E-Mart's warehouse discount store Traders has seen significant growth. /Photo courtesy of E-Mart

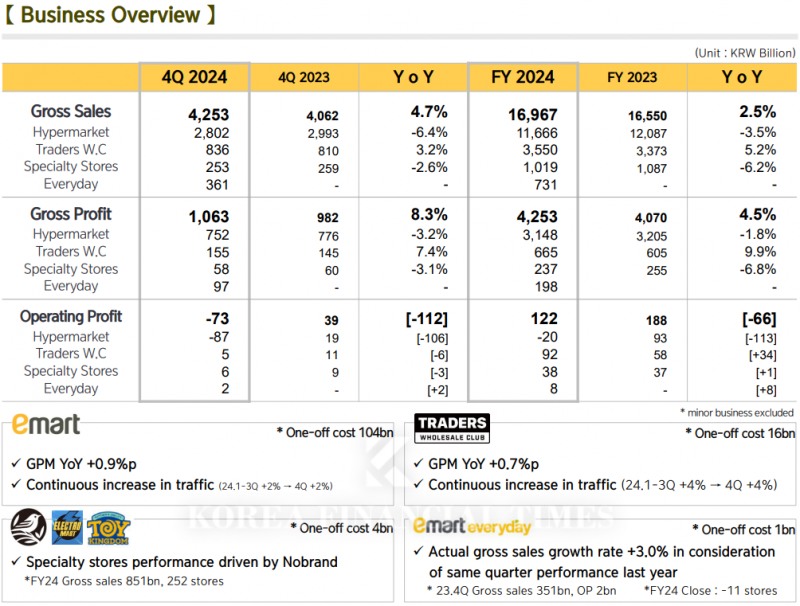

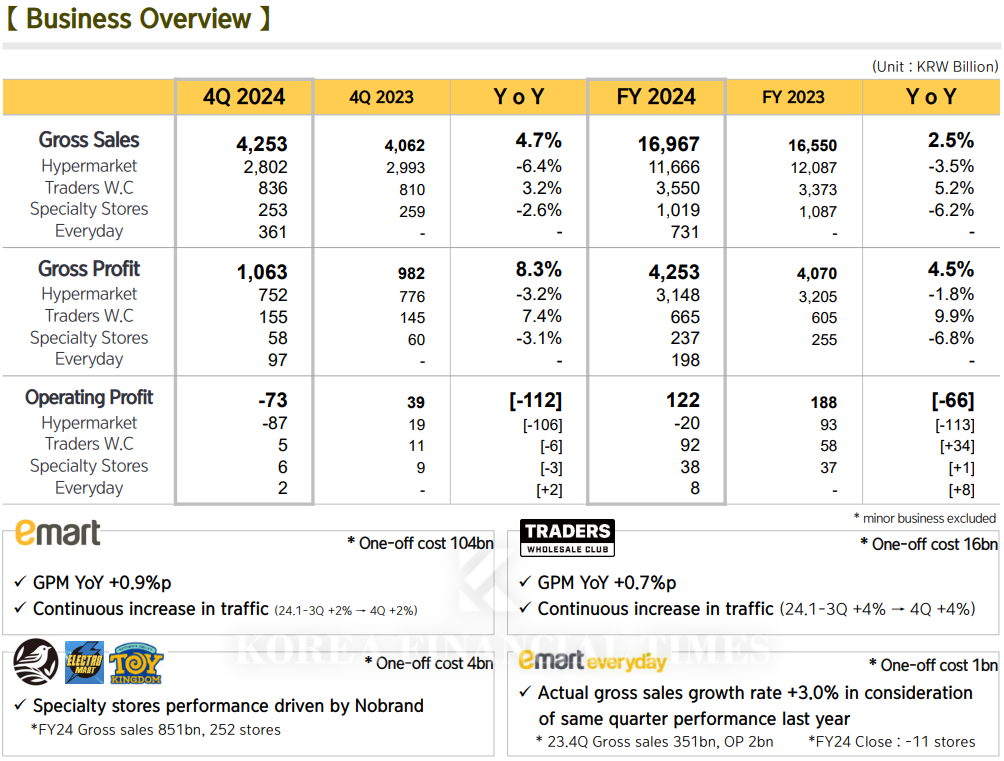

According to E-Mart on the 11th, Traders showed notable growth last year. Its annual operating profit (on a standalone basis) surged 59% year-over-year (YoY) to KRW 92.4 billion, while revenue increased by 5.2% to KRW 3.5495 trillion. The number of customers also grew by 4.8% compared to the previous year.

