LG Chem Vice Chairman and CEO Shin Hak-cheol visits the LG Chem booth at InterBattery 2025 and examines an electric vehicle charging cable made of ultra-high polymerization PVC. Photo = LG Chem.

Four director reappointments have been proposed for the meeting. The board has recommended reappointing Vice Chairman Shin Hak-cheol as an inside director and Vice Chairman Kwon Bong-seok, COO of LG Corp., as a non-executive director. Additionally, the reappointment of two outside directors—Professor Cho Hwa-soon from Yonsei University’s Department of Political Science and Diplomacy and Professor Lee Hyun-joo from KAIST’s Department of Biological and Chemical Engineering—will also be reviewed.

Shin and Kwon are the only two vice chairmen within LG Group. When Chairman Koo Kwang-mo took office in June 2018, there were six vice chairmen, but all have since stepped down. Shin and Kwon were directly appointed by Chairman Koo.

Unlike Vice Chairman Kwon, who was promoted internally, Vice Chairman Shin was recruited externally from 3M to LG Chem in November 2018. The following year, he officially took office as CEO of LG Chem and has led the company for six years.

A notable aspect of Shin’s reappointment is his two-year term. The other director candidates in this year’s LG Chem shareholders’ meeting are being appointed for three-year terms. LG typically sets board member terms at the statutory maximum of three years, and Shin's previous two terms were also three years each. While inside directors’ terms are not strictly guaranteed, making term differences less significant, the distinction in Shin’s case stands out.

This adjustment seems to reflect Shin’s age, as he was born in 1957 and is currently 67 years old. By the end of his new term in 2027, he will reach the age of 70.

Shin’s primary task is to restructure LG Chem’s business portfolio. He was recruited externally as a “materials expert” to reduce LG Chem’s reliance on petrochemicals and aggressively invest in three new key businesses—batteries, eco-friendly materials, and pharmaceuticals.

However, LG Chem currently faces difficulties in making aggressive investments. In 2024, LG Chem recorded a consolidated operating profit of KRW 917 billion, a 64% decline from the previous year. The petrochemical downturn has lasted longer than expected, and battery materials, which were nurtured as a substitute, are struggling due to EV chasm, a temporary slowdown in electric vehicle demand.

Shin remains firm in his commitment, stating, "Even with a demand slowdown, we will not neglect long-term R&D or the establishment of global cathode production bases."

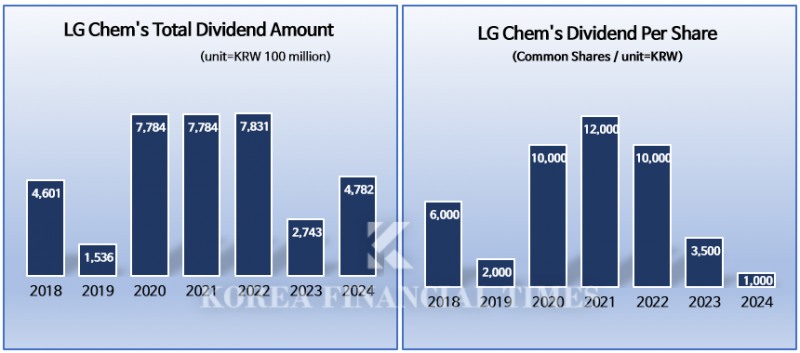

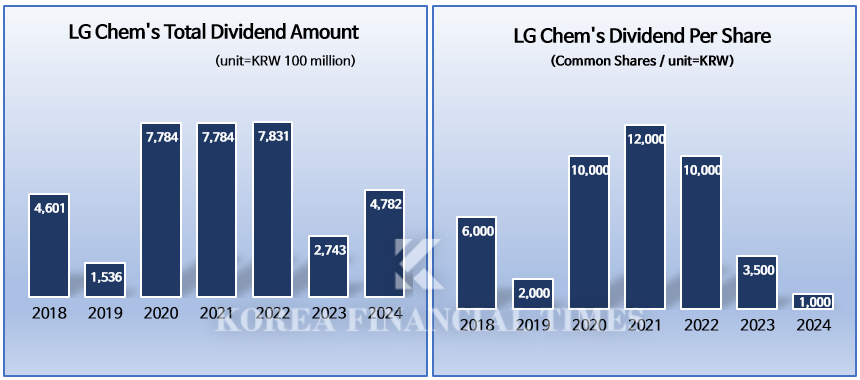

With limited financial resources, shareholder returns have inevitably shrunk. The board has decided on a dividend of KRW 1,000 per common share for last year. Compared to the high-dividend policy from 2020 to 2022, which was implemented following the spin-off of LG Energy Solution, this represents a tenfold reduction.

![아워홈 ‘전성기’ 일군 구지은, 오빠·언니 매각 뒤집을까 [주목 이 기업]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025030809043009761dd55077bc212411124362.jpg&nmt=18)

![현대제철 이사회, 올해는 車강판에 ‘올인’ [2025 이사회 톺아보기]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025031011014107875dd55077bc212411124362.jpg&nmt=18)

![현대엘리베이터 ‘훨훨 나는 실적·화기애애 주총’ [주목 이 기업]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025030809015505660dd55077bc212411124362.jpg&nmt=18)

![‘기술 퍼스트’ 삼성전자, “초격차 리더십 회복” 선언 [주목 이 기업]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025030809000404876dd55077bc212411124362.jpg&nmt=18)

![신동국의 이유있는 ‘태세전환’…한미약품 작년 주주수익 돌아보니 [정답은 TSR]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025030808580309390dd55077bc212411124362.jpg&nmt=18)

![지금은 ‘보톡스 춘추전국시대’…틈새공략 나선 전통제약사들 [제약바이오 파이경쟁 ①]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025030808544808375dd55077bc212411124362.jpg&nmt=18)

![[카드뉴스] 국립생태원과 함께 환경보호 활동 강화하는 KT&G](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202403221529138957c1c16452b0175114235199_0.png&nmt=18)

![[카드뉴스] 신생아 특례 대출 조건, 한도, 금리, 신청방법 등 총정리...연 1%대, 최대 5억](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=20240131105228940de68fcbb35175114235199_0.jpg&nmt=18)

![[카드뉴스] 어닝시즌은 ‘실적발표기간’으로](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202311301105084674de68fcbb35175114235199_0.png&nmt=18)

![[신간] 지속 가능 경영, 보고와 검증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025011710043006774f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 사모펀드 투자와 경영의 비밀](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024102809331308730f8caa4a5ce175114235199.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 똑똑한 금융생활...건전한 투자와 건강한 재무설계 지침서](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025031015443705043c1c16452b012411124362.jpg&nmt=18)

![[AD] 기아, 혁신적 콤팩트 SUV ‘시로스’ 세계 최초 공개](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113461807771f9c516e42f12411124362.jpg&nmt=18)

![[AD] 아이오닉5 '최고 고도차 주행 전기차' 기네스북 올랐다...압도적 전기차 입증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113204707739f9c516e42f12411124362.jpg&nmt=18)