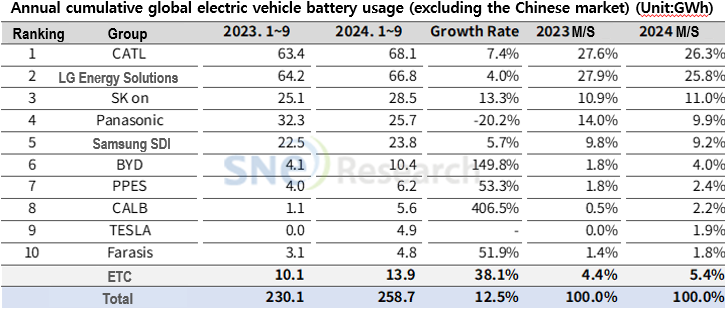

Recently, domestic battery companies are struggling with the Chinese battery offensive. According to SNE Research, China's CATL (36.7% market share) and BYD (16.4%) took first place in the global electric vehicle battery market in the first to third quarters of this year. LG Energy Solution, which ranked first in the 2022 survey, fell to third place with a market share of 12.1%. China's CALB (4.9%) took fourth place, ahead of SK On (4.8%, 5th place) and Samsung SDI (4.0%, 7th place).

The global growth of Chinese batteries has been achieved in a situation where direct entry into the U.S. is virtually blocked. SNE Research predicted that “CATL supplies batteries to many finished automobiles, including Tesla, BMW, Mercedes, Volkswagen, and Hyundai Motor,” and that “in the future, due to oversupply in the Chinese domestic market, it will rapidly expand its global market share through exports to Brazil, Thailand, Israel, and Australia.”

The good news for domestic companies is that Europe is also putting the brakes on Chinese electric vehicles. The European Union (EU) executive committee announced late last month that it would impose tariffs on Chinese electric vehicles from the existing 10% to 18-45% for five years depending on the company.

Add to that the tightening of EU carbon dioxide emissions regulations starting next year. Automakers doing business in Europe will have to increase sales of electric vehicles that do not emit carbon dioxide while driving to respond to the regulations. The industry predicts that European electric vehicle sales will increase by at least 20% to 70% next year. While there are concerns about increased competition in emerging markets, this could mean more opportunities for domestic battery companies in Europe.

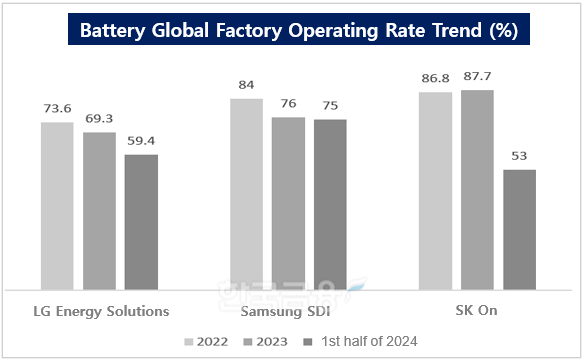

Source = Each company's business report

The industry estimates that it will be around 50-60% in the first half of the year.

Domestic companies are also cautiously predicting a recovery in demand in Europe. LG Energy Solution is looking forward to the European launch of its mass-market electric vehicle, the Kia EV3. In a conference call announcing its third-quarter performance, LG Energy Solution CFO Lee Chang-sil said, “It is quite difficult to accurately predict next year,” but added, “There are various factors that will improve demand, such as European carbon dioxide emission regulations and the expansion of mass-market electric vehicles by global automakers.” Son Michael, head of Samsung SDI’s medium- and large-sized battery strategy marketing division, said, “European countries are starting to expand their policy support again,” adding, ’In particular, Germany, which has the largest market, is again pushing for electric vehicle tax incentives for corporate vehicles.’

Gwak Horyung (horr@fntimes.com)

![조병규 外 부행장 12인 임기 만료…우리은행 지도부 대변화 예고[연말 금융 인사 미리보기]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024112615514706497237391cf861151384944.jpg&nmt=18)

![차기 우리은행장 최대 관심…우리금융 자회사 CEO 쇄신 바람 불까 [연말 금융 인사 미리보기]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024112909522300451f09e13944d391241172.jpg&nmt=18)

![정연기 우리금융캐피탈 대표, 호실적 이끌어 지주내 캐피탈 입지 강화 [연말 금융 인사 미리보기]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20230609145610002200d260cda7512450134.jpg&nmt=18)

![[DCM] 롯데렌탈 매각, 그룹 유동성 우려 어떤 경로로 완화될까](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024112912242007192a837df64942192515869.jpg&nmt=18)

![[DCM] SK브로드밴드, 수요예측 5배 초과 ‘대박‘…효성화학, 투자자 외면 '쓴맛'](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024112911531102183dd55077bc212411124362.jpg&nmt=18)

![실적 반등 이끈 박완식 우리카드 대표, 사법 리스크 세대교체 vs 안정 기로 [연말 금융 인사 미리보기]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2023121721513108075dd55077bc2175114235199.jpg&nmt=18)

![[카드뉴스] 국립생태원과 함께 환경보호 활동 강화하는 KT&G](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202403221529138957c1c16452b0175114235199_0.png&nmt=18)

![[카드뉴스] 신생아 특례 대출 조건, 한도, 금리, 신청방법 등 총정리...연 1%대, 최대 5억](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=20240131105228940de68fcbb35175114235199_0.jpg&nmt=18)

![[카드뉴스] 어닝시즌은 ‘실적발표기간’으로](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202311301105084674de68fcbb35175114235199_0.png&nmt=18)

![[신간] 사모펀드 투자와 경영의 비밀](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024102809331308730f8caa4a5ce175114235199.jpg&nmt=18)

![[신간]퍼스널브랜딩, 문학에서 길을 찾다](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024102214123606876f8caa4a5ce175114235199.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 김국주 전 제주은행장, ‘나는 시간을 그린다 1·2’ 에세이 출간](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024111517430908074c1c16452b012411124362.jpg&nmt=18)