Hyundai Motor Group Chairman Chung Eui-sun (C) visits Hyundai Motor's Chennai plant in India on Aug. 8, 2023. Photo: Hyundai Motor

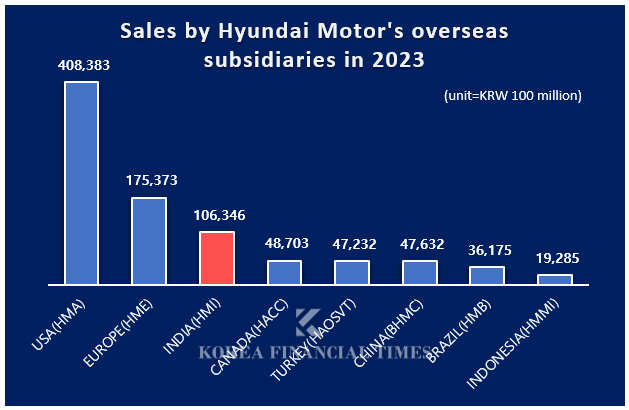

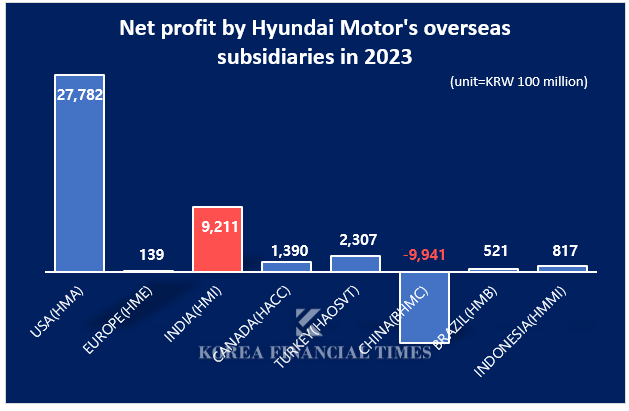

이미지 확대보기India is Hyundai's second largest overseas market after the United States. It has become even more important since China's slowing growth and Russia's withdrawal. Hyundai Motor India (HMI) had sales of KRW 10.63 trillion last year. It is the third largest after the United States (HMA, KRW 40.82 trillion) and Europe (HME, KRW 17.66 trillion). HMI's net profit was KRW 921.1 billion, second only to the United States (KRW 2.78 trillion), and more than the combined net profit of its five overseas subsidiaries, excluding China (KRW 517 billion).

Chart prepared by = Korea Financial Times

Chart prepared by = Korea Financial Times

Hyundai broke its annual sales record last year, selling 602,111 vehicles. Its market share was 14.6 %, ranking it second in the industry. The top spot went to Maruti Suzuki, an Indo-Japanese joint venture that first listed on the Indian stock market in 2003. Hyundai is the second automaker to list on the Indian stock market.

Hyundai aims to establish an annual production system of 1 million vehicles in India in the second half of next year. In addition to its existing Chennai plant (824,000 units), it will start up its Pune plant, which it acquired from GM last year.

In addition, the company has a blueprint to take the lead in the industry transition by introducing five EV models by 2030, including the strategic EV Creta EV. The strategy is not only to sell electric vehicles but also to lead the construction of an electrification ecosystem by expanding electric vehicle charging stations and collaborating with an Indian battery company (Exide Energy).

Hyundai Motor India's IPO last week was a success and is expected to raise around KRW 4.5 trillion. It is the largest IPO in the history of the Indian stock market. Hyundai Motor conducted the IPO by publicly selling 17.5% of its 100% stake in Indian subsidiaries, not issuing new shares. It prioritized raising cash that it could get its hands on immediately.

Some say that Hyundai Motor's preemptive entry into the Indian stock market is an adventurer. Despite India's growth potential, local political and labor risks are also a reason why global companies are reluctant to enter the country directly. GM's withdrawal from India was ostensibly due to poor profitability, but local policy uncertainty also played a role.

Gwak Horyung (horr@fntimes.com)

![[DQN] "지자체 금고 잡아라"…출연금 신한 1위·금고 규모 농협 압도적](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024112102061902156f09e13944d391241172.jpg&nmt=18)

![민병덕 의원, '토큰증권(STO) 법제화' 위한 2법 대표발의 [22대 국회]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024112011071109189179ad4390712813480118.jpg&nmt=18)

![[DCM] GS리테일, 1500억 공모채 발행…전북은행도 후순위채로 BIS비율 개선](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024112014294102958141825007d12411124362.jpg&nmt=18)

![[DQN] ‘잠잠할 날 없는 금융사고?’ 3년간 6천억대...BNK금융, 사고금액 최대](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024112021030009519237391cf861151384944.jpg&nmt=18)

![[DCM] KT, 2000억 회사채 발행... 장기 자금조달로 재무 안정성 확보](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024112113555900183141825007d12411124362.jpg&nmt=18)

![[카드뉴스] 국립생태원과 함께 환경보호 활동 강화하는 KT&G](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202403221529138957c1c16452b0175114235199_0.png&nmt=18)

![[카드뉴스] 신생아 특례 대출 조건, 한도, 금리, 신청방법 등 총정리...연 1%대, 최대 5억](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=20240131105228940de68fcbb35175114235199_0.jpg&nmt=18)

![[카드뉴스] 어닝시즌은 ‘실적발표기간’으로](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202311301105084674de68fcbb35175114235199_0.png&nmt=18)

![[신간] 사모펀드 투자와 경영의 비밀](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024102809331308730f8caa4a5ce175114235199.jpg&nmt=18)

![[신간]퍼스널브랜딩, 문학에서 길을 찾다](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024102214123606876f8caa4a5ce175114235199.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 김국주 전 제주은행장, ‘나는 시간을 그린다 1·2’ 에세이 출간](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024111517430908074c1c16452b012411124362.jpg&nmt=18)