The indirect investment in Bitcoin by both institutions is drawing attention.

According to the 13F report (Form 13F) filed with the U.S. Securities and Exchange Commission (SEC) on the 23rd, NPS invested 245,000 new shares of Microstrategy Inc. with the largest number of bitcoin holdings among single companies in the second quarter of 2024.

KIC also purchased 21,000 new shares of Microstrategy Inc.

The two did not directly buy bitcoin, or bitcoin spot ETFs (exchange-traded funds), but approached investment by buying corporate stocks with large bitcoin holdings.

It has already purchased bitcoin-related stocks through an investment in Coinbase Global Inc.

KIC has purchased Coinbase Global Inc. shares, the largest U.S. cryptocurrency exchange, since the fourth quarter of 2021, and has bought 22,272 more shares in the second quarter.

The National Pension Service also purchased Coinbase shares in the third quarter of 2023. On the other hand, the National Pension Service sold 23,956 shares, part of Coinbase, in the second quarter of this year.

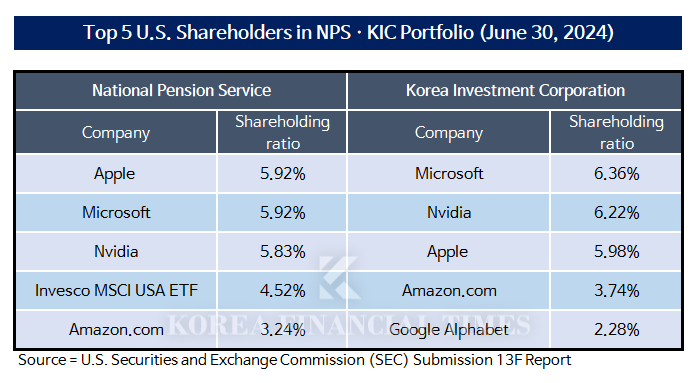

On the other hand, the investment direction was different for the so-called 'M7', which consists of big tech stocks such as Nvidia, Microsoft (MS), Apple, Alphabet (Google), Amazon, Meta, and Tesla. In the case of the National Pension Service, the proportion of leading stocks was increased, while KIC showed a pattern of profit-taking.

Nvidia, an artificial intelligence (AI) beneficiary, was the top stock that the National Pension Fund increased its allocation to in the second quarter of 2024. Nvidia's weight in the portfolio increased by 1.49 percentage points, from 4.34% to 5.83%.

In addition, the National Pension Service made new investments in the "T Rowe Price US Equity Research ETF (TSPA)" in the second quarter of this year. With 9.51 million shares, it was the second-largest overweight in the portfolio. TSPA is an ETF that focuses on growth stocks and has a large M7 weighting.

On the other hand, KIC sold 1,224,046 shares of Microsoft stock in the second quarter of 2024, and KIC also sold 542,291 shares of Nvidia.

Both were notable for having AI infrastructure companies in their portfolios.

In Q2 2024, KIC made a new investment of 334,161 shares in GE Vernova, the world's leading wind power equipment sales company. GE Vernova was spun off from GE Energy in April 2024.

The National Pension Service also included 531,667 GE Bernova shares in the second quarter of this year.

As of the end of June 2024, the value of the NPS's direct U.S. equity investment assets was $87 billion, up 4.4% from the previous quarter. This is the fifth consecutive quarter of all-time high.

In addition, as of the end of June, the value of KIC's direct investment in U.S. stocks was $39.7 billion, up 0.8% from the previous quarter.

Jeong Suneun (bravebambi@fntimes.com)

![기관 '알테오젠'·외인 '비에이치아이'·개인 '카페24' 1위 [주간 코스닥 순매수- 2025년 5월7일~5월9일]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025050921183006805179ad439072211389183.jpg&nmt=18)

![12개월 최고 연 7.00%…예가람저축은행 '정기적금(짠테크 특판)‘ [이주의 저축은행 적금금리-5월 2주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20250511031115045366a663fbf34175192139202.jpg&nmt=18)

![12개월 최고 연 3.10%…농협은행 'NH고향사랑기부예금' [이주의 은행 예금금리-5월 2주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025050912113006669300bf52dd2121131180157.jpg&nmt=18)

![12개월 최고 연 5.20%, 제주은행 'MZ 플랜적금' [이주의 은행 적금금리-5월 2주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025050914155302794300bf52dd2121131180157.jpg&nmt=18)

![24개월 최고 연 4.50%…키움저축은행 '아이키움정기적금‘ [이주의 저축은행 적금금리-5월 2주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20250511041300049786a663fbf34175192139202.jpg&nmt=18)

![12개월 최고 연 3.21%…상상인플러스저축은행 ‘크크크 회전정기예금’ [이주의 저축은행 예금금리-5월 2주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20250511021831001726a663fbf34175192139202.jpg&nmt=18)

![[주간 보험 이슈] 롯데손보 콜옵션 상환 강행에 금감원과 정면충돌…매각 암초 外](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20250508173708093049efc5ce4ae1182351117.jpg&nmt=18)

![24개월 최고 연 3.10%…고려저축은행 ‘회전정기예금’ [이주의 저축은행 예금금리-5월 2주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20250511012911018726a663fbf34175192139202.jpg&nmt=18)

![SK 출신 김장우가 에코프로비엠 대표 된 이유 [나는 CFO다]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025051002532701132dd55077bc212411124362.jpg&nmt=18)

![[카드뉴스] 신생아 특례 대출 조건, 한도, 금리, 신청방법 등 총정리...연 1%대, 최대 5억](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=20240131105228940de68fcbb35175114235199_0.jpg&nmt=18)

![[카드뉴스] KT&G ‘Global Jr. Committee’, 조직문화 혁신 방안 제언](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202503261121571288de68fcbb3512411124362_0.png&nmt=18)

![[카드뉴스] 국립생태원과 함께 환경보호 활동 강화하는 KT&G](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202403221529138957c1c16452b0175114235199_0.png&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 지속 가능 경영, 보고와 검증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025011710043006774f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 똑똑한 금융생활...건전한 투자와 건강한 재무설계 지침서](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025031015443705043c1c16452b012411124362.jpg&nmt=18)

![[카드뉴스] KT&G ‘Global Jr. Committee’, 조직문화 혁신 방안 제언](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202503261121571288de68fcbb3512411124362_0.png&nmt=18)

![[AD] 기아, 혁신적 콤팩트 SUV ‘시로스’ 세계 최초 공개](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113461807771f9c516e42f12411124362.jpg&nmt=18)

![[AD] 아이오닉5 '최고 고도차 주행 전기차' 기네스북 올랐다...압도적 전기차 입증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113204707739f9c516e42f12411124362.jpg&nmt=18)