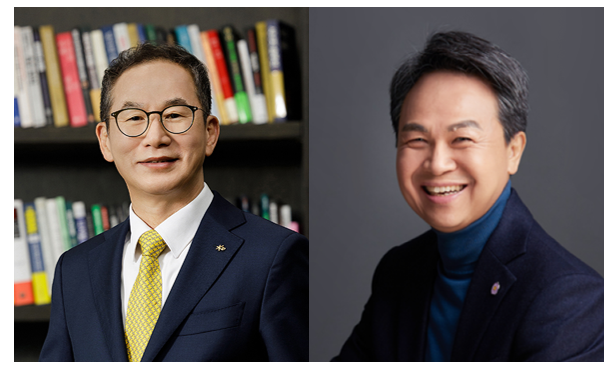

From left, Yang Jong-hee, Chairman & CEO of KB Financial Group, and Jin Ok-dong, Chairman & CEO of Shinhan Financial Group / Photo by each company

KB Financial Group's non-banking sector net profit for the first half of this year was KRW 1.276 trillion, up 11.1% from the first half of last year (KRW 1.149 trillion), according to a report by the financial sector on the 1st. 1. The non-banking segment's share of the group's total net profit rose to 49% from 41% in the same period.

KB Financial Group's contribution to the non-banking sector jumped from 33.5% in 2020 to 41.3% in 2021, before falling to 27.9% in 2022 and rising again to 29.6% as of last year.

Compared to other financial holding companies, KB Financial Group is relatively less dependent on banks, but with more than half of its revenue coming from banks, it needs to diversify its revenue.

KB Financial Group, which has grown its size through active mergers and acquisitions with the launch of the holding company in 2008, plans to expand its profit base by focusing its capabilities on the growth of existing non-bank affiliates.

Chairman Yang has been strengthening the non-banking division since taking over in November last year. “We will continue to generate profits from non-banking sectors such as securities, insurance, and cards while managing fundamentals to generate 10% ROE,” he said at an investor presentation (IR) in New York in May.

KB Financial Group aims to increase its share of non-banking and non-interest income sectors to 40%. KB Financial Group will include specific ROE enhancement measures in its corporate value enhancement plan to be announced in the 4th quarter of this year.

Shinhan Financial Group announced late last month that it aims to achieve an ROE of 10% by 2027 through an enterprise value enhancement plan.

To achieve this, the group will boost earnings power in non-interest, capital markets, and global segments, shrinking low-yielding assets while expanding higher-yielding assets.

Since taking office in March last year, Chairman Jin has emphasized the global segment and related growth strategies. Shinhan Financial Group aims to achieve a 30% share of global P&L by 2030.

Shinhan Financial Group's global P&L has continued to grow, reaching KRW 394.9 billion in 2021, KRW 564.6 billion in 2022, and KRW 563.8 billion in 2023. During the same period, the proportion of global profits and losses also increased to 9.8%, 12.1%, and 12.9% of the group's total profit and loss.

In the first half of this year, global P&L was KRW 410.8 billion, on track to reach KRW 1 trillion annually. The global P&L share was 15.0%.

Shinhan Financial Group's non-banking segment is considered a relative weakness compared to KB Financial Group. Shinhan Financial Group's non-bank sector net profit share was 27.2% in the first half of this year, down 7.3%p from the first half of last year (34.5%).

On an annualized basis, it increased from 36.2% in 2019 to 41.7% in 2020 and soared to 42.4% in 2021, but has been declining for two consecutive years to 39.0% in 2022 and 35.0% last year.

Shinhan Financial Group is trying to strengthen its competitiveness in the non-banking sector with the goal of raising the share of non-bank profits to 50% by 2030.

KB Financial Group, on the other hand, is still struggling in its global business. In the case of KB Kookmin Bank's Indonesian subsidiary, KB Bank (formerly Bukopin Bank), growth is put on hold as a large-scale deficit continues.

KB Financial Group, on the other hand, is still struggling in its global business. In the case of KB Kookmin Bank's Indonesian subsidiary, KB Bank (formerly Bukopin Bank), growth is put on hold as a large-scale deficit continues.

In the first half of this year, KB Financial Group's overseas sector net profit was KRW 3.3 billion, the smallest among the four major financials, and the proportion of global net profit was only 0.1%.

In his first reorganization late last year, Chairman Yang transformed the global division into a dedicated holding unit and placed it at the front of the organizational chart.

Han Aran (aran@fntimes.com)

![이영종 신한라이프 대표, GA 중심 공격영업 생보 '빅4' 안착 [신한금융 CEO 인선레이스]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20230208162617080718a55064dd12115218260.jpg&nmt=18)

![[추석기획②] “아직도 추석 선물 준비 못했다면?” 쿠팡·SSG닷컴·G마켓·컬리로](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024091311421407727b5b890e35c21823832217.jpg&nmt=18)

![정상혁 신한은행장, 리딩뱅크 수성 힘입어 연임 가도 ‘청신호’[신한금융 CEO 인선 레이스]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2023020816164106921c1c16452b0175114235199.jpg&nmt=18)

![정운진 신한캐피탈 사장, 투자·IB·기업금융 중심 수익성 확대 성과…건전성은 아킬레스건 [신한금융 CEO 인선레이스]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2022060509340103779dd55077bc2145619524.jpg&nmt=18)

![기관 '테크윙'·외인 '알테오젠'·개인 '에스티팜' 1위 [주간 코스닥 순매수- 9월9일~9월13일]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024091423290302303179ad439072211389183.jpg&nmt=18)

![정상혁·문동권·이영종 등 '빅3' 자회사 수장 임기 만료…진옥동 회장 ‘안정’ 택할까 [신한금융 CEO 인선 레이스]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024091403162307248f09e13944d391241172.jpg&nmt=18)

![위기 대비 추가 자본 쌓아야 하는 은행·지주들…'스트레스완충자본' 도입 영향은 [금융이슈 줌인]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024091423243408170f09e13944d582914364.jpg&nmt=18)

![12개월 최고 연 3.42%…수협銀 '헤이정기예금‘ [이주의 은행 예금금리-9월 3주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024091118170503526237391cf8611513838246.jpg&nmt=18)

![[카드뉴스] 국립생태원과 함께 환경보호 활동 강화하는 KT&G](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202403221529138957c1c16452b0175114235199_0.png&nmt=18)

![[카드뉴스] 신생아 특례 대출 조건, 한도, 금리, 신청방법 등 총정리...연 1%대, 최대 5억](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=20240131105228940de68fcbb35175114235199_0.jpg&nmt=18)

![[카드뉴스] 어닝시즌은 ‘실적발표기간’으로](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202311301105084674de68fcbb35175114235199_0.png&nmt=18)

![[카드뉴스] 팝업 스토어? '반짝매장'으로](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202310311616429986de68fcbb35175114235199_0.png&nmt=18)

![[신간] 성장이 멈춘 시대의 투자법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024082109281507249f8caa4a5ce175114235199.jpg&nmt=18)

![[신간] 레벨업 강한 커리어](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024042608050907026f8caa4a5ce175114235199.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] '쉬워요 맞춤법!' 출간... 맞춤법 틀려 지적받은 적 있나요?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024050301332807448c1c16452b018221117338.jpg&nmt=18)