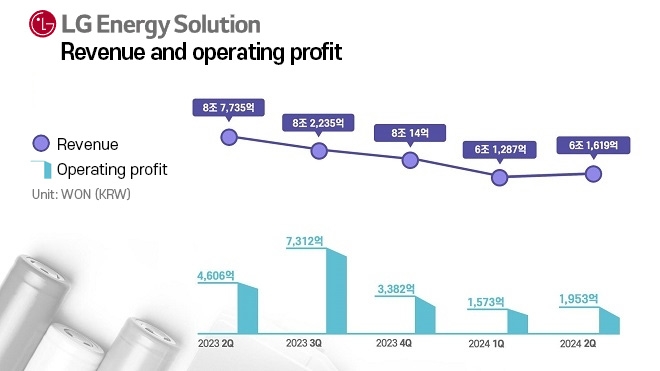

LG Energy Solutions reported on July 25 that its revenue for the second quarter of last year fell 29.8% year-on-year to 6.16 trillion won ($6.19 billion).

Operating profit for the same period fell 57.6% to 4606 billion won. Profitability plummeted even as the U.S. IRA tax credit nearly quadrupled from 110.9 billion won in the second quarter of last year to 447.8 billion won in the second quarter of this year. This was due to market-wide headwinds, including slowing demand for electric vehicles and weaker metal prices, which led to lower selling prices.

“This year's sales are expected to decline by more than 20 percent year-on-year,” LG Energy Solutions said today. Initially, the company expected sales to grow in the mid-single digits (4-6%) when it set its business plan for this year. However, the company was forced to lower its sales expectations as major automakers began to accelerate their electrification.

In particular, the global EV market growth rate has been lowered from the mid-20s to the low-20s. In particular, the U.S. EV market was expected to grow in the mid-30s, but now it has been lowered to the low-20s. We also lowered our European EV growth forecast from the mid-20s to the mid-10s.

We also reduced our IRA tax credit forecast from 45-50 GWh to 30-35 GWh. However, the IRA tax credit is unlikely to be completely eliminated even if Donald Trump is re-elected, the company said.

“Trump's election could pose a risk to EV demand,” said Changbeom Kang, chief strategy officer at LG Energy Solutions, ”but the IRA tax credit will remain in place as it requires administrative procedures and political consensus.”

LG Energy Solutions plans to overcome this difficult external situation through operational efficiency and technology leadership.

First, the company will review its ongoing investment plans. Only essential investments will be made in new facilities in accordance with strategic priorities, while production efficiency will be improved by converting existing EV battery production lines to ESS (energy storage systems) to improve plant utilization rates.

It is making progress in battery diversification. LG Energy Solutions, which centers on pouch-type NCM batteries, has recently signed contracts with Renault for LFP batteries and with Q CELLS to supply ESS batteries for the North American power grid.

The 4680 cylindrical battery, known as the “Tesla battery,” will also begin full-scale mass production at the Ochang plant as early as the end of the third quarter. “In addition to the customers we have already secured, we are in talks with various customers to supply the 4680 and various specifications of the 46 series,” said LG Energy Solutions.

Gwak Horyung (horr@fntimes.com)

![24개월 최고 연 5.15%, 제주은행 'MZ 플랜적금' [이주의 은행 적금금리-1월 4주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260123173802029085e6e69892f121162063.jpg&nmt=18)

![[DQN] 작년 말 보험사 수익률 엎치락 뒤치락…교보생명 DB형 1위·미래에셋 DC/IRP 주춤 [2025 4분기 퇴직연금 랭킹]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260123223119097638a55064dd122012615783.jpg&nmt=18)

![12개월 최고 연 3.20%…NH저축은행 'NH특판정기예금' [이주의 저축은행 예금금리-1월 4주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260123192428010886a663fbf34175192139202.jpg&nmt=18)

![12개월 최고 연 3.20%…SC제일은행 'e-그린세이브예금' [이주의 은행 예금금리-1월 4주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260123172457041555e6e69892f121162063.jpg&nmt=18)

![12개월 최고 연 4.95%, 제주은행 'MZ 플랜적금' [이주의 은행 적금금리-1월 4주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260123173647079195e6e69892f121162063.jpg&nmt=18)

![24개월 최고 연 2.90%…부산은행 '더 특판 정기예금' [이주의 은행 예금금리-1월 4주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260123172617013825e6e69892f121162063.jpg&nmt=18)

![[DCM] 롯데쇼핑, 강도 높은 구조조정...투자 효율성 제고 절실](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026012213330402565a837df64942115218260.jpg&nmt=18)

![[카드뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[카드뉴스] KT&G ‘Global Jr. Committee’, 조직문화 혁신 방안 제언](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202503261121571288de68fcbb3512411124362_0.png&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 조금 느려도 괜찮아...느림 속에서 발견한 마음의 빛깔](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=20251105082239062852a735e27af12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)