SK Innovation announced that the proposal to approve the merger agreement with SK E&S at the extraordinary general meeting of shareholders on the 27th was passed by 85.75% of the shareholders present.

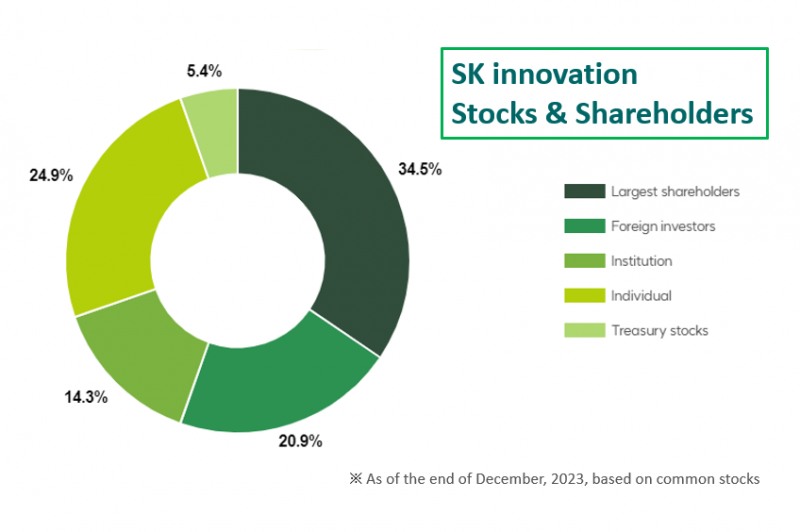

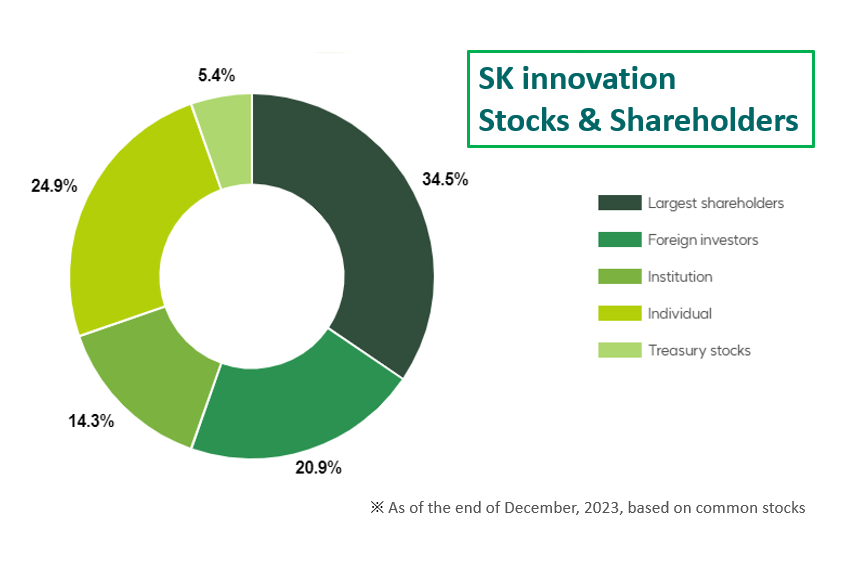

In particular, 95 percent of foreign shareholders attending the meeting voted in favor. Foreign investors account for about 21% of SK Innovation's total shares.

This can be explained by the fact that ISS and Glass Lewis, two of the world's largest proxy advisory firms, recommended in favor of the merger. Foreign investors tend to follow the opinions of these organizations.

ISS and Glass Lewis have recommended in favor of the merger because they believe that SK Innovation's management's reasons for the merger, such as financial stabilization and increasing future corporate value, are well-founded. They did not take issue with the “damage of shareholder value” due to the merger ratio set at the reference price, which was criticized by the National Pension Service and some minority shareholders.

Earlier, SK Innovation announced that the merger synergy effect will generate more than KRW 2.2 trillion in EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) as of 2030. Based on this, SK Innovation President Park Sang-kyu stressed, "We will make a leap into a comprehensive energy company worth KRW 20 trillion in EBITDA in 2030."

SK Innovation's financial stabilization is repeatedly mentioned because of its battery subsidiary, SK On. While SK On is struggling with accumulating deficits due to large-scale investments and short-term business uncertainty due to the EV chasm, its parent company SK Innovation is also under financial pressure. SK E&S is one of the group's strongest privately held companies, with annual operating income of more than 1 trillion won.

The merger of the two companies is scheduled for Nov. 1. If successfully launched, the combined entity will be the largest private energy company in the Asia-Pacific region with assets of KRW 100 trillion and sales of KRW 88 trillion.

Even though the merger has passed the shareholders' meeting, SK is not completely at peace. The exercise of the stock purchase right scheduled until the 19th of next month remains. This is the right of shareholders to demand that the company buy their shares after the merger is approved. If the amount of the exercise exceeds the limit set by SK (800 billion won), the merger could be scuttled. Although it is considered unlikely, it is also in the spotlight whether the National Pension Service, which voted against the merger, will exercise its claim. The National Pension Service's stake in SK Innovation is valued at around 650 billion won. For SK Innovation's management, the challenge is to boost the stock price, which is below the amount of the claim exercise (111,943 won).

Apart from the SK Innovation-SK E&S merger, SK On is scheduled to merge with SK Trading International and SK Enterm. It is a measure to improve SK On's cash flow, but it is not a fundamental solution.

SK On raised funds through a pre-IPO and promised investors an IPO in 2026. At the time of listing, the company has a valuation target of 100 trillion won, three times its current valuation. To achieve the goal, the battery sector's sales performance itself will need to be boosted.

Gwak Horyung (horr@fntimes.com)

![[DQN] "지자체 금고 잡아라"…출연금 신한 1위·금고 규모 농협 압도적](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024112102061902156f09e13944d391241172.jpg&nmt=18)

![민병덕 의원, '토큰증권(STO) 법제화' 위한 2법 대표발의 [22대 국회]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024112011071109189179ad4390712813480118.jpg&nmt=18)

![[DCM] KT, 2000억 회사채 발행... 장기 자금조달로 재무 안정성 확보](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024112113555900183141825007d12411124362.jpg&nmt=18)

![[DQN] ‘잠잠할 날 없는 금융사고?’ 3년간 6천억대...BNK금융, 사고금액 최대](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024112021030009519237391cf861151384944.jpg&nmt=18)

![[DCM] GS리테일, 1500억 공모채 발행…전북은행도 후순위채로 BIS비율 개선](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024112014294102958141825007d12411124362.jpg&nmt=18)

![[카드뉴스] 국립생태원과 함께 환경보호 활동 강화하는 KT&G](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202403221529138957c1c16452b0175114235199_0.png&nmt=18)

![[카드뉴스] 신생아 특례 대출 조건, 한도, 금리, 신청방법 등 총정리...연 1%대, 최대 5억](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=20240131105228940de68fcbb35175114235199_0.jpg&nmt=18)

![[카드뉴스] 어닝시즌은 ‘실적발표기간’으로](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202311301105084674de68fcbb35175114235199_0.png&nmt=18)

![[신간] 사모펀드 투자와 경영의 비밀](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024102809331308730f8caa4a5ce175114235199.jpg&nmt=18)

![[신간]퍼스널브랜딩, 문학에서 길을 찾다](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024102214123606876f8caa4a5ce175114235199.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 김국주 전 제주은행장, ‘나는 시간을 그린다 1·2’ 에세이 출간](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024111517430908074c1c16452b012411124362.jpg&nmt=18)