LG Energy Solution's CI / Image courtesy of LG Energy Solution

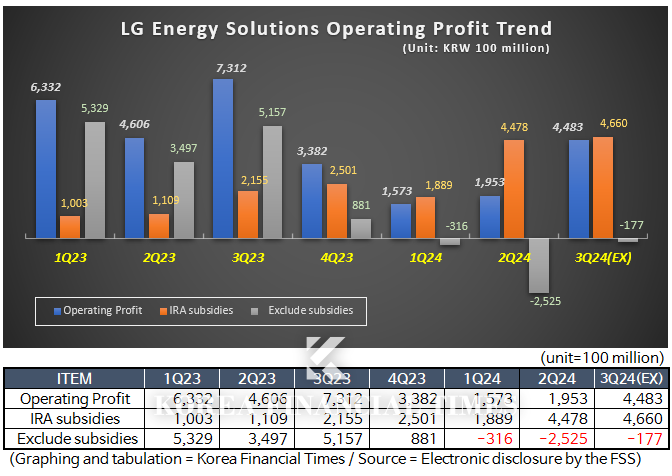

LG Energy Solution announced on the 8th that its sales for the 3rd quarter of 2024 were preliminarily calculated at KRW 6.88 trillion and operating profit at KRW 448.3 billion. Compared to the 3rd quarter of 2023, sales were down 16.3% and operating profit was down 38.7%.

The 3rd quarter of last year was just before the aftermath of the 'Electric Car Chasm' hit in earnest. This quarter's results are considered a relative success. It beat market expectations by 2% in revenue and 6.7% in operating profit. The stock price jumped 4% after the preliminary results were released.

There was also some positive news. The company announced on the 8th that it had signed a battery supply agreement with a Mercedes-Benz affiliate, focusing on North America. According to industry sources, it is a large-scale contract to supply 50.5 GWh of its next-generation cylindrical battery, '46Pi', for 10 years. LG Energy Solution said, “We cannot confirm any further details due to confidentiality agreements with our customers.”

Mercedes-Benz is a representative company that has preferred Chinese batteries such as CATL. In Korea, the company has been embroiled in controversy for installing cheaper Parasys batteries in its cars after a fire in a parking lot in Incheon.

In the first half of the year, LG Energy Solution won a trillion-scale ESS project in the U.S. ESS market. The U.S. ESS market is already dominated by Chinese companies with competitive prices. It is significant that LG Energy Solution is seeing a counterproductive effect as developed countries such as the U.S. and Europe are building tariff barriers against Chinese products.

CEO Kim Dong-myung presents the company's vision and mid- to long-term strategy at the 'LG Energy Solution Vision Sharing Meeting'./ Photo courtesy of LG Energy Solution

이미지 확대보기Of course, there are also worries. The company's 3rd-quarter results reflected KRW 466 billion in subsidies under the Advanced Manufacturing Production Credit (AMPC) of the U.S. IRA (Inflation Reduction Act). Excluding this, the profit from actual operating activities was a negative KRW 17.7 billion. While this is down from the 2nd quarter of this year (a loss of KRW 252.5 billion), it is the third consecutive quarter of substantial losses.

There are concerns about the sustainability of the IRA subsidies that are supporting current performance. The core goal of the IRA is to attract investment and create jobs in the U.S. in the green energy sector. The question is, how long will this continue to be a situation where Korean companies benefit from legislation that is in the interest of the US. There is also the US presidential election next month. "We cannot let our guard down even if Kamala Harris is elected, not to mention Donald Trump, who denies climate change," said a battery industry insider, adding, ”It is uneasy to depend on a single policy for company performance.”

LG Energy Solution President Kim Dong-myung indirectly expressed this concern when he declared at the vision declaration ceremony the previous day that the company would be recognized for its corporate value by creating a stable EBITDA profitability of mid-10% excluding IRA within five years. Mr. Kim said he aims to expand the company's portfolio, which is skewed toward lithium-ion batteries for electric vehicles, to include dry process LFP, battery solutions, and ESS.

Gwak Horyung (horr@fntimes.com)

![[현장] 지브리 프사 말고 ‘새로구미’ 어때?…압구정 뜨는 '새로도원' 가보니](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20250402115241068616febc6baa62115218260.jpg&nmt=18)

![[삼성전자의 와신상담] ③ 8년간 묵혀둔 곳간 올핸 열릴까?...삼성전자 초대형 M&A 가능성](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=202504021558020204074925877362115218260.jpg&nmt=18)

![[DCM] '15년만 회사채 최대 7000억 조달'...고려아연 엇갈린 시선](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025040300434208182a837df64942192515869.jpg&nmt=18)

![[단독] 대우건설 자회사 대우에스티, 지난해 공정위·서울시 제재](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025040212332508946e41d7fc6c2183101242202.jpg&nmt=18)

![[카드뉴스] KT&G ‘Global Jr. Committee’, 조직문화 혁신 방안 제언](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202503261121571288de68fcbb3512411124362_0.png&nmt=18)

![[카드뉴스] 국립생태원과 함께 환경보호 활동 강화하는 KT&G](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202403221529138957c1c16452b0175114235199_0.png&nmt=18)

![[카드뉴스] 신생아 특례 대출 조건, 한도, 금리, 신청방법 등 총정리...연 1%대, 최대 5억](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=20240131105228940de68fcbb35175114235199_0.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 지속 가능 경영, 보고와 검증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025011710043006774f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 똑똑한 금융생활...건전한 투자와 건강한 재무설계 지침서](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025031015443705043c1c16452b012411124362.jpg&nmt=18)

![[카드뉴스] KT&G ‘Global Jr. Committee’, 조직문화 혁신 방안 제언](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202503261121571288de68fcbb3512411124362_0.png&nmt=18)

![[AD] 기아, 혁신적 콤팩트 SUV ‘시로스’ 세계 최초 공개](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113461807771f9c516e42f12411124362.jpg&nmt=18)

![[AD] 아이오닉5 '최고 고도차 주행 전기차' 기네스북 올랐다...압도적 전기차 입증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113204707739f9c516e42f12411124362.jpg&nmt=18)