On the 30th, E-Mart announced that it would tender 2.12 million 661,000 common shares (27.33%) of Shinsegae E&C's registered shares. Currently, E-Mart holds 5.46 million shares (70.46%) of Shinsegae E&C. It plans to buy all shares except treasury shares (171,432 shares, 2.21%) and then delist Shinsegae E&C.

However, shareholders of Shinsegae E&C are not happy. Shinsegae E&C's stock price has been declining since 2021. With full group support expected, it is inevitable that E-Mart is seen as buying at a low price. It is inevitable that E-Mart will be criticized for buying at a low price.

The group's support for Shinsegae E&C began in earnest this year. In January, Shinsegae E&C merged with Shinsegae Yeongrangho Resort and secured KRW 68.6 billion in capital. In May, it issued KRW 650 billion in new capital securities backed by credit enhancements, such as the fund replenishment agreement from parent company E-Mart. And in June, the company transferred its leisure business to Chosun Hotel & Resort and received KRW 181.8 billion in proceeds. In addition, Shinsegae I&C purchased bonds (KRW 60 billion) issued by Shinsegae E&C to ease the repayment burden.

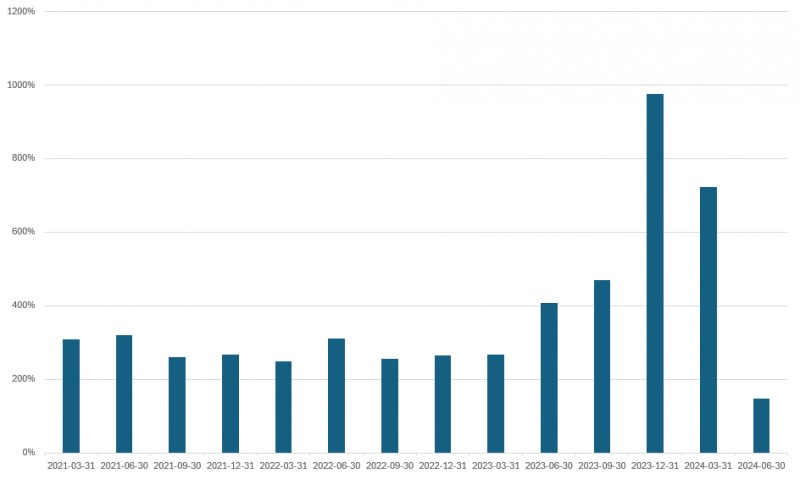

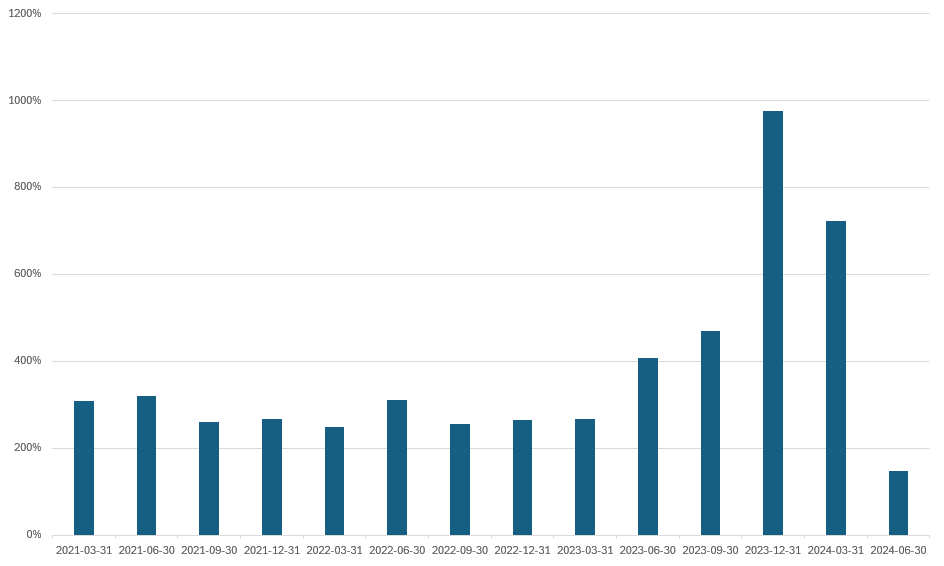

As a result of the diversionary support to E-Mart and its affiliates, Shinsegae E&C's debt-to-equity ratio fell from 976.2% at the end of last year to 145.7% at the end of the first half of this year. While improving profitability remains a challenge, the company's financial buffer has reduced the likelihood of a further downgrade following the downgrade earlier this year ('A0, negative' → 'A-, stable'). From E-Mart's point of view, Shinsegae E&C has less credit risk.

