On July 1, the Korean won was recently trading near the 1,400 won mark, according to the financial investment industry. While further gains are seen as limited, it's hardly reassuring.

Currently, the Korean won is trading at levels similar to those seen in April, when the U.S. Consumer Price Index (CPI) rose more than expected (3.5%). At the time, the dollar appreciated and the won depreciated as expectations of a rate cut by the US Federal Reserve (Fed) faded.

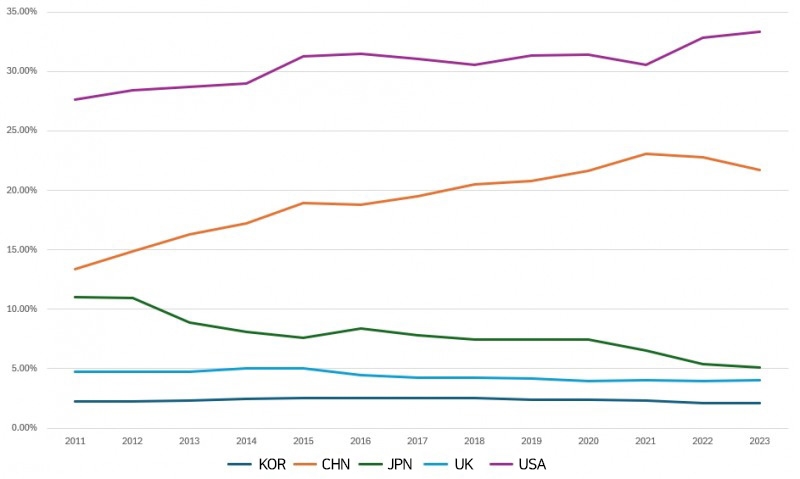

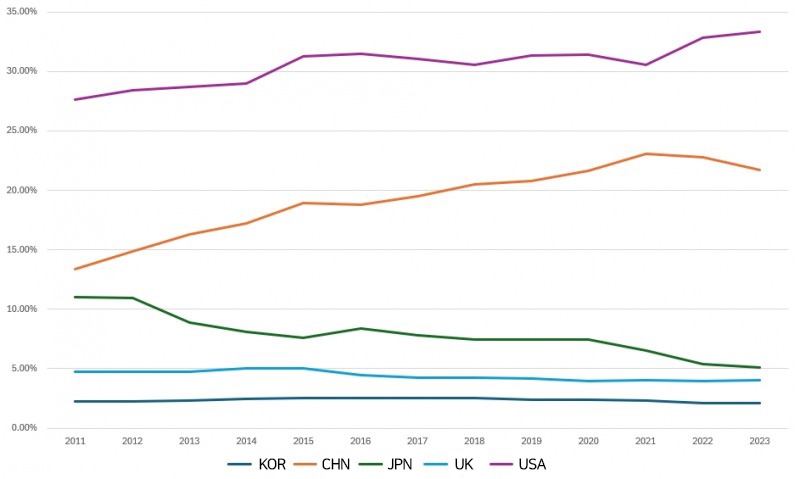

Trends in the share of GDP of each country relative to the global economy./Source=Bank of Korea

이미지 확대보기However, the current rally in the won-dollar exchange rate is of a different nature than in April. While the U.S. interest rate decision and Japanese monetary policy are still under debate, growth, employment, and inflation are either in line with market expectations or slowing down.

The Korean won's appreciation has been driven by changing economic fundamentals. According to the Bank of Korea, the share of the U.S. gross domestic product (GDP) in the global economy (37 countries, including the U.S. and China, but excluding data gaps such as Russia) expanded from 27.60% in 2011 to 33.32% in 2023, while Korea's GDP shrank from 2.22% to 2.09% during the same period.

