On July 1, the Korean won was recently trading near the 1,400 won mark, according to the financial investment industry. While further gains are seen as limited, it's hardly reassuring.

Currently, the Korean won is trading at levels similar to those seen in April, when the U.S. Consumer Price Index (CPI) rose more than expected (3.5%). At the time, the dollar appreciated and the won depreciated as expectations of a rate cut by the US Federal Reserve (Fed) faded.

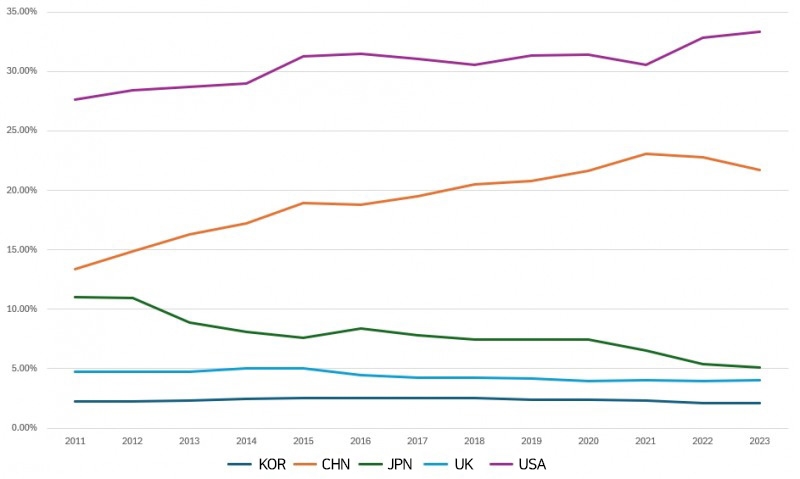

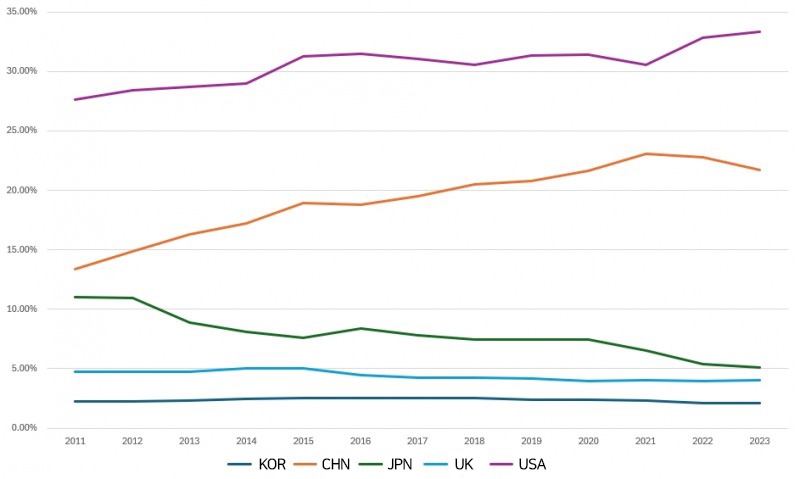

Trends in the share of GDP of each country relative to the global economy./Source=Bank of Korea

이미지 확대보기However, the current rally in the won-dollar exchange rate is of a different nature than in April. While the U.S. interest rate decision and Japanese monetary policy are still under debate, growth, employment, and inflation are either in line with market expectations or slowing down.

The Korean won's appreciation has been driven by changing economic fundamentals. According to the Bank of Korea, the share of the U.S. gross domestic product (GDP) in the global economy (37 countries, including the U.S. and China, but excluding data gaps such as Russia) expanded from 27.60% in 2011 to 33.32% in 2023, while Korea's GDP shrank from 2.22% to 2.09% during the same period.

