The U.S. is expected to cut its benchmark interest rate in September due to a slowdown in the domestic economy caused by surging consumer prices and job insecurity. Wall Street analysts are highly speculating that the US will take this opportunity to make a 'big cut' of up to 0.5 percentage points.

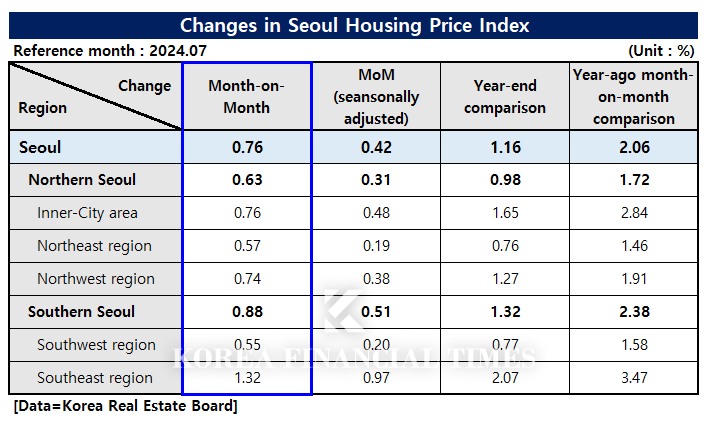

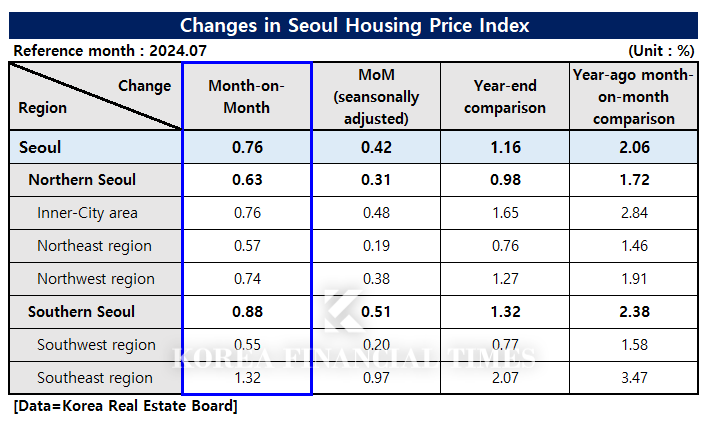

The problem is Korea's situation. According to the Korea Real Estate Board(REB), weekly apartment price trends nationwide for the second week of August 2024 (as of Aug. 12) showed a 0.08% increase in sales prices and a 0.07% increase in rental prices. On a monthly basis, the Seoul residential (apartment, townhouse, and detached house) price index for July was up 0.76% from June. This was the largest increase in four years and seven months since December 2019 (0.86%).

On top of that, experts say that the price of apartments in Seoul has been on the rise for more than 60 weeks, and the spark for the rise in apartment sales prices remains large. The prospect of a decrease in new occupancy next year also adds to concerns over soaring housing prices.

In response, experts believe that the Bank of Korea is likely not to cut its benchmark interest rate in September. Experts generally predict that if the U.S. Federal Reserve lowers its policy interest rate (basic interest rate) in September as expected, the Bank of Korea will only start lowering it in October or November after checking household loans and real estate stability following the implementation of the second stage of the stress total debt repayment ratio (DSR).

Only the five major commercial banks (KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup) had more household loans by 4.1795 trillion won by the middle of this month. Lee Chang-yong, governor of the Bank of Korea, said after freezing the benchmark interest rate for 12 consecutive months last month, "All members of the Monetary Policy Committee agreed that the Bank of Korea should not make a mistake in triggering a rise in housing prices by excessively supplying liquidity or giving a wrong signal about the timing of a rate cut."

The key is how much the second stage of stress DSR, which is scheduled to be implemented in September, will affect the market. Stress DSR is a system that calculates the loan limit by imposing a certain level of additional interest rate (stress rate) when calculating DSR in preparation for the possibility that borrowers using variable-rate loans will increase their burden of repayment of principal and interest due to rising interest rates during the loan period.

In February this year, the government introduced a first-stage measure to apply 25 percent of the basic stress rate to bank mortgage loans.

Starting from the second half of the year, the government was scheduled to implement a two-stage measure to apply 50 percent of the stress rate to bank mortgage loans, credit loans and second-tier mortgage loans, but it was pushed back by two months to September. The government said it will raise the weight applied to the basic stress rate of 1.5 percent to 50 percent from September 1, and apply the stress rate to 0.75%. In addition, the application will be expanded to include bank credit loans and second-tier mortgage loans, but credit loans will be limited to cases where the balance exceeds 100 million won.

“If the bomb of a rate cut is dropped while Seoul real estate is exploding like it is now, the house price explosion, which has been limited to Seoul, will spread from the metropolitan area to the provinces, causing tremendous chaos,” said a real estate expert. ”We have maintained interest rates in the 3% range without raising them to the 5% range while the U.S. raised interest rates to the 5% range, so even if the U.S. makes a big cut, it will not be easy for us to make such a cut because of the risks of decreasing foreign exchange reserves.”

Jang Hosung (hs6776@fntimes.com)

![[DQN] "지자체 금고 잡아라"…출연금 신한 1위·금고 규모 농협 압도적](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024112102061902156f09e13944d391241172.jpg&nmt=18)

![[DQN] ‘잠잠할 날 없는 금융사고?’ 3년간 6천억대...BNK금융, 사고금액 최대](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024112211120005687237391cf861151384944.jpg&nmt=18)

![[DCM] KT, 2000억 회사채 발행... 장기 자금조달로 재무 안정성 확보](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024112113555900183141825007d12411124362.jpg&nmt=18)

![[DCM] "한화오션, 공모채 경쟁률 8.4대 1… 효성첨단소재도 목표액 초과"](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024112210235807058141825007d12411124362.jpg&nmt=18)

![[카드뉴스] 국립생태원과 함께 환경보호 활동 강화하는 KT&G](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202403221529138957c1c16452b0175114235199_0.png&nmt=18)

![[카드뉴스] 신생아 특례 대출 조건, 한도, 금리, 신청방법 등 총정리...연 1%대, 최대 5억](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=20240131105228940de68fcbb35175114235199_0.jpg&nmt=18)

![[카드뉴스] 어닝시즌은 ‘실적발표기간’으로](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202311301105084674de68fcbb35175114235199_0.png&nmt=18)

![[신간] 사모펀드 투자와 경영의 비밀](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024102809331308730f8caa4a5ce175114235199.jpg&nmt=18)

![[신간]퍼스널브랜딩, 문학에서 길을 찾다](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024102214123606876f8caa4a5ce175114235199.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 김국주 전 제주은행장, ‘나는 시간을 그린다 1·2’ 에세이 출간](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024111517430908074c1c16452b012411124362.jpg&nmt=18)