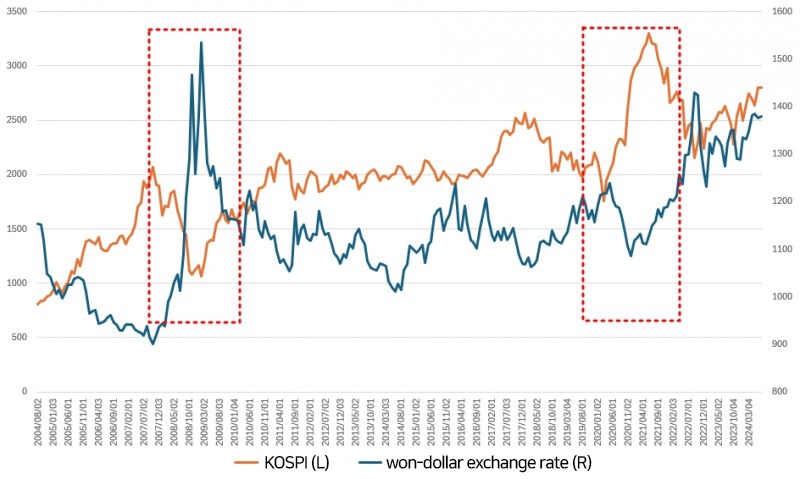

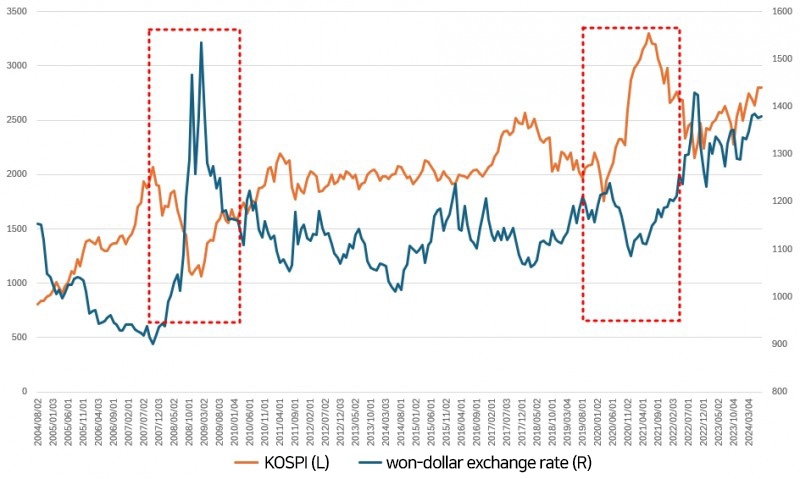

On the other hand, the exchange rate of the won to the dollar was only above 1,200 won during the 2008 financial crisis before the COVID-19 pandemic. Since then, the exchange rate has been above KRW 1,200, but it was only a "temporary" phenomenon due to short-term market instability.

In March 2022, the KRW exchange rate broke through the 1200 won level and started trading at a different level than before. Since then, the exchange rate hasn't fallen below 1200 won.

It cannot be overlooked that the US Federal Reserve started raising interest rates in earnest at that time. Also, Korea had a trade deficit from April 2022 to June 2023. It is true that there was no material for the won to strengthen.

However, even after the trade balance returned to a surplus, the Korean won hasn't been able to depreciate. This is partly due to the fact that the US interest rate is higher than the Korean interest rate. However, Korea is an export-oriented country, so strong exports partially offset the U.S.-Korea interest rate differential. This means that other factors besides interest rates and the trade balance are affecting the KRW exchange rate.

Therefore, the aforementioned changes in the GDP shares of major global economies could be the answer. Behind this is the US-China trade war and global supply chain reorganization.

Especially since the COVID-19 pandemic, supply chain issues have emerged and trade trends have begun to change. The U.S. has been a manufacturing powerhouse through "reshoring", which is still ongoing.

Conversely, the conditions for Korea's economic fundamentals to return to the previous level are either the rise of China or an increase in exports to the United States. However, given that the Korean economy grew in an environment of global trade openness, the current protectionist trend is a weakening factor.

The dollar exchange rate and KOSPI index tends to move into the opposite direction.Recently, it is moving between KRW 1300 to 1400 and 1400 won./ Source=Bank of Korea, Korea Exchange

이미지 확대보기The direction of the won-dollar exchange rate also affects the domestic stock market. Basically, the more attractive the won becomes, the higher the stock market will rise.

Semiconductors and automobiles account for a high proportion of Korea's exports. Of these, semiconductors are important in terms of the stock market. The first and second largest companies by market capitalization are Samsung Electronics and SK Hynix, which together account for 26% of the KOSPI.

However, it is doubtful that growth focused on semiconductors will be able to raise the level of the Korean stock market from its current level. While a weaker won makes exports more competitive, it also weighs heavily on raw material prices. In fact, domestic companies' operating margins have been low in the past during high exchange rates.

"Countries are gradually reducing their trade openness and expectations for China's economic recovery are falling," said Choi Kwang-hyuk, a researcher at LS Securities. "Korea has reduced its dependence on the Chinese economy, but it still accounts for a large share of exports." "Considering the Korean economy's position in the global economy, we don't think the won is too weak at the moment," he said.

Lee Sungkyu (lsk0603@fntimes.com)

![[DCM] ‘우량급 턱걸이’ 포스코퓨처엠…등급 방어는 ‘의문 부호’](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026010723454307283a837df6494123820583.jpg&nmt=18)

![[DCM] 흥국증권, ‘경쟁률 최하위’…유진·한양증권도 하위권, 주관 역량 시험대 [2025 결산②]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026010717182700654141825007d12411124362.jpg&nmt=18)

![연합자산관리, 올해 NPL 47% 인수…CR부문 이익도 4배 급증 [NPL 2025 딜 리뷰]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20251230211847080766a663fbf34175192139202.jpg&nmt=18)

![[프로필] 고영철 제34대 신협중앙회장 당선자, '현장·중앙회·정책' 역량 모두 갖춘 신협맨](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026010717414106601957e88cdd511420215123.jpg&nmt=18)

![[카드뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[카드뉴스] KT&G ‘Global Jr. Committee’, 조직문화 혁신 방안 제언](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202503261121571288de68fcbb3512411124362_0.png&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 조금 느려도 괜찮아...느림 속에서 발견한 마음의 빛깔](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=20251105082239062852a735e27af12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)