Hyundai Motor Group Chairman Chung Eui-sun (L) and U.S. President Donald Trump announce their investment plans in the United States at the White House in Washington, DC, U.S., March 24, 2025. Photo via White House YouTube Live

On April 4, José Muñoz, President and CEO of Hyundai Motor America (HMA), and Song Ho Sung, President and CEO of Kia Corporation, stated, "We currently have no plans to raise prices in the U.S." This announcement came a day after former U.S. President Donald Trump implemented a 25% tariff on imported vehicles, signaling that the companies would not immediately respond with price hikes.

Hyundai and Kia are not alone in temporarily freezing prices. Other automakers with local production facilities in the U.S., such as General Motors (GM), Toyota, and Honda, have made similar announcements. This approach appears to reflect their strategy to rely on locally produced vehicles while observing how the situation unfolds, especially since President Trump is leveraging tariffs as a negotiation tool.

In contrast, automakers with relatively lower stakes in the U.S. market have responded with immediate price hikes. Ferrari raised its vehicle prices in the U.S. by 10%, while Jaguar Land Rover announced it would suspend exports to the U.S. starting in April. Volkswagen and BMW have also informed that they will add dealer fees to export models subject to tariffs starting next month.

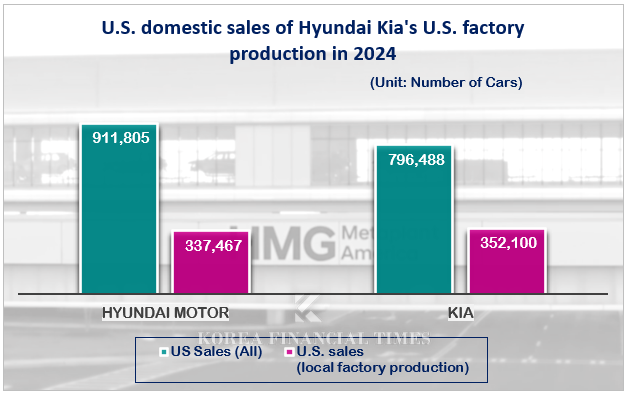

Despite their local production efforts, Hyundai and Kia face limitations in meeting U.S. demand solely with domestically produced vehicles.

At Hyundai's Alabama plant, models such as the Tucson, Santa Fe, and Genesis GV70 are manufactured. Last year, this plant produced 337,467 units for domestic sales. Given Hyundai's total U.S. sales of 911,805 units last year, only 37% of its vehicles were locally produced. Key sedan models like the Elantra (Avante) and Sonata are manufactured at Hyundai's Ulsan plant in South Korea for export. Some Tucson units are also produced at Kia's Mexico plant.

U.S.factories = Hyundai Alabama, Kia Georgia / Data = each company

Given Hyundai and Kia's high reliance on the U.S. market, their financial performance is expected to take a hit.

According to Lee Ji-soo, an analyst at Korea Investment & Securities Co., Ltd., who analyzed various scenarios involving tariffs on Korean automakers on April 3, Hyundai is estimated to face an annual cost increase of KRW 5.145 trillion if it absorbs a 25% tariff on its exported volume of 570,000 units from South Korea. Similarly, Kia's burden is projected at KRW 3.82 trillion under the same conditions. Combined, this amounts to KRW 8.9 trillion—equivalent to 33% of both companies' combined operating profit of KRW 26.9 trillion last year.

To mitigate tariff-related costs, there is speculation that Hyundai and Kia may consider producing internal combustion engine vehicles at their recently completed eco-friendly Meta Plant America (HMGMA) in Georgia. However, Lee noted that relocating production from South Korea would require union negotiations and limit the range of models that can be produced overseas.

The industry is closely watching Hyundai and Kia's first-quarter earnings conference call scheduled for later this month. An industry insider commented, "Even if they reiterate their commitment to freezing prices until May during this call, it will likely be difficult to exclude tariff impacts from their second-quarter earnings guidance."

Gwak Horyung (horr@fntimes.com)

![기관 '알테오젠'·외인 '에이비엘바이오'·개인 '삼천당제약' 1위 [주간 코스닥 순매수- 2025년 4월7일~4월11일]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025041123072807854179ad4390721123588129.jpg&nmt=18)

![12개월 최고 연 3.21%…상상인플러스저축은행 ‘크크크 회전정기예금’ [이주의 저축은행 예금금리-4월 2주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20250412214741017656a663fbf34175192139202.jpg&nmt=18)

![24개월 최고 연 3.10%…고려저축은행 ‘회전정기예금’ [이주의 저축은행 예금금리-4월 2주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20250412223240086636a663fbf34175192139202.jpg&nmt=18)

![24개월 최고 연 4.50%…키움저축은행 '아이키움정기적금‘ [이주의 저축은행 적금금리-4월 2주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20250412210550050346a663fbf34175192139202.jpg&nmt=18)

![기관 'LG에너지솔루션'·외인 '한국전력'·개인 '삼성전자' 1위 [주간 코스피 순매수- 2025년 4월7일~4월11일]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025041122561808254179ad4390721123588129.jpg&nmt=18)

![12개월 최고 연 4.50%…키움저축은행 '아이키움정기적금‘ [이주의 저축은행 적금금리-4월 2주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20250412205929096966a663fbf34175192139202.jpg&nmt=18)

![한국투자파트너스, 美 1억달러 펀드결성…국내 딥테크·바이오 '집중' [2025년 VC 전략지도]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025041307494302407dd55077bc25812315232.jpg&nmt=18)

![[카드뉴스] KT&G ‘Global Jr. Committee’, 조직문화 혁신 방안 제언](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202503261121571288de68fcbb3512411124362_0.png&nmt=18)

![[카드뉴스] 국립생태원과 함께 환경보호 활동 강화하는 KT&G](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202403221529138957c1c16452b0175114235199_0.png&nmt=18)

![[카드뉴스] 신생아 특례 대출 조건, 한도, 금리, 신청방법 등 총정리...연 1%대, 최대 5억](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=20240131105228940de68fcbb35175114235199_0.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 지속 가능 경영, 보고와 검증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025011710043006774f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 똑똑한 금융생활...건전한 투자와 건강한 재무설계 지침서](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025031015443705043c1c16452b012411124362.jpg&nmt=18)

![[카드뉴스] KT&G ‘Global Jr. Committee’, 조직문화 혁신 방안 제언](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202503261121571288de68fcbb3512411124362_0.png&nmt=18)

![[AD] 기아, 혁신적 콤팩트 SUV ‘시로스’ 세계 최초 공개](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113461807771f9c516e42f12411124362.jpg&nmt=18)

![[AD] 아이오닉5 '최고 고도차 주행 전기차' 기네스북 올랐다...압도적 전기차 입증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113204707739f9c516e42f12411124362.jpg&nmt=18)