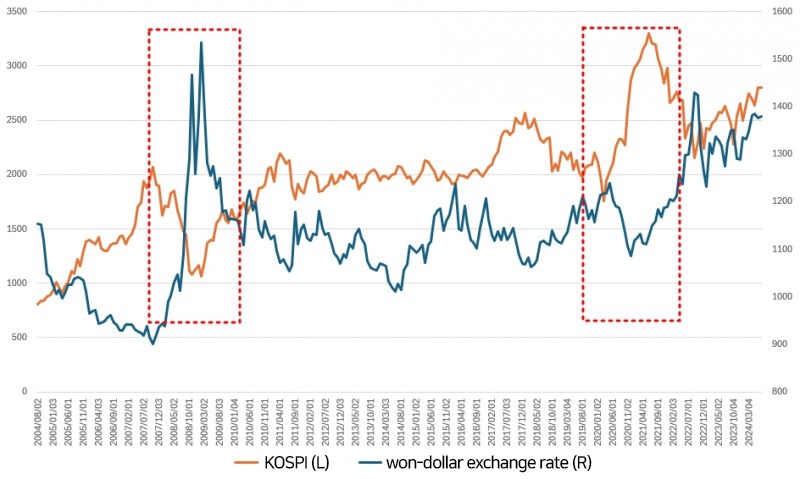

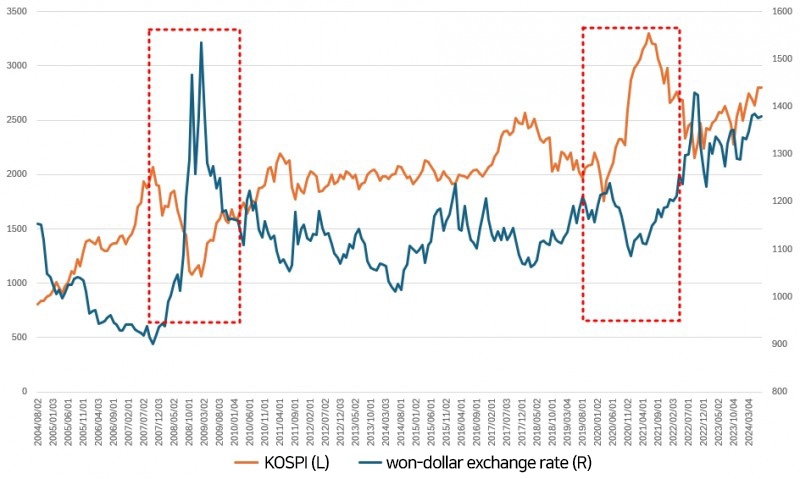

On the other hand, the exchange rate of the won to the dollar was only above 1,200 won during the 2008 financial crisis before the COVID-19 pandemic. Since then, the exchange rate has been above KRW 1,200, but it was only a "temporary" phenomenon due to short-term market instability.

In March 2022, the KRW exchange rate broke through the 1200 won level and started trading at a different level than before. Since then, the exchange rate hasn't fallen below 1200 won.

However, even after the trade balance returned to a surplus, the Korean won hasn't been able to depreciate. This is partly due to the fact that the US interest rate is higher than the Korean interest rate. However, Korea is an export-oriented country, so strong exports partially offset the U.S.-Korea interest rate differential. This means that other factors besides interest rates and the trade balance are affecting the KRW exchange rate.

Therefore, the aforementioned changes in the GDP shares of major global economies could be the answer. Behind this is the US-China trade war and global supply chain reorganization.

Especially since the COVID-19 pandemic, supply chain issues have emerged and trade trends have begun to change. The U.S. has been a manufacturing powerhouse through "reshoring", which is still ongoing.

Conversely, the conditions for Korea's economic fundamentals to return to the previous level are either the rise of China or an increase in exports to the United States. However, given that the Korean economy grew in an environment of global trade openness, the current protectionist trend is a weakening factor.

The dollar exchange rate and KOSPI index tends to move into the opposite direction.Recently, it is moving between KRW 1300 to 1400 and 1400 won./ Source=Bank of Korea, Korea Exchange

이미지 확대보기The direction of the won-dollar exchange rate also affects the domestic stock market. Basically, the more attractive the won becomes, the higher the stock market will rise.

Semiconductors and automobiles account for a high proportion of Korea's exports. Of these, semiconductors are important in terms of the stock market. The first and second largest companies by market capitalization are Samsung Electronics and SK Hynix, which together account for 26% of the KOSPI.

However, it is doubtful that growth focused on semiconductors will be able to raise the level of the Korean stock market from its current level. While a weaker won makes exports more competitive, it also weighs heavily on raw material prices. In fact, domestic companies' operating margins have been low in the past during high exchange rates.

"Countries are gradually reducing their trade openness and expectations for China's economic recovery are falling," said Choi Kwang-hyuk, a researcher at LS Securities. "Korea has reduced its dependence on the Chinese economy, but it still accounts for a large share of exports." "Considering the Korean economy's position in the global economy, we don't think the won is too weak at the moment," he said.

Lee Sungkyu (lsk0603@fntimes.com)

![[삼성전자의 와신상담] ② 삼성전자 바꾸는 이재용 3픽 '전장‧디스플레이‧로봇'](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=202504011507190072374925877362115218260.jpg&nmt=18)

![[DQN] 은행권 건전성지표 하락세…산업은행, BIS비율 최하위](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20250331144322006145e6e69892f2208613587.jpg&nmt=18)

![[DCM] 트럼프 관세 우려...’눈치게임’ 채권시장](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025040120244107244a837df64942192515869.jpg&nmt=18)

![싼타페 위협하는 그랑 콜레오스, 현대차 세단 상승세 [3월 자동차 판매량]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20250401165748096277de3572ddd2115218260.jpg&nmt=18)

![삼성·현대·DL이앤씨, 신재생·도시정비·입찰기술실 등 조직개편 속도 [건설사 수익성 개선①]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025033116355900751e41d7fc6c212014262187.jpg&nmt=18)

![현대·포스코이앤씨, 주택 아닌 에너지로 새 성장 전략 ‘눈길’ [건설사 수익성 개선②]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025033111355006809b372994c95118332810.jpg&nmt=18)

![[카드뉴스] KT&G ‘Global Jr. Committee’, 조직문화 혁신 방안 제언](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202503261121571288de68fcbb3512411124362_0.png&nmt=18)

![[카드뉴스] 국립생태원과 함께 환경보호 활동 강화하는 KT&G](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202403221529138957c1c16452b0175114235199_0.png&nmt=18)

![[카드뉴스] 신생아 특례 대출 조건, 한도, 금리, 신청방법 등 총정리...연 1%대, 최대 5억](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=20240131105228940de68fcbb35175114235199_0.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 지속 가능 경영, 보고와 검증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025011710043006774f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 똑똑한 금융생활...건전한 투자와 건강한 재무설계 지침서](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025031015443705043c1c16452b012411124362.jpg&nmt=18)

![[카드뉴스] KT&G ‘Global Jr. Committee’, 조직문화 혁신 방안 제언](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202503261121571288de68fcbb3512411124362_0.png&nmt=18)

![[AD] 기아, 혁신적 콤팩트 SUV ‘시로스’ 세계 최초 공개](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113461807771f9c516e42f12411124362.jpg&nmt=18)

![[AD] 아이오닉5 '최고 고도차 주행 전기차' 기네스북 올랐다...압도적 전기차 입증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113204707739f9c516e42f12411124362.jpg&nmt=18)