Former Ecopro Chairman Lee Dong-chae (center) with GEM Chairman Heo Gae-hwa (right) and GEM Vice Chairman Wang Min (left). Photo/Ecopro

Lee was born in 1959 and started his first job as a high school graduate as a banker at the Korea Housing Bank (now KB Kookmin Bank). He realized the limitations of his educational background and left the bank after failing to get promoted. He then joined Samsung Electronics, but left the company due to repetitive tasks and worked at an accounting firm for six years after earning a certificate as a certified public accountant.

The company first turned profitable in 2015, when sales exceeded KRW 100 billion. It was Lee's determination to invest in research and development while enduring a decade of losses that convinced him of the future of electric vehicles. Since then, his technology has been recognized by securing SK ON as a customer as well as Samsung SDI, an existing supplier. EcoPro BM, a cathode material subsidiary that went public in 2019, is competing for the 1st and 2nd place in KOSDAQ market capitalization.

Former chairman Lee Dong-chae, who had been on a roll, also faced a crisis. The company's former chairman, Lee Dong-chae, was sentenced to two years in prison in May last year in a second trial for violating the Capital Market Act. He was accused of buying and selling stocks through a nominee account before the information on the 2020-2021 supply contract for EcoPro BM was disclosed, making a profit of KRW 1.1 billion. “The guilt is not light in that he took personal profit without considering bona fide investors,” the court noted.

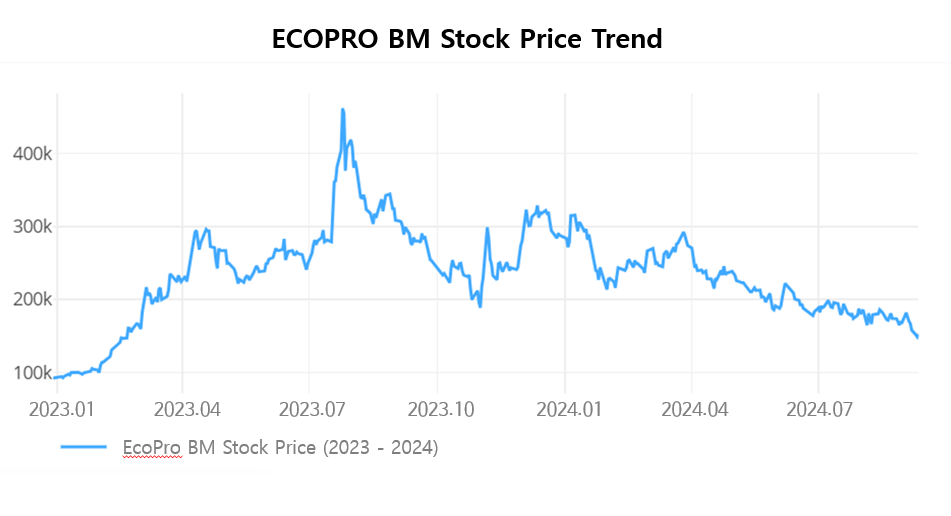

After a sudden management vacuum, EcoPro has been hit by the electric vehicle chasm (temporary slowdown in demand). Last year, the company posted an operating profit of KRW 153.2 billion, down 60% from the previous year. In the 4th quarter of last year, the company posted a massive deficit of KRW 110 billion. Its operating profit for the first half of this year is only KRW 10.6 billion. Holding company EcoPro's consolidated operating loss for the1st half of the year reached KRW 84.4 billion. EcoPro BM's stock price, which once exceeded KRW 400,000 in July last year, has now fallen to KRW 150,000.

Lee immediately returned to the front lines of management. He is not returning as chairman, but as a senior advisor, but his presence is no different. Earlier this month, he met with Chinese precursor company GEM at its headquarters in Ochang, Cheongju, to discuss building an integrated positive electrode material supply chain in Indonesia.

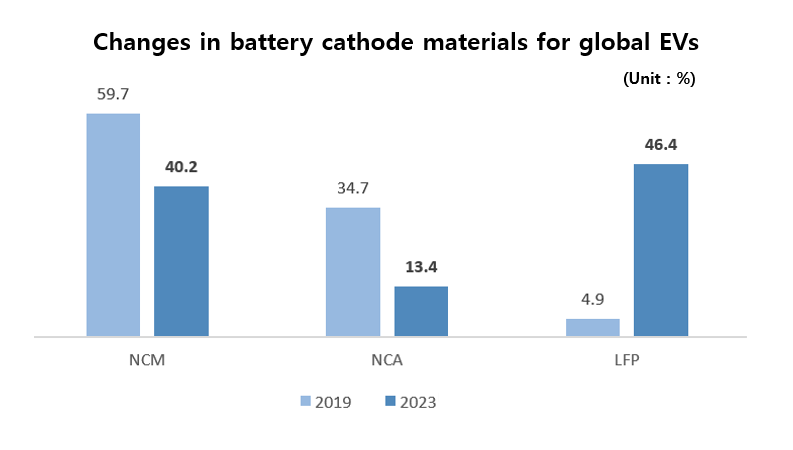

Lee also held a meeting with employees, where he reiterated the EV chasm crisis, the company said. With Chinese LFP batteries threatening the ternary battery market, “there is no future if we continue as we are,” Lee said.

In response, former chairman Lee's card is to vertically integrate businesses such as mines, smelters, precursors, and cathode materials by expanding cooperation with GEM, which operates a nickel-producing smelter in Indonesia. "If the project is successful, we will achieve a competitive industrial innovation that no one can match," he stressed.

Gwak Horyung (horr@fntimes.com)

![[DCM] SK렌터카, 유동성 리스크 차단...투자자 반응 기대](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024103012533004870a837df649411612622953.jpg&nmt=18)

![[DCM] ‘독이 된 사업 확장’ 코리아세븐, ‘온∙오프’ 경쟁 모두 밀려](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024103013585409982a837df649411612622953.jpg&nmt=18)

![[DCM] 10월 공모채 발행 8조 돌파...기준금리 인하 효과 '톡톡'](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024103019030003030a837df649411612622953.jpg&nmt=18)

![[카드뉴스] 국립생태원과 함께 환경보호 활동 강화하는 KT&G](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202403221529138957c1c16452b0175114235199_0.png&nmt=18)

![[카드뉴스] 신생아 특례 대출 조건, 한도, 금리, 신청방법 등 총정리...연 1%대, 최대 5억](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=20240131105228940de68fcbb35175114235199_0.jpg&nmt=18)

![[카드뉴스] 어닝시즌은 ‘실적발표기간’으로](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202311301105084674de68fcbb35175114235199_0.png&nmt=18)

![[신간] 사모펀드 투자와 경영의 비밀](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024102809331308730f8caa4a5ce175114235199.jpg&nmt=18)

![[신간]퍼스널브랜딩, 문학에서 길을 찾다](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024102214123606876f8caa4a5ce175114235199.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)