Standard & Poor's (S&P) has raised Hyundai and Kia's ratings to A- from BBB+, with a rating outlook of 'stable'. In February, Hyundai and Kia received A3 and A- ratings from Moody's and Fitch, respectively.

As a result, Hyundai Motor Co. and Kia Motors Corp. received A grades from the world's top three credit rating agencies this year.

S&P's A- rating is the seventh highest out of 22 possible ratings (AAA to D), meaning that the company's creditworthiness is solid and its credit risk is significantly lower. Improved creditworthiness can increase access to global markets and lower financing rates, which can reduce costs. Only Toyota, Mercedes-Benz, BMW, and Honda received an A in the rating.

“Receiving A- ratings from all three global credit rating agencies is an official recognition of Hyundai and Kia's excellent financial strength and global market competitiveness,” said a Hyundai Motor Group official.

S&P had previously lowered Hyundai and Kia's ratings to 'BBB+' from 'A-' and assigned a 'negative' rating outlook in late 2019. It was the first time in five years that the ratings were returned to A-. And this is the first time the company has ever received an A3 rating from Moody's.

At the time, Hyundai-Kia's credit rating was downgraded due to declining global sales and profitability. In the U.S., the company's sedan-centric sales system has been stretched to the limit, and in China, three years after the THAAD conflict, sales have been declining every year, let alone recovering. Add to that the Theta2 engine defect, and the company had to rack up trillions in provisions. The red flag was raised on the competitiveness of the business.

Source=Financial Supervisory Service Electronic Disclosure System company disclosure data

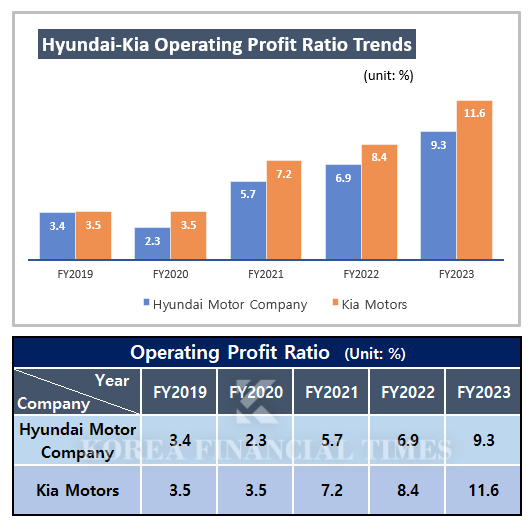

It has completely changed in terms of its performance over the past three years. They are among the most profitable in the world, even with limited sales due to the pandemic. Hyundai's operating margin was 5.7% in 2021, 6.9% in 2022, and 9.3% in 2023. Kia posted 7.2% and 8.4% in 2021 and 2022, and a double-digit profit margin (11.6%) last year.

At the center of the turnaround was Hyundai Motor Group Chairman Chung Eui-sun.

Chung was promoted to chairman in 2018 when downward pressure on his credit rating intensified, and took full control of the group's management. He was the first to strengthen his authority and responsibility at each global subsidiary to respond quickly to market trends. Apart from the existing method of mass selling of cost-effective vehicles, he has increased brand awareness by increasing the lineup of mid-sized or higher SUVs or high-end vehicles (Genesis).

This is leading to profitability improvement in China's business, which has a severe accumulated deficit. In particular, Kia's Chinese joint venture returned to profitability in the second quarter for the first time in eight years. According to Kia's semi-annual report, Yueda Kia posted a net loss of 17.2 billion won in the first half of this year. Considering that the net loss was 28.8 billion won in the first quarter of this year, it is estimated that it made a net profit of 11.6 billion won in the second quarter.

Gwak Horyung (horr@fntimes.com)

![Hyundai Motor Group headquarters. [Photo by Hyundai Motor Group]](https://cfnimage.commutil.kr/phpwas/restmb_allidxmake.php?pp=002&idx=3&simg=2024082315141705194141825007d175114235199.jpg&nmt=18)

![Hyundai Motor Group headquarters. [Photo by Hyundai Motor Group]](https://cfnimage.commutil.kr/phpwas/restmb_allidxmake.php?pp=002&idx=999&simg=2024082315141705194141825007d175114235199.jpg&nmt=18)

![[삼성전자의 와신상담] ② 삼성전자 바꾸는 이재용 3픽 '전장‧디스플레이‧로봇'](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=202504011507190072374925877362115218260.jpg&nmt=18)

![[DQN] 은행권 건전성지표 하락세…산업은행, BIS비율 최하위](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20250331144322006145e6e69892f2208613587.jpg&nmt=18)

![삼성·현대·DL이앤씨, 신재생·도시정비·입찰기술실 등 조직개편 속도 [건설사 수익성 개선①]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025033116355900751e41d7fc6c212014262187.jpg&nmt=18)

![싼타페 위협하는 그랑 콜레오스, 현대차 세단 상승세 [3월 자동차 판매량]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20250401165748096277de3572ddd2115218260.jpg&nmt=18)

![현대·포스코이앤씨, 주택 아닌 에너지로 새 성장 전략 ‘눈길’ [건설사 수익성 개선②]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025033111355006809b372994c95118332810.jpg&nmt=18)

![[카드뉴스] 신생아 특례 대출 조건, 한도, 금리, 신청방법 등 총정리...연 1%대, 최대 5억](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=20240131105228940de68fcbb35175114235199_0.jpg&nmt=18)

![[카드뉴스] KT&G ‘Global Jr. Committee’, 조직문화 혁신 방안 제언](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202503261121571288de68fcbb3512411124362_0.png&nmt=18)

![[카드뉴스] 국립생태원과 함께 환경보호 활동 강화하는 KT&G](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202403221529138957c1c16452b0175114235199_0.png&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 지속 가능 경영, 보고와 검증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025011710043006774f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 똑똑한 금융생활...건전한 투자와 건강한 재무설계 지침서](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025031015443705043c1c16452b012411124362.jpg&nmt=18)

![[카드뉴스] KT&G ‘Global Jr. Committee’, 조직문화 혁신 방안 제언](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202503261121571288de68fcbb3512411124362_0.png&nmt=18)

![[AD] 기아, 혁신적 콤팩트 SUV ‘시로스’ 세계 최초 공개](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113461807771f9c516e42f12411124362.jpg&nmt=18)

![[AD] 아이오닉5 '최고 고도차 주행 전기차' 기네스북 올랐다...압도적 전기차 입증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113204707739f9c516e42f12411124362.jpg&nmt=18)