According to financial reports on the 16th, SK innovation and SK E&S will hold a board meeting on the 17th to discuss the merger.

The key is the merger ratio.

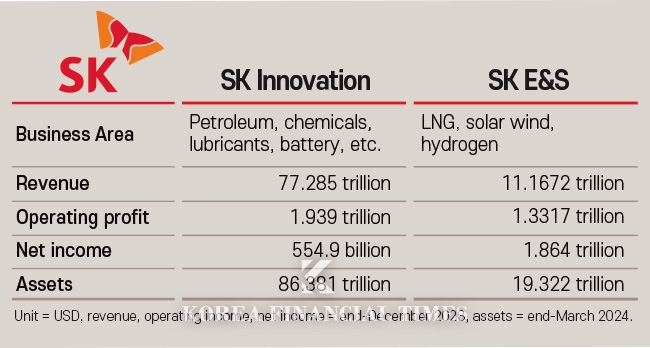

SK E&S is overvalued, while SK innovation is undervalued. Compared to SK E&S, SK Innovation has seven times the sales and assets, but its recent profits are similar. Moreover, SK Innovation's price-to-earnings ratio (PBR) is 0.5x, which is half of the average for KOSPI companies, due to a decline in its stock price due to the sluggish industry.

In conclusion, SK E&S shareholders are favored if the merger ratio is calculated based on stock price, while SK Innovation shareholders are favored if it is evaluated based on asset value under the exception rule.

The industry is expected to discuss the merger ratio based on stock prices. In this case, it is estimated that the merger ratio between SK innovation and SK E&S will be 1:2.

The largest shareholder of both companies is SK Corporation. It owns 36% of SK innovation and 90% of SK E&S. The higher the valuation of SK E&S, the lower the diluted share value after the merger. Convincing private equity firm KKR, which holds redeemable convertible preference shares (RCPS) in SK E&S, is also inevitable. KKR holds 3.1 trillion won worth of SK E&S RCPS. If the merger proceeds by increasing the valuation of SK innovation and KKR opposes the merger, it will have to repay the funds.

However, it is expected to face a backlash from SK innovation's minority shareholders, whose stake value will be diluted. The company is expected to present its future vision through the merger or boost its stock price through a shareholder return policy.

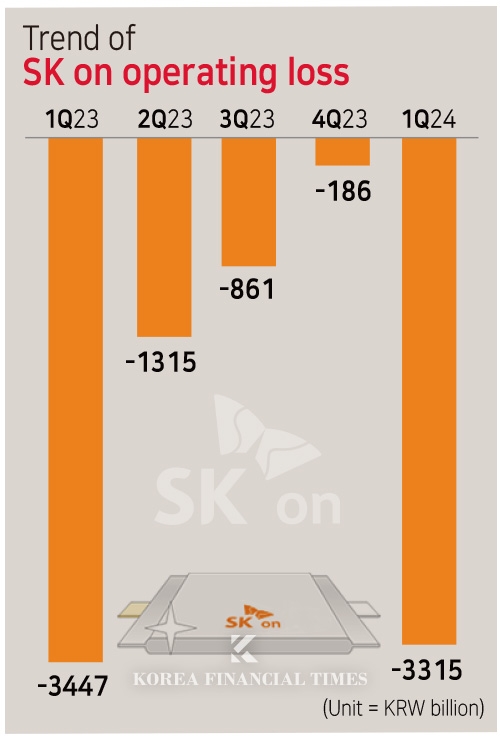

If SK E&S, a cash-generative company, were to merge with its parent company, SK Innovation, it could provide more support for SK Energy.

Of course, this is not a fundamental solution to SK E&S's funding crisis, so it needs to secure its own profitability. SK innovation had previously proposed a merger of its lubricant subsidiary SK Enmove and SK On, but it was reportedly canceled due to stakeholder opposition. More recently, SK Innovation has also been considering a merger with SK Trading International and SK Enterm.

SK innovation said, "We are reviewing various strategic measures to strengthen the competitiveness of the SK ON business, but no specific decisions have been made."

Gwak Horyung (horr@fntimes.com)

![[DQN] "지자체 금고 잡아라"…출연금 신한 1위·금고 규모 농협 압도적](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024112102061902156f09e13944d391241172.jpg&nmt=18)

![[DQN] ‘잠잠할 날 없는 금융사고?’ 3년간 6천억대...BNK금융, 사고금액 최대](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024112021030009519237391cf861151384944.jpg&nmt=18)

![[DCM] KT, 2000억 회사채 발행... 장기 자금조달로 재무 안정성 확보](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024112113555900183141825007d12411124362.jpg&nmt=18)

![강남 '래미안대치팰리스' 45평, 3.7억 오른 52.5억에 거래 [일일 아파트 신고가]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20231108083323039755e6e69892f222110224112.jpg&nmt=18)

![가상자산 과세 여-야 대립각…'유예 VS 시행' 줄다리기 [22대 국회]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2021111120211305168179ad43907611057578.jpg&nmt=18)

![[카드뉴스] 국립생태원과 함께 환경보호 활동 강화하는 KT&G](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202403221529138957c1c16452b0175114235199_0.png&nmt=18)

![[카드뉴스] 신생아 특례 대출 조건, 한도, 금리, 신청방법 등 총정리...연 1%대, 최대 5억](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=20240131105228940de68fcbb35175114235199_0.jpg&nmt=18)

![[카드뉴스] 어닝시즌은 ‘실적발표기간’으로](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202311301105084674de68fcbb35175114235199_0.png&nmt=18)

![[신간] 사모펀드 투자와 경영의 비밀](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024102809331308730f8caa4a5ce175114235199.jpg&nmt=18)

![[신간]퍼스널브랜딩, 문학에서 길을 찾다](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024102214123606876f8caa4a5ce175114235199.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 김국주 전 제주은행장, ‘나는 시간을 그린다 1·2’ 에세이 출간](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024111517430908074c1c16452b012411124362.jpg&nmt=18)