Debt-to-equity ratio(on a separate basis) trend by quarter for Shinsegae E&C./Source=Deep Search, Korea Financial Times

이미지 확대보기Shinsegae E&C is criticized for its weak self-sustainability due to its growth through internal group transactions. Starfields, where Shinsegae E&C can secure stable revenue, are also the main business of Shinsegae Properties, in which E-Mart holds a 100% stake. Shinsegae Properties has each of the Starfield entities under its umbrella and has been making a strong push for projects such as Hwaseong International Theme Park, which recently came under fire for delayed compensation payments.

Starfield has received relatively positive reviews among the projects promoted by Chairman Chung Yong-jin. Shareholders of Shinsegae E&C had high hopes that the company would be able to withstand the share price decline and rise again in a difficult environment, but E-Mart's tender offer will dash those hopes.

Shinsegae Properties will use a portion of the proceeds to secure a stake in Shinsegae Star REITs (50%). After the REITs business license is approved, the company will go public next year.

Shinsegae Properties is focusing on the development of new Starfield complexes. As the business requires large-scale expenditures, it plans to liquidate assets and secure investor funds through the REITs.

In this process, Shinsegae E&C will benefit alongside Shinsegae Properties. If Shinsegae Properties can stabilize its financing and improve its profitability, it will be positive for E-Mart, which will acquire an additional stake in Shinsegae E&C.

Group growth centered on Shinsegae Properties is not guaranteed. However, it is good to see that the financial buffer has reduced the difficulty of financing due to the group's creditworthiness.

“E-Mart's purchase of a stake in Shinsegae E&C is unlikely to have a significant impact on immediate credit fluctuations,” said a researcher at the rating agency. ”While Shinsegae E&C's actual borrowing burden has increased, its lower debt-to-equity ratio more than offsets this and demonstrates its willingness to support the group centered on E-Mart.” “If the securitization through Shinsegae Star REITs is followed by a successful IPO, the financial structure could improve more than expected,” he added.

Lee Sungkyu (lsk0603@fntimes.com)

![[DCM] '금리 충격' 롯데그룹, 전방위 구조조정∙자산매각 불가피](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024112521455208787a837df64942192515869.jpg&nmt=18)

![4대 금융 CEO 37명 임기 만료…인사 태풍 ‘촉각’ [연말 금융 인사 미리보기]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024112607143100418f09e13944d391241172.jpg&nmt=18)

![[DCM] DL, 유동성 확보 총력…여천NCC는 ‘발목’](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024112601153906131a837df64942192515869.jpg&nmt=18)

![이재근 행장 필두 부행장 24명 전원 임기 만료...국민은행 인사 행방은[연말 금융 인사 미리보기]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024080716110804667c1c16452b0175114235199.jpg&nmt=18)

![이재근·김성현·이창권·이환주 등 인사 대상…‘취임 2년차’ 양종희 회장 선택은 [연말 금융 인사 미리보기]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024112621442006457f09e13944d582914364.jpg&nmt=18)

![이환주 KB라이프생명 대표, 푸르덴셜-KB 안정적 합병 성과…세대교체 VS 안정 [연말 금융 인사 미리보기]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024112608410108437dd55077bc212411124362.jpg&nmt=18)

![[카드뉴스] 국립생태원과 함께 환경보호 활동 강화하는 KT&G](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202403221529138957c1c16452b0175114235199_0.png&nmt=18)

![[카드뉴스] 신생아 특례 대출 조건, 한도, 금리, 신청방법 등 총정리...연 1%대, 최대 5억](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=20240131105228940de68fcbb35175114235199_0.jpg&nmt=18)

![[카드뉴스] 어닝시즌은 ‘실적발표기간’으로](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202311301105084674de68fcbb35175114235199_0.png&nmt=18)

![[신간] 사모펀드 투자와 경영의 비밀](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024102809331308730f8caa4a5ce175114235199.jpg&nmt=18)

![[신간]퍼스널브랜딩, 문학에서 길을 찾다](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024102214123606876f8caa4a5ce175114235199.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 김국주 전 제주은행장, ‘나는 시간을 그린다 1·2’ 에세이 출간](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024111517430908074c1c16452b012411124362.jpg&nmt=18)