During the same period, E-Mart's hypermarket division’s revenue fell 3.5% YoY to KRW 11.6665 trillion. Its operating profit, which stood at KRW 92.8 billion a year earlier, plummeted by more than KRW 100 billion, resulting in an operating loss of KRW 19.9 billion. This loss was largely due to the reflection of one-time expenses, such as retirement provisions and voluntary retirement compensation, amounting to KRW 103.6 billion. Considering these factors, Traders’ growth stands out. Although the scale differs, Traders also recorded one-time expenses of KRW 16 billion.

As e-commerce and SSMs (super supermarkets) erode the customer base of hypermarkets, Traders has emerged as a major contributor to E-Mart's performance.

Looking at quarterly performance, Traders posted revenue of KRW 915.7 billion and an operating profit of KRW 30.6 billion in Q1 2024 (on a standalone basis), marking YoY increases of 11.9% and 313.5%, respectively. In Q2, revenue grew 3.9% to KRW 832.6 billion, while operating profit jumped 65.4% to KRW 22 billion.

For Q3, revenue increased by 2.3% to KRW 965.2 billion, and operating profit rose 30% to KRW 34.4 billion. Finally, in Q4 2023, revenue increased by 3.2% to KRW 836 billion, while operating profit declined 52.7% to KRW 5.2 billion.

Regarding Traders' growth, E-Mart explained, "In an era of high inflation, Traders’ value-for-money bulk products and differentiated product offerings have aligned with consumer needs, leading to increased customer traffic."

Especially, T-Café continues to attract foot traffic to offline stores by regularly introducing new menu items. The buzz around its affordability draws customers to the café, leading to additional purchases at Traders and creating a spillover effect.

Another key advantage of Traders is its accessibility and ease of entry compared to other warehouse-style discount stores. Traders has the largest number of stores among domestic and international warehouse-style retailers in Korea, with 22 locations as of last year.

In comparison, Costco, the U.S. warehouse retailer operating in Korea, has 19 locations, while Lotte Mart’s warehouse-style discount store, Max, operates six locations nationwide. Additionally, unlike Costco, which requires a membership card for entry, Traders allows customers to shop without any membership fees, offering a competitive edge.

Meanwhile, E-Mart’s domestic competitor, Max, has not announced any new store openings since launching its Changwon Jungang branch in 2022.

E-Mart plans to capitalize on this momentum by expanding Traders’ store network. Following the opening of Traders Magok this month, the company is preparing to launch a new Guwol store in the second half of the year. An E-Mart representative stated, "Along with expanding our presence, we will further strengthen our competitive edge in the market."

Park seulgi (seulgi@fntimes.com)

![게임강국 ‘콘솔 약체’ 오명 벗는다…K콘솔 5형제 [주목 이 기업]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025031616092101878dd55077bc25812315232.jpg&nmt=18)

![현대로템 흑자전환 '키맨' 김두홍 [나는 CFO다]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025031615594500123dd55077bc25812315232.jpg&nmt=18)

![‘배달앱 새 시대’ 배민 vs 쿠팡이츠, 1위 뺏느냐 뺏기느냐 [주목 이 기업]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025031616115904614dd55077bc25812315232.jpg&nmt=18)

![정경선 현대해상 전무, 인사·조직 개편…위기 타개 시험대 [오너 보험사 리뷰 ②]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025031610134900117dd55077bc25812315232.jpg&nmt=18)

![강남권 재건축도 유찰…조합원들은 '발 동동' [2025 도시정비 기상도②]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025031716114705026e41d7fc6c2183101242202.jpg&nmt=18)

![[카드뉴스] 국립생태원과 함께 환경보호 활동 강화하는 KT&G](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202403221529138957c1c16452b0175114235199_0.png&nmt=18)

![[카드뉴스] 신생아 특례 대출 조건, 한도, 금리, 신청방법 등 총정리...연 1%대, 최대 5억](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=20240131105228940de68fcbb35175114235199_0.jpg&nmt=18)

![[카드뉴스] 어닝시즌은 ‘실적발표기간’으로](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202311301105084674de68fcbb35175114235199_0.png&nmt=18)

![[신간] 지속 가능 경영, 보고와 검증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025011710043006774f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 사모펀드 투자와 경영의 비밀](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024102809331308730f8caa4a5ce175114235199.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 똑똑한 금융생활...건전한 투자와 건강한 재무설계 지침서](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025031015443705043c1c16452b012411124362.jpg&nmt=18)

![[AD] 기아, 혁신적 콤팩트 SUV ‘시로스’ 세계 최초 공개](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113461807771f9c516e42f12411124362.jpg&nmt=18)

![[AD] 아이오닉5 '최고 고도차 주행 전기차' 기네스북 올랐다...압도적 전기차 입증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113204707739f9c516e42f12411124362.jpg&nmt=18)