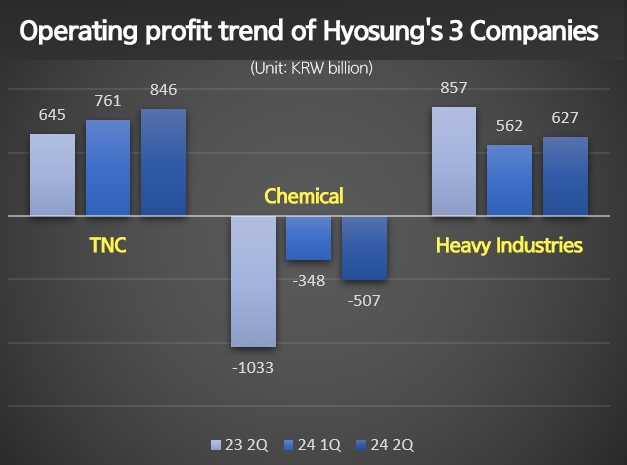

Hyosung Heavy Industries & Construction posted revenue of KRW 1.19 trillion and operating profit of KRW 62.7 billion in the second quarter of this year. This is a 6.3% increase in revenue from the second quarter of last year, but a 26.8% decrease in operating profit. Operating margin fell 1.4 percentage points from 7.6% to 5.2%.

The decline in profitability was driven by the construction segment, which swung into the red with an operating loss of 2.3 billion won. The company said it recorded a loss due to one-time factors such as a freight labor strike and rising costs, including construction materials.

The heavy industry segment, which has a strong business in high-voltage transformers, mainly in the U.S., posted an operating profit of 65 billion won (8.7% operating margin). This was up 13.8% year-on-year and 80.5% compared to the first quarter of this year.

Orders for power equipment are increasing not only in the U.S. but also in Europe and the Middle East. At the end of the second quarter, new orders in the heavy industry sector amounted to 1.519 trillion won, nearly double the amount in the second quarter of last year. Since the beginning of this year, Hyosung Heavy Industries has announced investments of 100 billion won to expand its ultra-high voltage transformer plants in Changwon, Gyeongnam and Tennessee, USA.

Hyosung Chemical's flagship product, polypropylene (PP), is experiencing a sales slump due to low-cost production by Chinese companies. The industry expects China's massive PP expansion to continue through next year. Hyosung is looking to sell its lucrative specialty gas (NF3) business for cleaning semiconductors to help it emerge from the financial crisis caused by the recession.

Hyosung TNC, the largest affiliate within Hyosung Group, posted sales of 1.9826 trillion won and operating profit of 84.6 billion won. These figures were up 2.8% and 31.2% year-on-year, respectively. Excluding one-time expenses in the merchant business, the results were largely in line with expectations.

Synthetic fiber spandex, which holds the top global market share, is also showing solid demand growth despite competition from China. According to NH Investment & Securities, Hyosung TNC's spandex selling price fell 4% quarter-on-quarter, but sales volume increased 11% over the same period.

The favorable spandex market is expected to continue this year, but there are concerns that the improvement in profitability will be limited due to rising raw material prices and oversupply.

Gwak Horyung (horr@fntimes.com)

![‘함안 조씨 가문’ 효성·한타…고배당 진실은? [정답은 TSR]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024112421075006266dd55077bc25812315232.jpg&nmt=18)

![[주간 보험 이슈] 금감원 암뇌심 주요치료비 제동…이틀 금감원 발 절판마케팅 또 성행 外](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20241124105620043708a55064dd11251906169.jpg&nmt=18)

![기관 '루닛'·외인 '리가켐바이오'·개인 '알테오젠' 1위 [주간 코스닥 순매수- 11월18일~11월22일]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024112321335609421179ad439072211389183.jpg&nmt=18)

![12개월 최고 연 3.80%…케이뱅크 ‘코드K 자유적금’ [이주의 은행 적금금리-11월 4주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024112414424906840237391cf86223388684.jpg&nmt=18)

![12개월 최고 연 3.42%...농협·수협銀 예금상품 [이주의 은행 예금금리-11월 4주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024112414394306065237391cf86223388684.jpg&nmt=18)

![[카드뉴스] 국립생태원과 함께 환경보호 활동 강화하는 KT&G](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202403221529138957c1c16452b0175114235199_0.png&nmt=18)

![[카드뉴스] 신생아 특례 대출 조건, 한도, 금리, 신청방법 등 총정리...연 1%대, 최대 5억](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=20240131105228940de68fcbb35175114235199_0.jpg&nmt=18)

![[카드뉴스] 어닝시즌은 ‘실적발표기간’으로](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202311301105084674de68fcbb35175114235199_0.png&nmt=18)

![[신간] 사모펀드 투자와 경영의 비밀](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024102809331308730f8caa4a5ce175114235199.jpg&nmt=18)

![[신간]퍼스널브랜딩, 문학에서 길을 찾다](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024102214123606876f8caa4a5ce175114235199.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 김국주 전 제주은행장, ‘나는 시간을 그린다 1·2’ 에세이 출간](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2024111517430908074c1c16452b012411124362.jpg&nmt=18)