Photo=S-Oil Mapo Office Building

According to the investment banking (IB) industry on the 24th, S-OIL is conducting a demand forecast for the issuance of public corporate bonds worth 350 billion KRW. The bond maturities are structured as follows: 3-year (200 billion KRW), 5-year (70 billion KRW), 7-year (30 billion KRW), and 10-year (50 billion KRW).

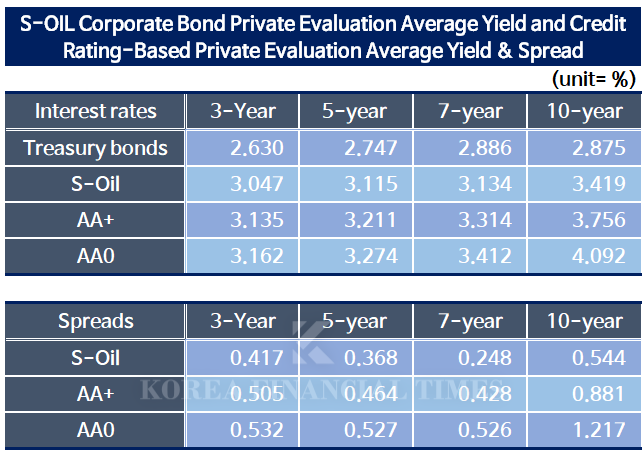

The company has proposed an interest rate band of -30 to +30 basis points (bp) relative to the average private bond evaluation yield for each maturity. Depending on demand forecast results, the issuance size may increase to a maximum of 440 billion KRW. The funds raised will be used entirely for debt repayment.

The joint bookrunners include Samsung Securities, NH Investment & Securities, Shinhan Investment, KB Securities, and Mirae Asset Securities. Daishin Securities, Hana Securities, and iM Securities are participating in underwriting.

S-OIL’s credit rating is AA+ according to Korea Investors Service (KIS), while Korea Ratings (KR) and NICE Investors Service rate it at AA0. However, both KR and NICE have assigned a “Positive” outlook, suggesting a likely upgrade to AA+.

Currently, S-OIL’s private bond evaluation yield for each maturity is lower than the AA+ average yield, indicating that its credit profile is stronger than AA0-rated bonds used for comparison.

For the 10-year bond, the AA+ credit spread (credit yield minus government bond yield) stands at 88bp, while S-OIL’s private bond evaluation yield spread is 54bp. The AA0 credit spread is significantly higher at 122bp.

Source=Financial Investment Association

The government bond yield currently shows a 10-year yield of 2.875%, which is lower than the 7-year yield (2.886%). Typically, longer-term yields are higher, but long-term rates often align with economic growth forecasts. This suggests market concerns about a potential slowdown in Korea’s economic growth.

In such periods, corporate bond issuance can become more challenging, as funds tend to flow into government bonds or high-credit corporate bonds. Even high-rated companies may find it difficult to issue long-term bonds in large amounts.

S-OIL’s bond yield levels indicate that it is among the highest-rated AA+ issuers. However, unlike government bonds, its 10-year bond yield is not lower than its 7-year bond yield. Looking at the credit spreads, they narrow progressively for the 3-year, 5-year, and 7-year bonds but widen significantly for the 10-year bond.

A higher credit spread for the 10-year bond may appeal to investors. Notably, no other domestic refining or petrochemical company issued a 10-year bond last year, nor has any done so this year prior to S-OIL’s issuance.

This approach can be indirectly understood through credit rating agencies’ criteria for rating adjustments. While KR has assigned an AA+ rating, as of Q3 2023, S-OIL has met some conditions for a potential downgrade.

KIS and NICE have given a “Positive” outlook but have set downgrade triggers that could revert their ratings to “Stable.” This reflects the combination of increased debt due to large-scale investments (such as the Shaheen Project) and deteriorating profitability amid a downturn in the refining and petrochemical industries.

The “Shaheen Project” is part of a strategic initiative led by S-OIL’s largest shareholder, Saudi Aramco. In addition to issuing corporate bonds, S-OIL has been in ongoing discussions with Aramco and financial institutions regarding funding. However, the company appears to be maintaining a cautious stance on increasing its financial burden.

An IB industry insider commented, “S-OIL has historically had a lower credit spread compared to the average for its rating grade. While it has issued 10-year bonds since 2023, the issuance size has been gradually decreasing.” He added, “The longer the maturity, the higher the interest cost. Given the need to manage its debt scale, S-OIL is likely to remain cautious in significantly expanding its bond issuance.”

Lee Sungkyu (lsk0603@fntimes.com)

![12개월 최고 연 3.25%…SC제일은행 'e-그린세이브예금' [이주의 은행 예금금리-12월 3주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20251219093349025015e6e69892f222110224112.jpg&nmt=18)

![기관 '알테오젠'·외인 '에이비엘바이오'·개인 '에코프로' 1위 [주간 코스닥 순매수- 2025년 12월15일~12월19일]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025121921461601587179ad4390711823510140.jpg&nmt=18)

![24개월 최고 연 2.71%…기업은행 'IBK더굴리기통장' [이주의 은행 예금금리-12월 3주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20251219093505001355e6e69892f222110224112.jpg&nmt=18)

![24개월 최고 연 5.15%, 제주은행 'MZ 플랜적금' [이주의 은행 적금금리-12월 3주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20251219093759034615e6e69892f222110224112.jpg&nmt=18)

![흥국생명 대표에 김형표 CFO 내정…외형 성장서 재무 개선에 방점 [태광그룹 2026 자회사 CEO 인사]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20251218222159018238a55064dd118222261122.jpg&nmt=18)

![기관 '삼성전자'·외인 '삼성전자우'·개인 '삼성전자' 1위 [주간 코스피 순매수- 2025년 12월15일~12월19일]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025121921362000980179ad4390711823510140.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[카드뉴스] KT&G ‘Global Jr. Committee’, 조직문화 혁신 방안 제언](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202503261121571288de68fcbb3512411124362_0.png&nmt=18)

![[카드뉴스] 국립생태원과 함께 환경보호 활동 강화하는 KT&G](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202403221529138957c1c16452b0175114235199_0.png&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 조금 느려도 괜찮아...느림 속에서 발견한 마음의 빛깔](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=20251105082239062852a735e27af12411124362.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)

![[AD]‘패밀리카 선두 주자’ 기아, ‘The 2026 카니발’ 출시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2025081810452407346749258773621116810840.jpg&nmt=18)

![[AD] ‘상품성↑가격↓’ 현대차, 2025년형 ‘아이오닉 5’·‘코나 일렉트릭’ 출시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202505131018360969274925877362115218260.jpg&nmt=18)